Question

A regional electrical distributor currently has 1,000 customers who buy an average of $6,000 per year, generating a 50% margin. From experience, the company knows

A regional electrical distributor currently has 1,000 customers who buy an average of $6,000 per year, generating a 50% margin. From experience, the company knows that 25% of its customers will not return the next year and it takes an average of $500 to acquire each new customer.

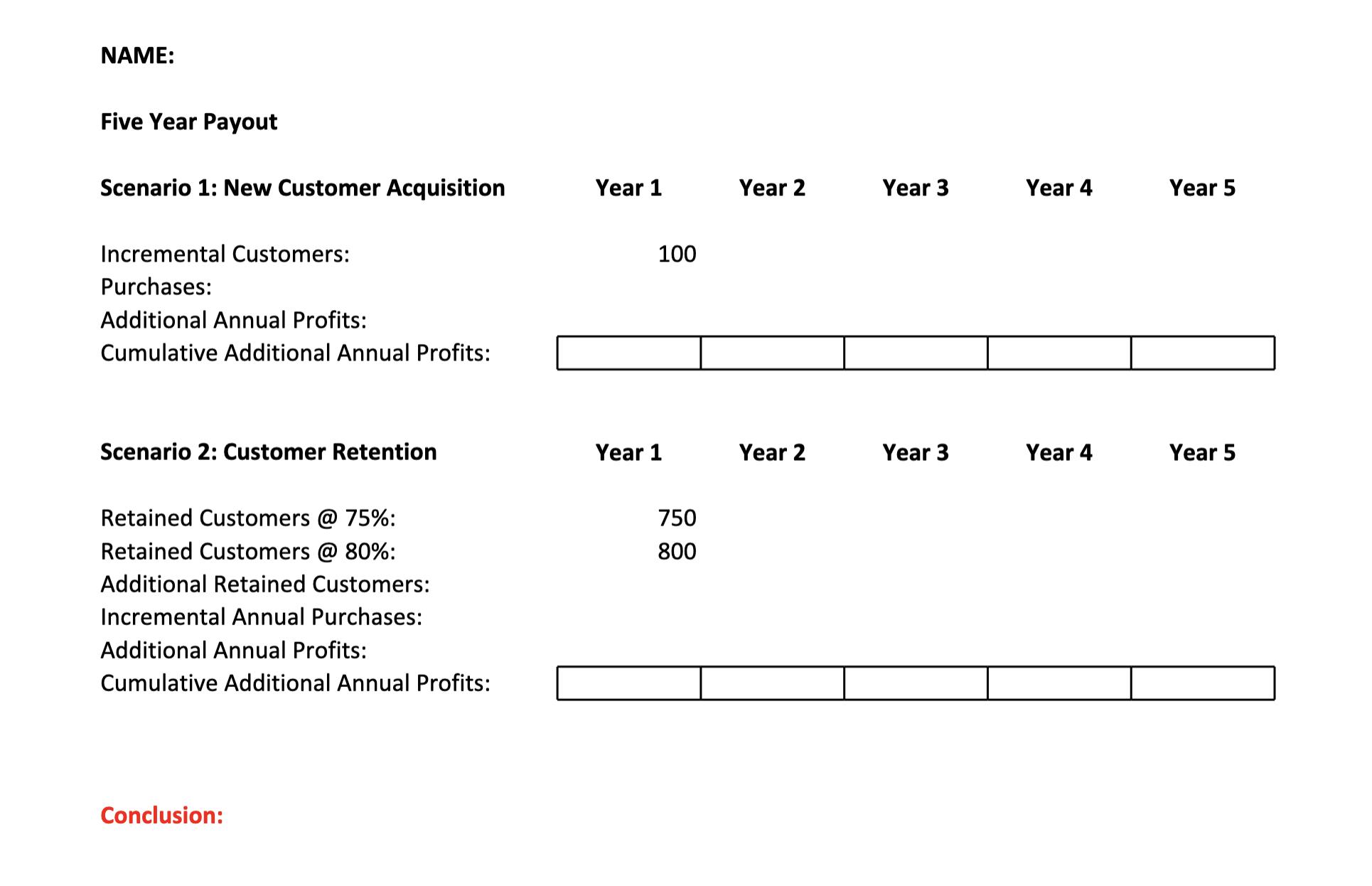

Given a choice of 1) investing $50,000 in a new customer acquisition program for 100 additional customers or 2) investing $50,000 in a new retention program which would take the rate of retention from 75% to 80%, what should the company do? To properly answer this question, you need to complete the Excel template for both scenarios (customer acquisition and customer retention) to show which option is the most profitable. Assume the new programs are in effect and you are calculating the impact for both beginning Year 1. Also, do not account for the cost of the programs since they are the same cost and it doesn't impact the overall conclusion.

Restrict your analysis to a fiveyear period (see the template for an easy analysis:

NAME: Five Year Payout Scenario 1: New Customer Acquisition Incremental Customers: Purchases: Additional Annual Profits: Cumulative Additional Annual Profits: Scenario 2: Customer Retention Retained Customers @ 75\%: Retained Customers @ 80\%: Additional Retained Customers: Incremental Annual Purchases: Additional Annual Profits: Cumulative Additional Annual Profits: Year 1 Year 2 Year 3 Year 4 Year 5 Year 1 Year 2 Year 3 Year 4 Year 5 750 800 Conclusion

NAME: Five Year Payout Scenario 1: New Customer Acquisition Incremental Customers: Purchases: Additional Annual Profits: Cumulative Additional Annual Profits: Scenario 2: Customer Retention Retained Customers @ 75\%: Retained Customers @ 80\%: Additional Retained Customers: Incremental Annual Purchases: Additional Annual Profits: Cumulative Additional Annual Profits: Year 1 Year 2 Year 3 Year 4 Year 5 Year 1 Year 2 Year 3 Year 4 Year 5 750 800 Conclusion Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started