Question

a) Refer to the chosen subcontract for the roofing for the Mr and Mrs Brown Project and calculate an appropriate retention amount to apply to

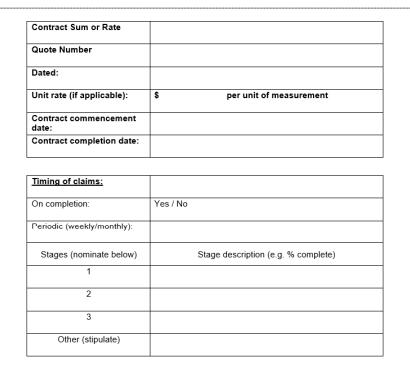

a) Refer to the chosen subcontract for the roofing for the Mr and Mrs Brown Project and calculate an appropriate retention amount to apply to the trade contractor's progress payments (the usual amount is 5% of the contract sum). Use the contract amount ($32,000) for your selected trade worker (roofer) from Task 3.1 above. Show your calculation in the contract and write the retention amount in the space provided under General Conditions

b) Calculate and complete the Progress Payment Schedule as shown below and add it as an

b) Calculate and complete the Progress Payment Schedule as shown below and add it as an

addendum to the subcontract document. A minimum of 3 stages of construction for the trade work

should be included. In addition, in the schedule, determine the retention amounts and the subsequent

amounts of progress payments. (Note: there is a Sample Progress Payment Schedule provided for you

on the OLS). Use the following steps as a guide:

a. Use 25%, 50% and 100% complete as the 3 stages

b. Calculate the progress amounts for each stage (these should add to give the total contract sum)

c. Calculate the amounts retained at 10% of the progress amount until 5% of the contract sum has

been retained.

d. Calculate the amounts of progress payments to be paid at each stage.

e. Calculate the amounts of retention to be released at practical completion and at the final

payment.

Contract Sum or Rate Quote Number Dated: Unit rate (if applicable): Contract commencement date: Contract completion date: Timing of claims: On completion: Periodic (weekly/monthly): Stages (nominate below) 2 3 Other (stipulate) $ Yes/No per unit of measurement Stage description (e.g. % complete)

Step by Step Solution

3.29 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started