Answered step by step

Verified Expert Solution

Question

1 Approved Answer

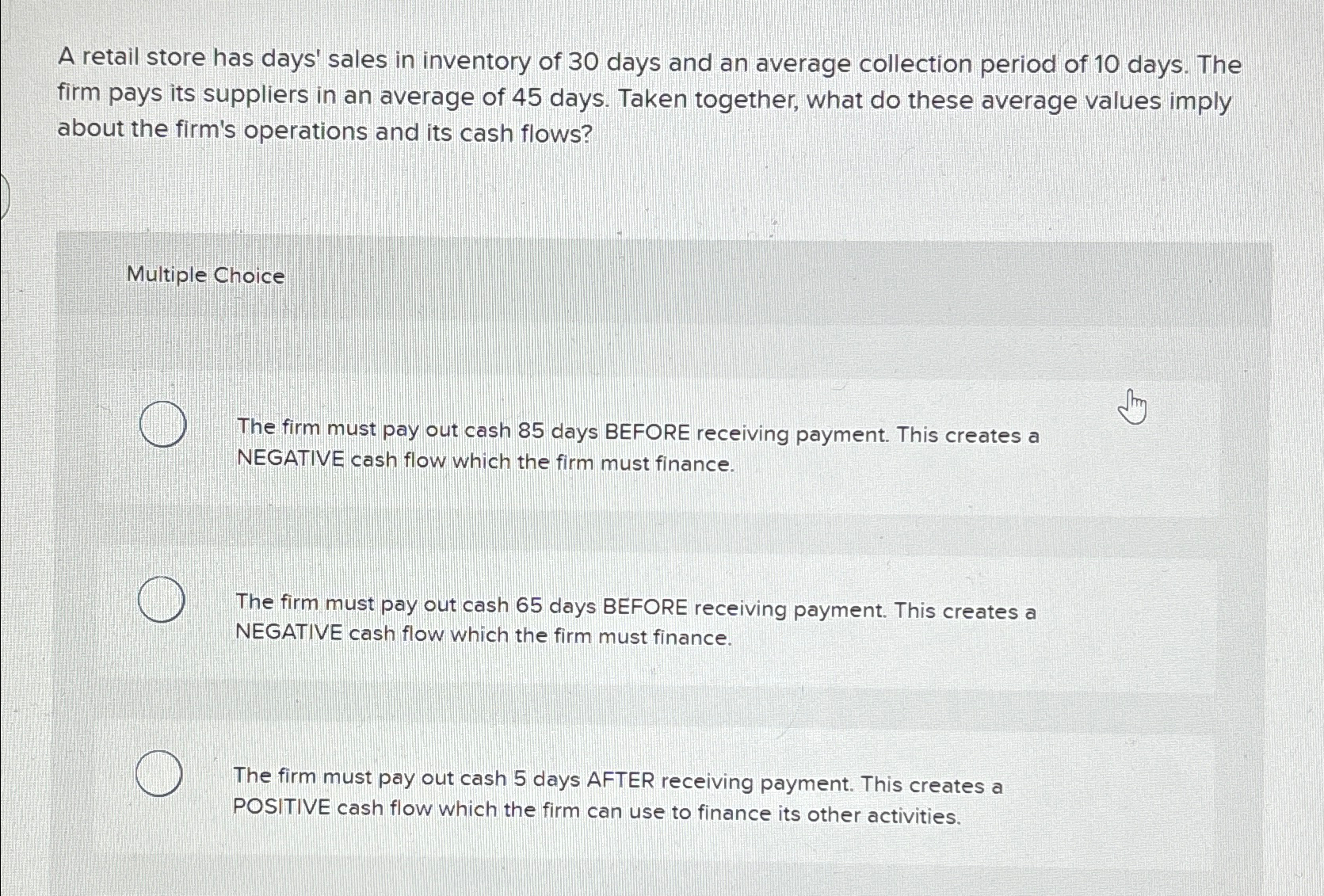

A retail store has days' sales in inventory of 3 0 days and an average collection period of 1 0 days. The firm pays its

A retail store has days' sales in inventory of days and an average collection period of days. The firm pays its suppliers in an average of days. Taken together, what do these average values imply about the firm's operations and its cash flows?

Multiple Choice

The firm must pay out cash days BEFORE receiving payment. This creates a NEGATIVE cash flow which the firm must finance.

The firm must pay out cash days BEFORE receiving payment. This creates a NEGATIVE cash flow which the firm must finance.

The firm must pay out cash days AFTER receiving payment. This creates a POSITIVE cash flow which the firm can use to finance its other activities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started