Question

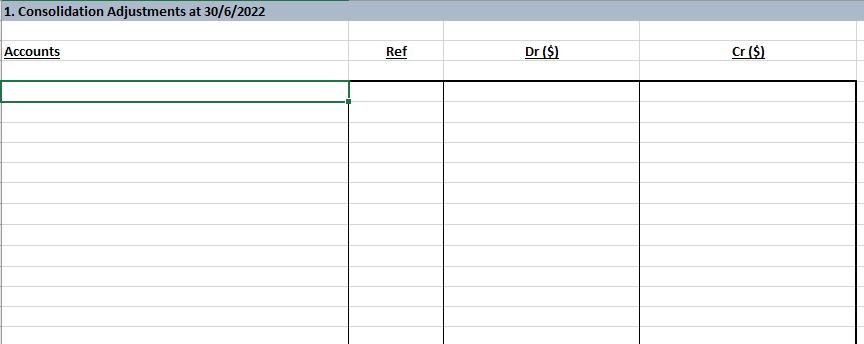

a) Record the consolidated journal entries necessary to prepare consolidated accounts for the year ending 30 June 2022 for the group comprising M Ltd and

a) Record the consolidated journal entries necessary to prepare consolidated accounts for the year ending 30 June 2022 for the group comprising M Ltd and N Ltd (In Sheet 2: Consolidated Journal Entries)

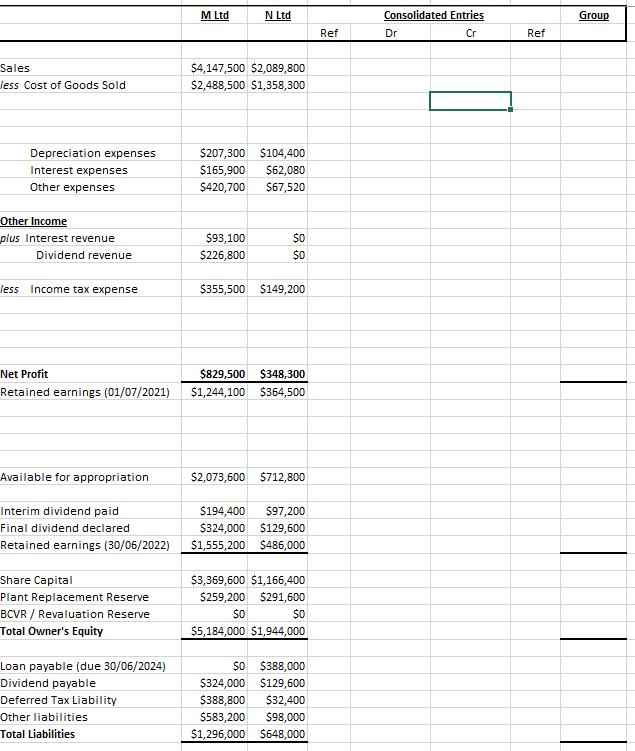

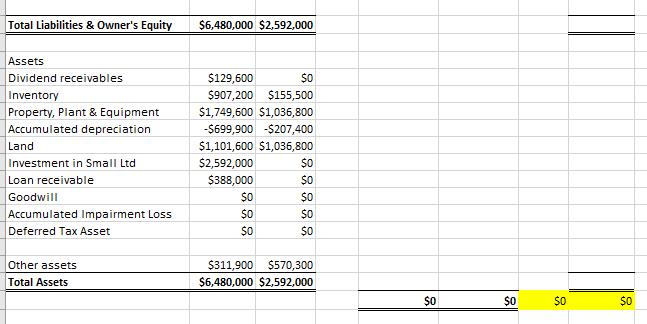

b) Complete the consolidated worksheet for the year ending 30 June 2022 (In Sheet 3: Consolidated Worksheet). i. Entering the consolidated journal entries in Part (a) above to the appropriate debit and credit columns in the Consolidated Worksheet; and ii. Completing the Group figures in the Consolidated Worksheet.

Background information:

Please complete Sheet 3: Consolidated Worksheet

Complete Sheet 2: Consolidated Journal Entries

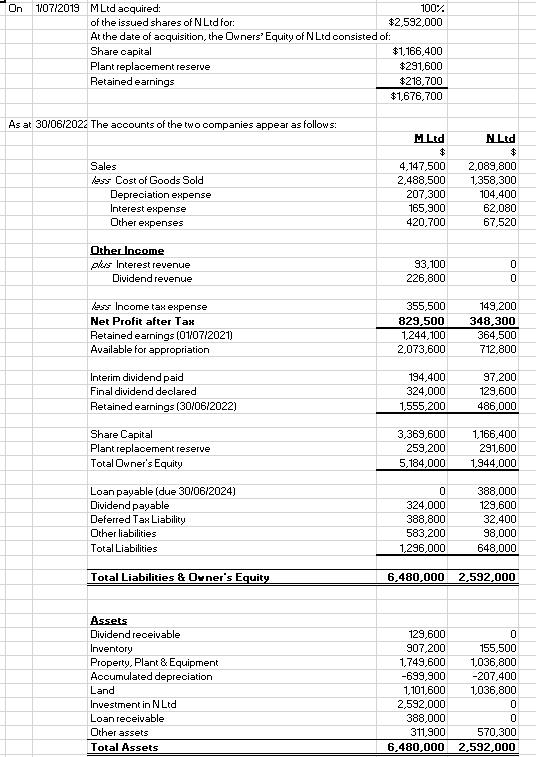

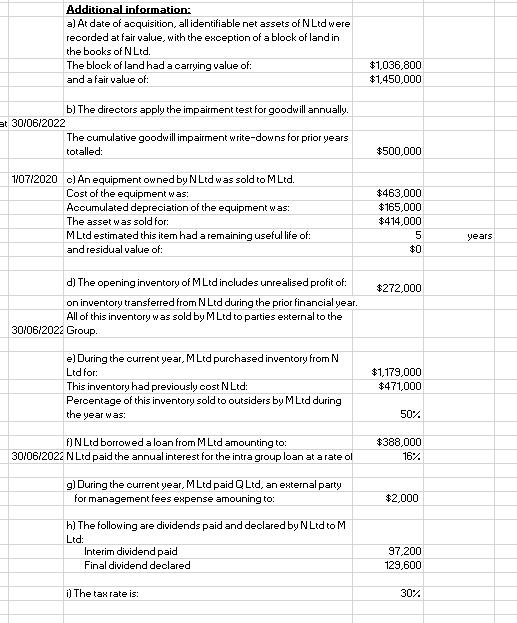

On 1/07/2019 M Ltd acquired: of the issued shares of N Ltd for: At the date of acquisition, the Owners' Equity of N Ltd consisted of: Share capital Plant replacement reserve Retained earnings As at 30/06/2022 The accounts of the two companies appear as follows: Sales less Cost of Goods Sold Depreciation expense Interest expense Other expenses Other Income plus Interest revenue Dividend revenue less Income tax expense Net Profit after Tax Retained earnings (01/07/2021) Available for appropriation Interim dividend paid Final dividend declared Retained earnings (30/06/2022) Share Capital Plant replacement reserve Total Owner's Equity Loan payable (due 30/06/2024) Dividend payable Deferred Tax Liability Other liabilities Total Liabilities Total Liabilities & Owner's Equity Assets Dividend receivable Inventory Property, Plant & Equipment Accumulated depreciation 100% $2,592,000 Land Investment in N Ltd Loan receivable Other assets Total Assets $1,166,400 $291,600 $218,700 $1,676,700 M. Ltd $ 4,147,500 2,488,500 207,300 165,900 420,700 93,100 226,800 355,500 829,500 1,244,100 2,073,600 194,400 324,000 1,555,200 3,369,600 259,200 5,184,000 0 324,000 388,800 583,200 1,296,000 129,600 907,200 1,749,600 -699,900 1,101,600 2,592,000 N.Ltd 388,000 311,900 $ 2,089,800 1,358,300 104,400 62,080 67,520 0 0 149,200 348,300 364,500 712,800 97,200 129,600 486,000 1,166,400 291,600 1,944,000 6,480,000 2,592,000 388,000 129,600 32,400 98,000 648,000 0 155,500 1,036,800 -207,400 1,036,800 0 0 570,300 6,480,000 2,592,000

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To prepare consolidated journal entries and complete the consolidated worksheet we need to consider a variety of factors as outlined in the additional information provided including previous acquisiti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started