Question

a. Record the amortization of $2,150 license purchased for cash with estimated useful life of four years. b. Record the amortization expense for the $24,800

a. Record the amortization of $2,150 license purchased for cash with estimated useful life of four years.

b. Record the amortization expense for the $24,800 leasehold improvement on on the parking lot of the building whose estimated useful life was five years with no residual value. The lease will expire in 10 years.

c. Record the depreciation on $90,000 equipment (with a residual value of $13,400 and estimated useful life of 10 years).

d. Record the depreciation on Machine A sold for $7,400 cash. costing $28,500 with an accumulated depreciation (straight line) to December 31 of the prior year, $20,500 ($4,900 residual value and four-year life).

e. Record the amortization, if any, on the $8,100 expenditures made during the current year for ordinary repairs.

f. Record the depreciation on Machine B costing $20,800 using a $3,400 residual value and four-year life. The machine has been completely reconditioned for $9,400.

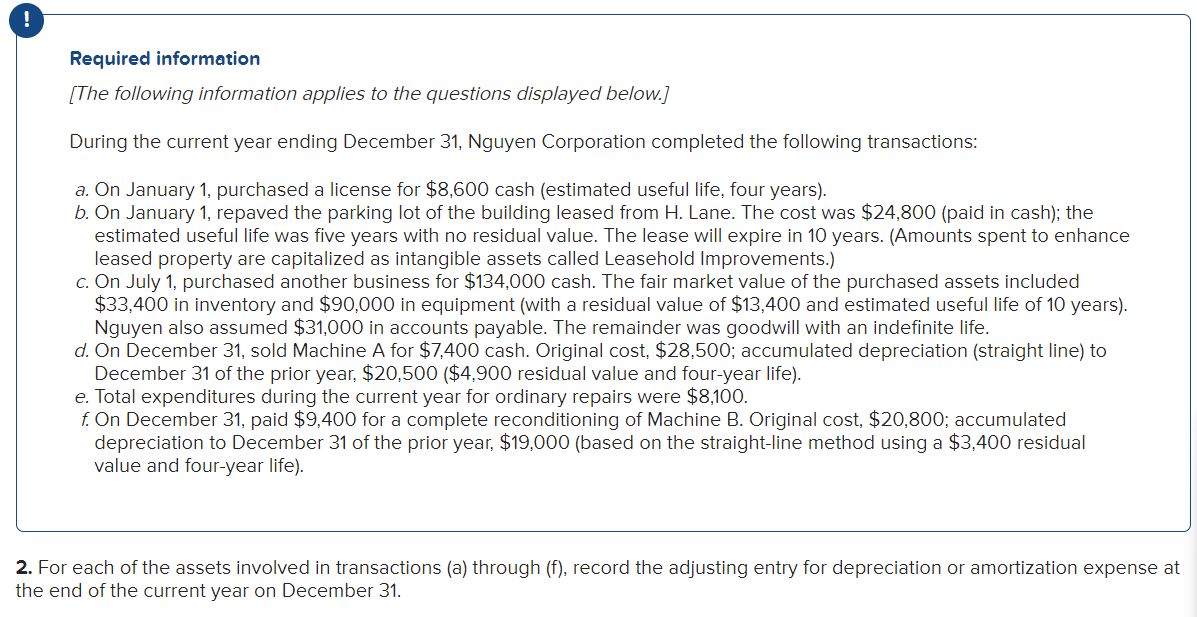

Required information [The following information applies to the questions displayed below.] During the current year ending December 31 , Nguyen Corporation completed the following transactions: a. On January 1, purchased a license for $8,600 cash (estimated useful life, four years). b. On January 1, repaved the parking lot of the building leased from H. Lane. The cost was $24,800 (paid in cash); the estimated useful life was five years with no residual value. The lease will expire in 10 years. (Amounts spent to enhance leased property are capitalized as intangible assets called Leasehold Improvements.) c. On July 1, purchased another business for $134,000 cash. The fair market value of the purchased assets included $33,400 in inventory and $90,000 in equipment (with a residual value of $13,400 and estimated useful life of 10 years). Nguyen also assumed $31,000 in accounts payable. The remainder was goodwill with an indefinite life. d. On December 31, sold Machine A for $7,400 cash. Original cost, $28,500; accumulated depreciation (straight line) to December 31 of the prior year, $20,500 (\$4,900 residual value and four-year life). e. Total expenditures during the current year for ordinary repairs were $8,100. f. On December 31, paid $9,400 for a complete reconditioning of Machine B. Original cost, $20,800; accumulated depreciation to December 31 of the prior year, $19,000 (based on the straight-line method using a $3,400 residual value and four-year life). 2. For each of the assets involved in transactions (a) through ( f), record the adjusting entry for depreciation or amortization expense at the end of the current year on December 31 . Required information [The following information applies to the questions displayed below.] During the current year ending December 31 , Nguyen Corporation completed the following transactions: a. On January 1, purchased a license for $8,600 cash (estimated useful life, four years). b. On January 1, repaved the parking lot of the building leased from H. Lane. The cost was $24,800 (paid in cash); the estimated useful life was five years with no residual value. The lease will expire in 10 years. (Amounts spent to enhance leased property are capitalized as intangible assets called Leasehold Improvements.) c. On July 1, purchased another business for $134,000 cash. The fair market value of the purchased assets included $33,400 in inventory and $90,000 in equipment (with a residual value of $13,400 and estimated useful life of 10 years). Nguyen also assumed $31,000 in accounts payable. The remainder was goodwill with an indefinite life. d. On December 31, sold Machine A for $7,400 cash. Original cost, $28,500; accumulated depreciation (straight line) to December 31 of the prior year, $20,500 (\$4,900 residual value and four-year life). e. Total expenditures during the current year for ordinary repairs were $8,100. f. On December 31, paid $9,400 for a complete reconditioning of Machine B. Original cost, $20,800; accumulated depreciation to December 31 of the prior year, $19,000 (based on the straight-line method using a $3,400 residual value and four-year life). 2. For each of the assets involved in transactions (a) through ( f), record the adjusting entry for depreciation or amortization expense at the end of the current year on December 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started