Question: A resident alien couple with two (2) dependent children. The husband receives an annual salary of P652,000, with allowances of P100,000, and a housing

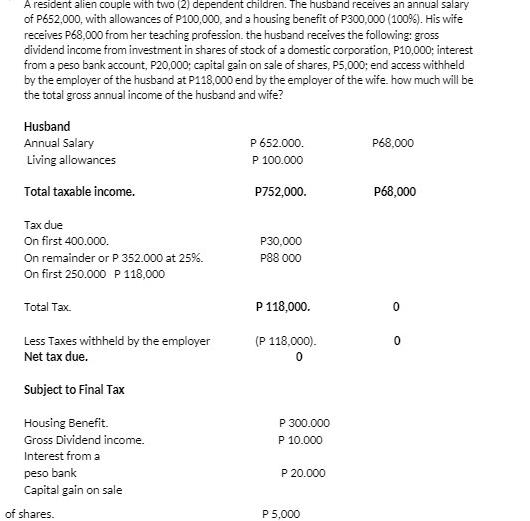

A resident alien couple with two (2) dependent children. The husband receives an annual salary of P652,000, with allowances of P100,000, and a housing benefit of P300,000 (100%). His wife receives P68,000 from her teaching profession. the husband receives the following: gross dividend income from investment in shares of stock of a domestic corporation, P10,000; interest from a peso bank account, P20,000; capital gain on sale of shares, P5,000; end access withheld by the employer of the husband at P118,000 end by the employer of the wife. how much will be the total gross annual income of the husband and wife? Husband Annual Salary Living allowances Total taxable income. Tax due On first 400.000. On remainder or P 352.000 at 25%. On first 250.000 P 118,000 Total Tax Less Taxes withheld by the employer Net tax due. Subject to Final Tax Housing Benefit. Gross Dividend income. Interest from a peso bank Capital gain on sale of shares. P 652.000. P 100.000 P752,000. P30,000 P88 000 P 118,000. (P 118,000). 0 P 300.000 P 10.000 P 20.000 P 5,000 P68,000 P68,000 0 0

Step by Step Solution

There are 3 Steps involved in it

To calculate the total gross annual income of the husband and wife we need to sum up th... View full answer

Get step-by-step solutions from verified subject matter experts