Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A resident foreign corporation branch had the following results of operations in 2021, the fifth year of its operations: Gross income from sales of

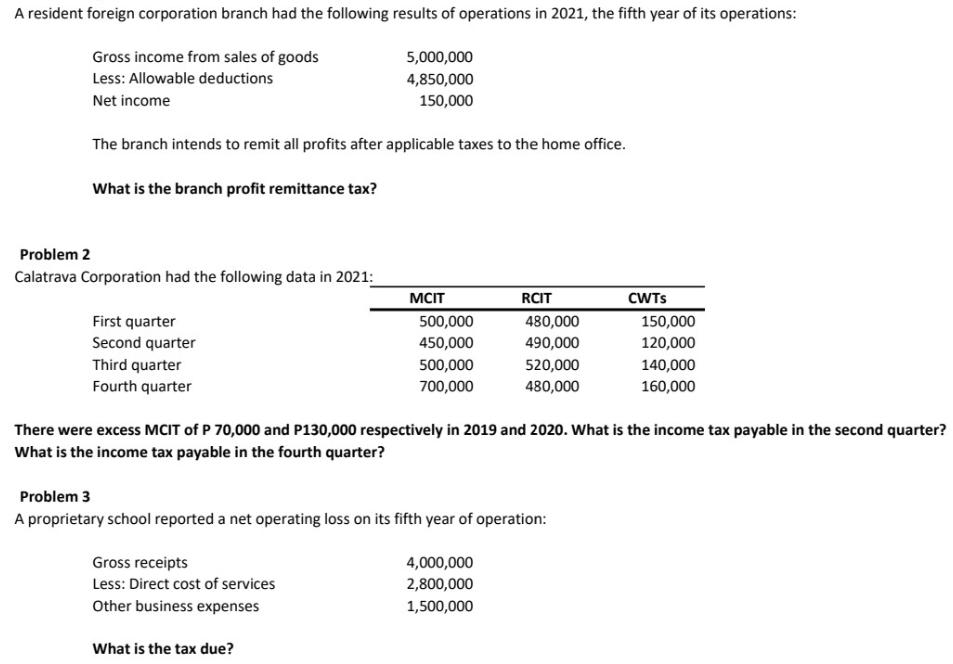

A resident foreign corporation branch had the following results of operations in 2021, the fifth year of its operations: Gross income from sales of goods Less: Allowable deductions Net income 5,000,000 4,850,000 150,000 The branch intends to remit all profits after applicable taxes to the home office. What is the branch profit remittance tax? Problem 2 Calatrava Corporation had the following data in 2021: First quarter Second quarter Third quarter Fourth quarter MCIT RCIT CWTS 500,000 480,000 150,000 450,000 490,000 120,000 500,000 520,000 140,000 700,000 480,000 160,000 There were excess MCIT of P 70,000 and P130,000 respectively in 2019 and 2020. What is the income tax payable in the second quarter? What is the income tax payable in the fourth quarter? Problem 3 A proprietary school reported a net operating loss on its fifth year of operation: Gross receipts Less: Direct cost of services Other business expenses What is the tax due? 4,000,000 2,800,000 1,500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Problem 1 To calculate the branch profit remittance tax we need to determine the taxable income of the branch Taxable income is calculated by subtract...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started