Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A retiree nearing retirement has asked for your impression of their retirement portfolio. The retiree's portfolio is very simple - choices were limited to

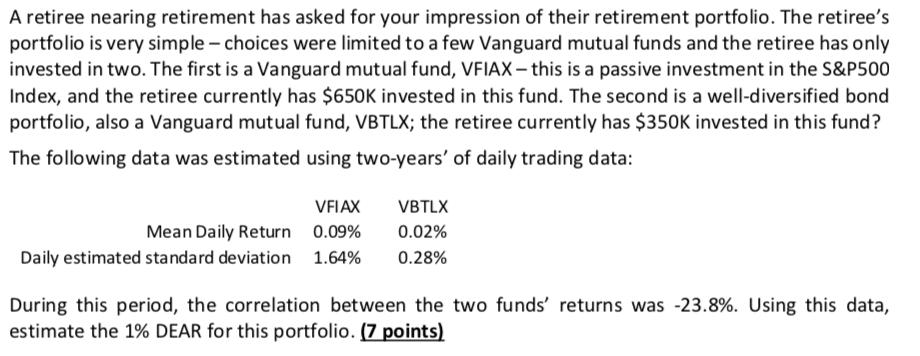

A retiree nearing retirement has asked for your impression of their retirement portfolio. The retiree's portfolio is very simple - choices were limited to a few Vanguard mutual funds and the retiree has only invested in two. The first is a Vanguard mutual fund, VFIAX-this is a passive investment in the S&P500 Index, and the retiree currently has $650K invested in this fund. The second is a well-diversified bond portfolio, also a Vanguard mutual fund, VBTLX; the retiree currently has $350K invested in this fund? The following data was estimated using two-years' of daily trading data: VFIAX VBTLX Mean Daily Return 0.09% Daily estimated standard deviation 1.64% 0.02% 0.28% During this period, the correlation between the two funds' returns was -23.8%. Using this data, estimate the 1% DEAR for this portfolio. (7 points)

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Investment in VFIAX 650000 Investment in VBTLX 350000 Therefore the weights are as follows w ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started