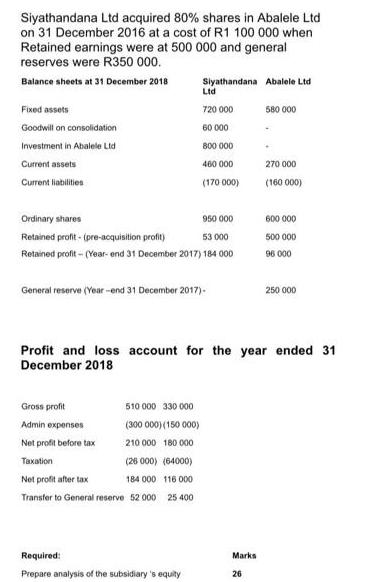

Siyathandana Ltd acquired 80% shares in Abalele Ltd on 31 December 2016 at a cost of R1 100 000 when Retained earnings were at

Siyathandana Ltd acquired 80% shares in Abalele Ltd on 31 December 2016 at a cost of R1 100 000 when Retained earnings were at 500 000 and general reserves were R350 000. Balance sheets at 31 December 2018 Fixed assets Goodwill on consolidation Investment in Abalele Ltd Current assets Current liabilities Ordinary shares 950 000 Retained profit-(pre-acquisition profit) 53 000 Retained profit-(Year-end 31 December 2017) 184 000 General reserve (Year-end 31 December 2017)- Gross profit Admin expenses Net profit before tax Taxation Net profit after tax 184 000 Transfer to General reserve 52 000 Siyathandana Abalele Ltd Ltd 720 000 510 000 330 000 (300 000) (150 000) 210 000 180 000 (26 000) (64000) 60 000 800 000 460 000 (170 000) 116 000 25 400 Required: Prepare analysis of the subsidiary's equity Profit and loss account for the year ended 31 December 2018 Marks 580 000 26 270 000 (160 000) 600 000 500 000 96 000 250 000

Step by Step Solution

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started