Question

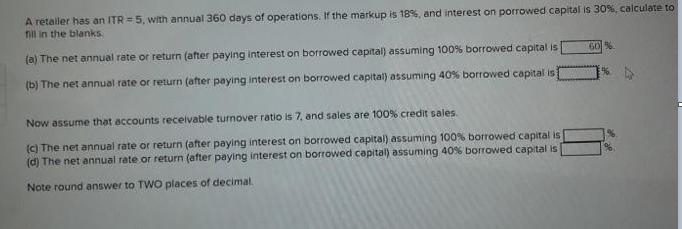

A retaler has an ITR =5, with annual 360 days of operations. If the markup is 18%, and interest on porrowed capital is 30%,

A retaler has an ITR =5, with annual 360 days of operations. If the markup is 18%, and interest on porrowed capital is 30%, calculate to fill in the blanks. (a) The net annual rate or return (after paying interest on borrowed cepital) assuming 100% borrowed capital is 60% (b) The net annual rate or return (after paying interest on borrowed capital) assuming 40% borrowed capital is Now assume that accounts receivable turnover ratio is 7, and sales are 100% credit sales. (C) The net annual rate or return (after paying interest on borrowed capital) assuming 100% borrowed capital is (d) The net annual rate or return (after paying interest on borrowed capital) assuming 40% borrowed capital is Note round answer to TWO places of decimal.

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Probability And Statistics

Authors: William Mendenhall, Robert J. Beaver, Barbara M. Beaver

13th Edition

0495389536, 9780495389538

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App