Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A retail lease for 1 0 , 0 0 0 square feet of rentable space is being negotiated for a five - year term. Option

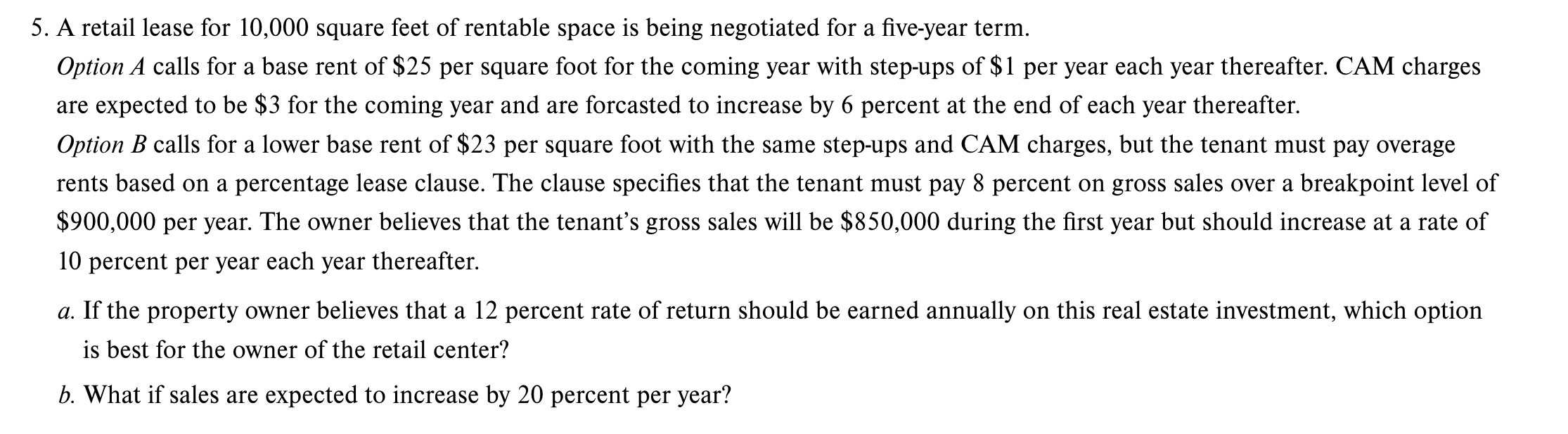

A retail lease for square feet of rentable space is being negotiated for a fiveyear term.

Option A calls for a base rent of $ per square foot for the coming year with stepups of $ per year each year thereafter. CAM charges

are expected to be $ for the coming year and are forcasted to increase by percent at the end of each year thereafter.

Option B calls for a lower base rent of $ per square foot with the same stepups and CAM charges, but the tenant must pay overage

rents based on a percentage lease clause. The clause specifies that the tenant must pay percent on gross sales over a breakpoint level of

$ per year. The owner believes that the tenant's gross sales will be $ during the first year but should increase at a rate of

percent per year each year thereafter.

a If the property owner believes that a percent rate of return should be earned annually on this real estate investment, which option

is best for the owner of the retail center?

b What if sales are expected to increase by percent per year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started