Question

A Record the entry for purchased land for $6,100 cash. B Record the entry for purchased merchandise on account for $30,000, terms 2/10 n/45. C

A

Record the entry for purchased land for $6,100 cash.

B

Record the entry for purchased merchandise on account for $30,000, terms 2/10 n/45.

C

Record the entry for paid freight of $300 cash on merchandise purchased FOB shipping point.

D

Record the entry for returned $1,600 of defective merchandise purchased in Event 2.

E

Record the entry for sold merchandise for $23,000 cash.

F

Record the entry for sold merchandise on account for $41,000, terms 1/10 n/30.

G

Record the entry for discount on inventory purchased.

H

Record the entry for cash paid within the discount period on accounts payable.

I

Record the entry for paid $1,400 cash for selling expenses.

J

Record the entry for discount on inventory sold.

K

Record the entry for the collection of amount due on the account receivable within the discount period.

L

Record the entry for collected $1,000 of the accounts receivable but not within the discount period.

M

Record the entry for paid $2,600 of other operating expenses.

N

Record the entry for a physical count indicated that $39,000 of inventory was on hand at the end of the accounting period.

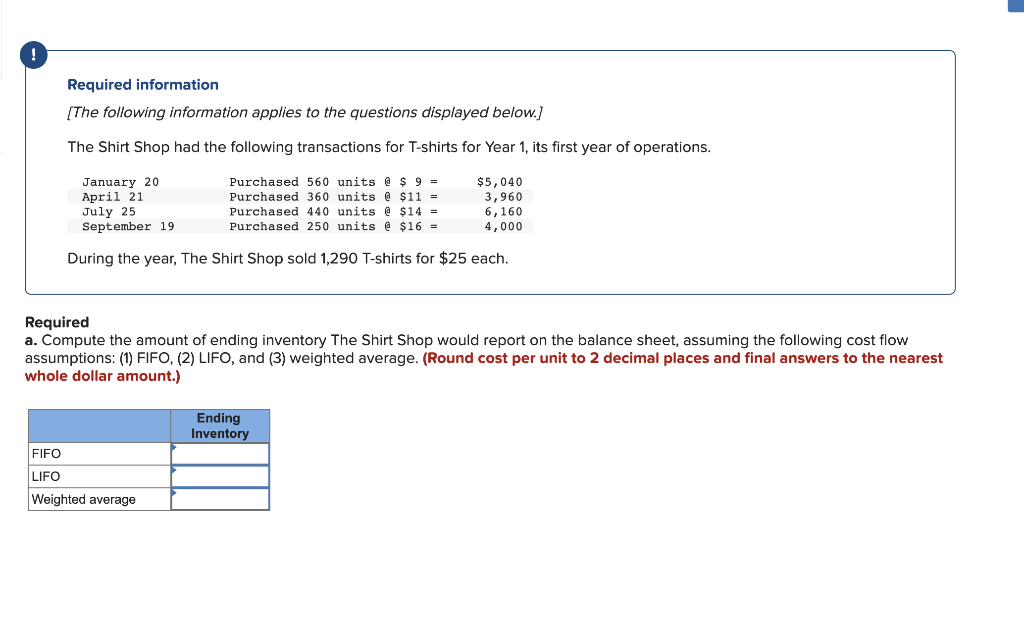

Required information [The following information applies to the questions displayed below.] The Shirt Shop had the following transactions for T-shirts for Year 1 , its first year of operations. During the year, The Shirt Shop sold 1,290 T-shirts for $25 each. 2equired 1. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following cost flow issumptions: (1) FIFO, (2) LIFO, and (3) weighted average. (Round cost per unit to 2 decimal places and final answers to the nearest vhole dollar amount.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started