Question

A resident decedent died on April 1, 2021. He availed of a P500,000 salary loan from ABC Manufacturing Corporation (his employer) by issuing a

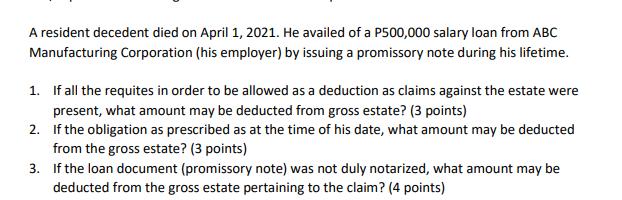

A resident decedent died on April 1, 2021. He availed of a P500,000 salary loan from ABC Manufacturing Corporation (his employer) by issuing a promissory note during his lifetime. 1. If all the requites in order to be allowed as a deduction as claims against the estate were present, what amount may be deducted from gross estate? (3 points) 2. If the obligation as prescribed as at the time of his date, what amount may be deducted from the gross estate? (3 points) 3. If the loan document (promissory note) was not duly notarized, what amount may be deducted from the gross estate pertaining to the claim? (4 points)

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 If all the requirements to be allowed as a deduction as claims against the estate were pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Dynamic Business Law The Essentials

Authors: Nancy Kubasek, M. Neil Browne, Daniel Herron, Lucien Dhooge, Linda Barkacs

5th Edition

1260253384, 978-1260253382

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App