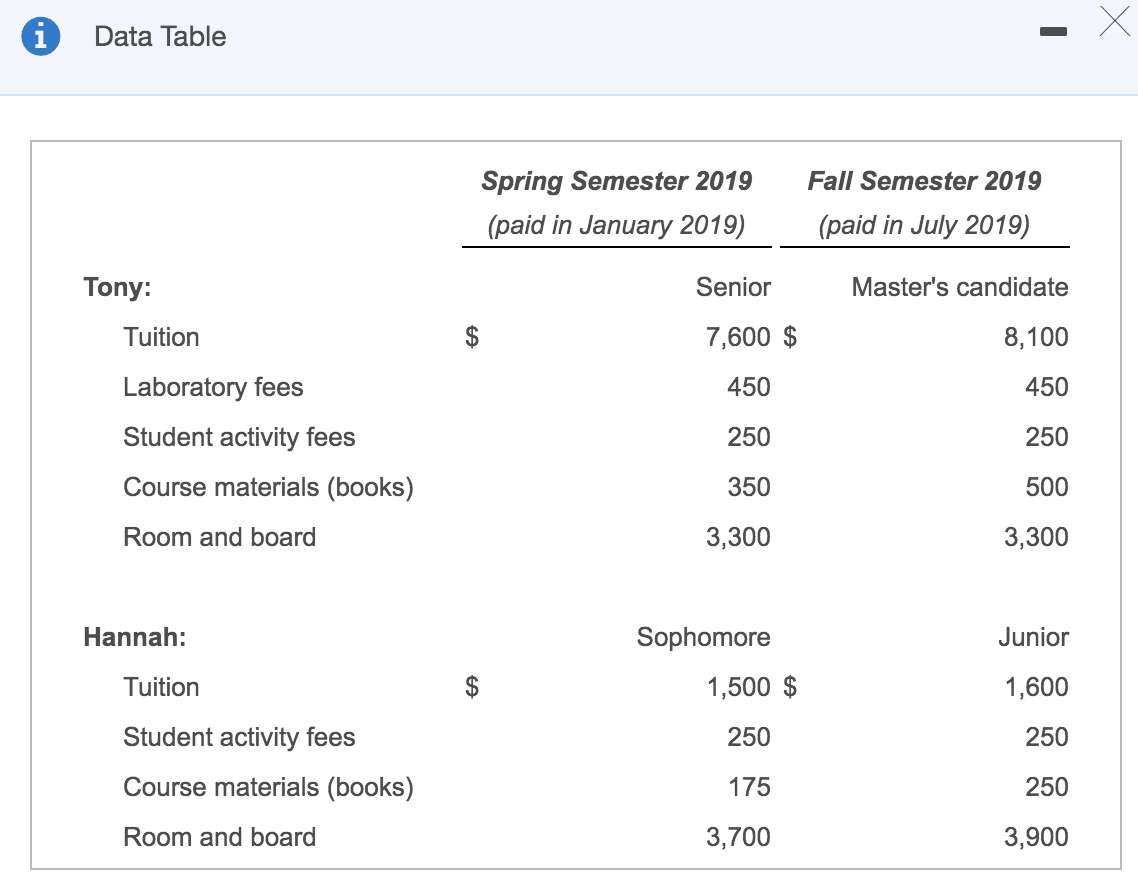

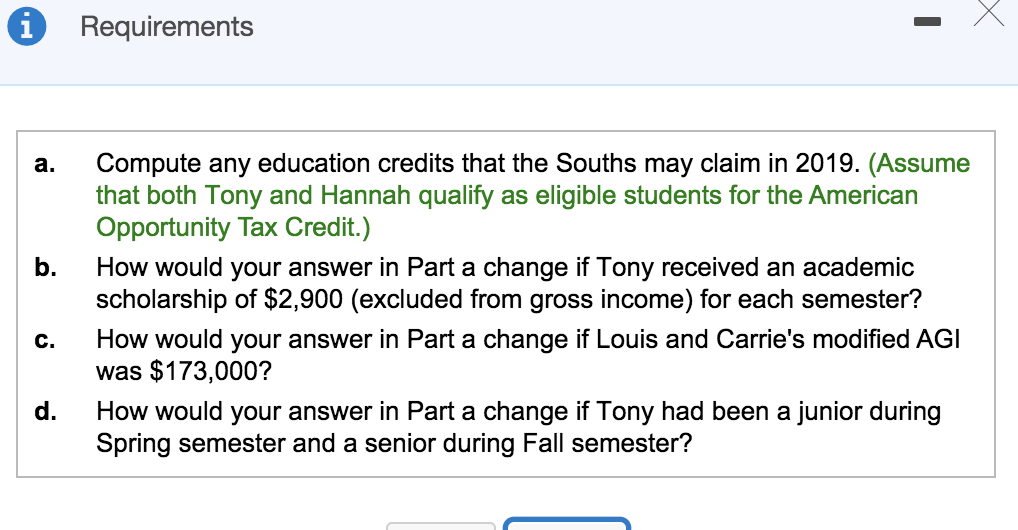

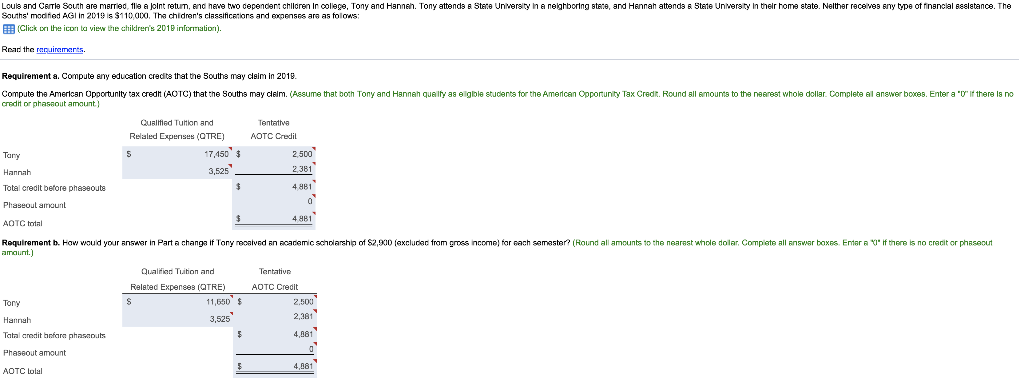

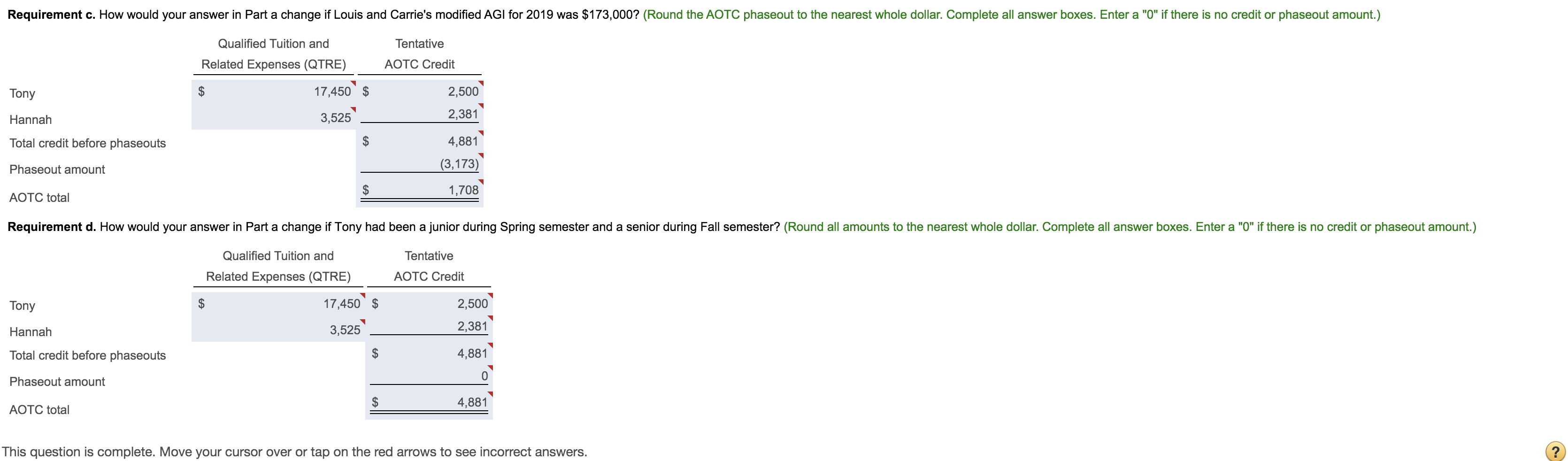

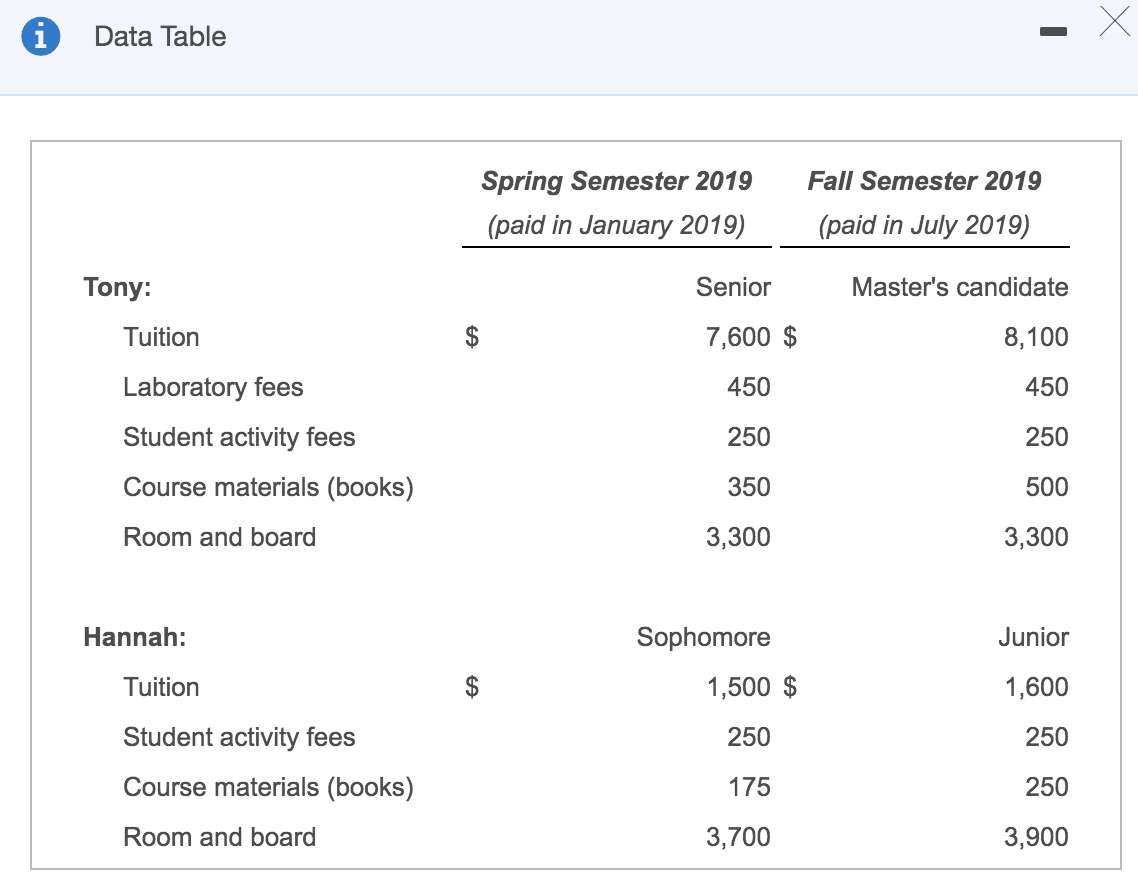

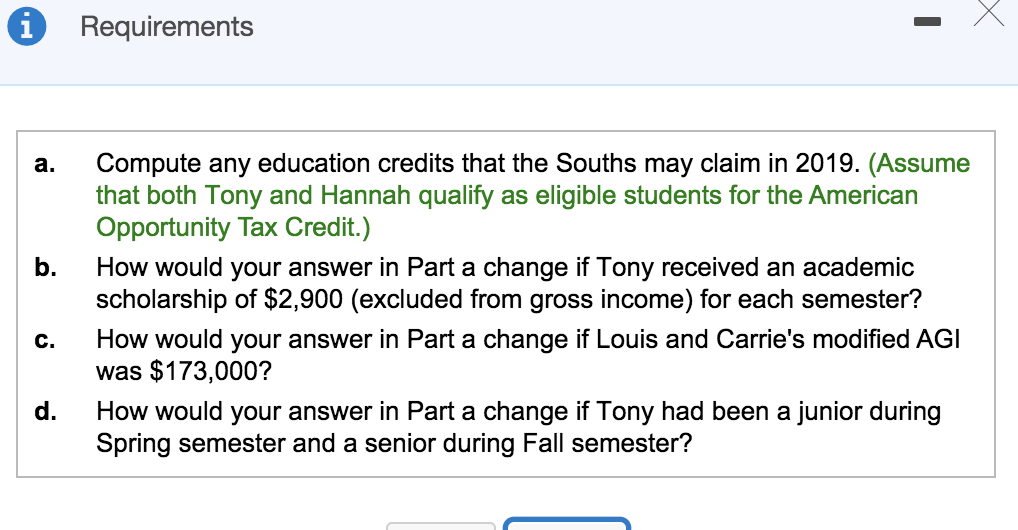

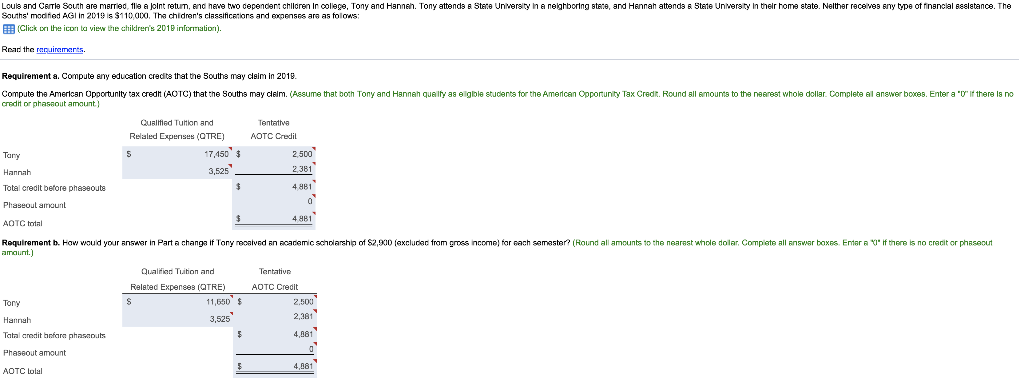

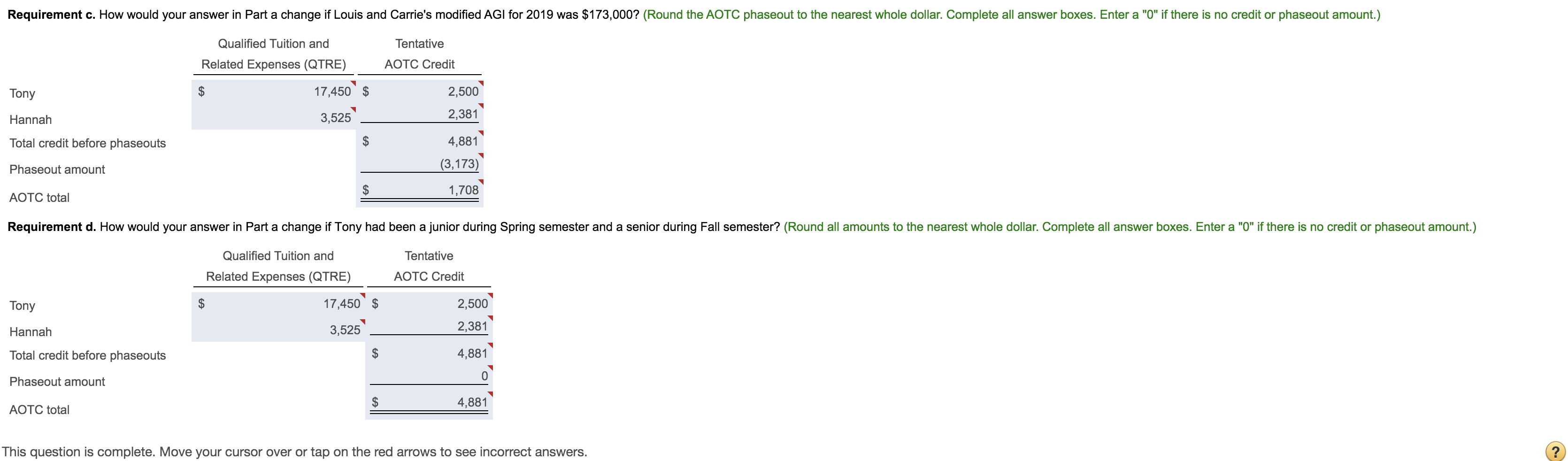

A Requirements a. b. Compute any education credits that the Souths may claim in 2019. (Assume that both Tony and Hannah qualify as eligible students for the American Opportunity Tax Credit.) How would your answer in Part a change if Tony received an academic scholarship of $2,900 (excluded from gross income) for each semester? How would your answer in Part a change if Louis and Carrie's modified AGI was $173,000? How would your answer in Part a change if Tony had been a junior during Spring semester and a senior during Fall semester? c. Louis and Cartie South are married, tile a joint return, and have two dependent children in college, Tony and Hannen, Tony attends a Steco University in a neighboring stere, and Henneh attenda a State University in their home state. Neither receives any type of financial selatance. The Souths' modified AGI in 2019 is $110 DX, Tha chidren's classifications and exenses are as follows: (Click on the icon to view the children's 2019 information). Roar the repuisinerts. Requirement a. Compute sny education credits that the Souths may daim in 2018. Compute the American Opportunity tax credit (AOTC) that the Souths may calm. (Assume that both Tony and Hannah qualty as elgole students for the American Opportunity Tax Credit. Round all amounts to the nearest whole dollar. Complete al answer boxes. Enter a "U" If there is no creditor phassout amount Tentativa AOTC Credit Qualified Tuition and Relaled Expenses (CTRE) 17,450 $ 3,525_ 2.500 2.381 Tary Hannah Total credit before phaseouts Phaseoul amount AOTC total 4.461 Requirement b. Fow would your answer in Part a change if Tony recalvad an academic scholarship of $2,900 (excludier from gmes income for each semester? (Round all amounts to the nearest whole dolar. Complete all answer boxes Enter a amount.) "If there is no creditor phaseout Qualifiers Tuition and Related Expenses (QTRE) 11,650 $ Tentative AOTC Credit 2.500 2,361 4,881 Hannah Tatal credit before phaseouts Phaseout amount 3,525 AOTC lolal 4.881 Requirement c. How would your answer in Part a change if Louis and Carrie's modified AGI for 2019 was $173,000? (Round the AOTC phaseout to the nearest whole dollar. Complete all answer boxes. Enter a "0" if there is no credit or phaseout amount.) Tentative AOTC Credit Qualified Tuition and Related Expenses (QTRE) 17,450 $ 3,525 Tony 2,500 2,381 Hannah | Total credit before phaseouts Phaseout amount 4,881 (3,173) 1,708 | AOTC total Requirement d. How would your answer in Part a change if Tony had been a junior during Spring semester and a senior during Fall semester? (Round all amounts to the nearest whole dollar. Complete all answer boxes. Enter a "0" if there is no credit or phaseout amount.) Qualified Tuition and Related Expenses (QTRE) Tentative AOTC Credit Tony 2,500 17,450 $ 3,525 Hannah 2,381 | Total credit before phaseouts A 4,881) Phaseout amount | 4,881 AOTC total This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers. A Requirements a. b. Compute any education credits that the Souths may claim in 2019. (Assume that both Tony and Hannah qualify as eligible students for the American Opportunity Tax Credit.) How would your answer in Part a change if Tony received an academic scholarship of $2,900 (excluded from gross income) for each semester? How would your answer in Part a change if Louis and Carrie's modified AGI was $173,000? How would your answer in Part a change if Tony had been a junior during Spring semester and a senior during Fall semester? c. Louis and Cartie South are married, tile a joint return, and have two dependent children in college, Tony and Hannen, Tony attends a Steco University in a neighboring stere, and Henneh attenda a State University in their home state. Neither receives any type of financial selatance. The Souths' modified AGI in 2019 is $110 DX, Tha chidren's classifications and exenses are as follows: (Click on the icon to view the children's 2019 information). Roar the repuisinerts. Requirement a. Compute sny education credits that the Souths may daim in 2018. Compute the American Opportunity tax credit (AOTC) that the Souths may calm. (Assume that both Tony and Hannah qualty as elgole students for the American Opportunity Tax Credit. Round all amounts to the nearest whole dollar. Complete al answer boxes. Enter a "U" If there is no creditor phassout amount Tentativa AOTC Credit Qualified Tuition and Relaled Expenses (CTRE) 17,450 $ 3,525_ 2.500 2.381 Tary Hannah Total credit before phaseouts Phaseoul amount AOTC total 4.461 Requirement b. Fow would your answer in Part a change if Tony recalvad an academic scholarship of $2,900 (excludier from gmes income for each semester? (Round all amounts to the nearest whole dolar. Complete all answer boxes Enter a amount.) "If there is no creditor phaseout Qualifiers Tuition and Related Expenses (QTRE) 11,650 $ Tentative AOTC Credit 2.500 2,361 4,881 Hannah Tatal credit before phaseouts Phaseout amount 3,525 AOTC lolal 4.881 Requirement c. How would your answer in Part a change if Louis and Carrie's modified AGI for 2019 was $173,000? (Round the AOTC phaseout to the nearest whole dollar. Complete all answer boxes. Enter a "0" if there is no credit or phaseout amount.) Tentative AOTC Credit Qualified Tuition and Related Expenses (QTRE) 17,450 $ 3,525 Tony 2,500 2,381 Hannah | Total credit before phaseouts Phaseout amount 4,881 (3,173) 1,708 | AOTC total Requirement d. How would your answer in Part a change if Tony had been a junior during Spring semester and a senior during Fall semester? (Round all amounts to the nearest whole dollar. Complete all answer boxes. Enter a "0" if there is no credit or phaseout amount.) Qualified Tuition and Related Expenses (QTRE) Tentative AOTC Credit Tony 2,500 17,450 $ 3,525 Hannah 2,381 | Total credit before phaseouts A 4,881) Phaseout amount | 4,881 AOTC total This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers