Question

A resident citizen, has the following data for the year 2020: Description From Philippines From Ukraine Gross sales 5,000,000 3,000,000 Sales returns and allowances

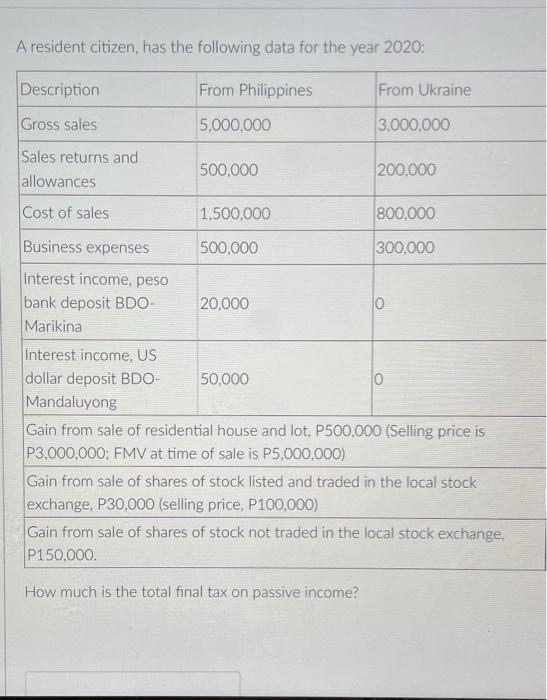

A resident citizen, has the following data for the year 2020: Description From Philippines From Ukraine Gross sales 5,000,000 3,000,000 Sales returns and allowances 500,000 200,000 Cost of sales 1,500,000 800,000 Business expenses 500,000 300,000 Interest income, peso bank deposit BDO- 20,000 Marikina Interest income, US dollar deposit BDO- Mandaluyong 50,000 Gain from sale of residential house and lot, P500,000 (Selling price is P3,000,000; FMV at time of sale is P5.000,000) Gain from sale of shares of stock listed and traded in the local stock exchange, P30,000 (selling price, P100,000) Gain from sale of shares of stock not traded in the local stock exchange, P150,000. How much is the total final tax on passive income?

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer Interest income peso bank ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

12th edition

978-1133952428, 1285078578, 1133952429, 978-1285078571

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App