Answered step by step

Verified Expert Solution

Question

1 Approved Answer

in full retirement age based on year of birth and the reduction in benefits received before full retirement age. For example, Mary was born

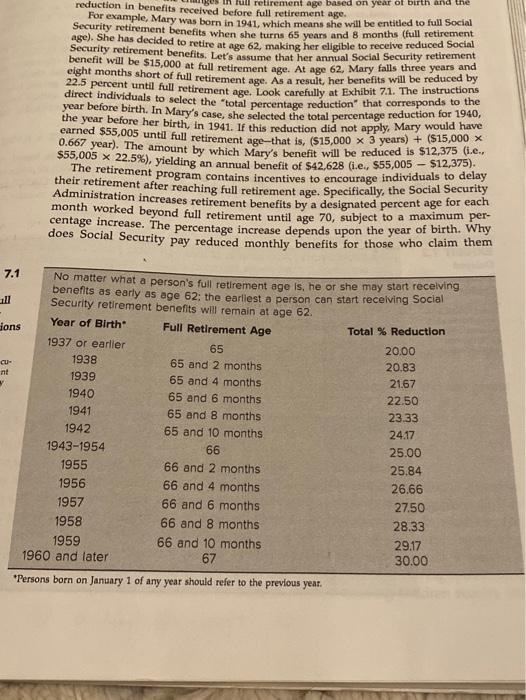

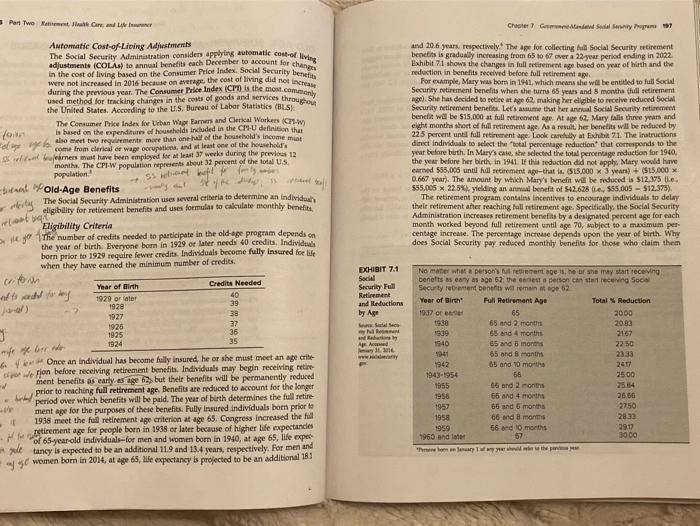

in full retirement age based on year of birth and the reduction in benefits received before full retirement age. For example, Mary was born in 1941, which means she will be entitled to full SOcial Security retirement benefits when she turns 65 years and 8 months (full retirement age). She has decided to retire at aoe 62, making her eligible to receive reduced Social Security retirement benefits, Let's assume that her annual Social Security retirement benefit will be $15,000 at full retirement age. At age 62, Mary falls three years and eight months short of full retirement age. As a result, her benefits will be reduced by 22.5 percent until full retirement age. Look carefully at Exhibit 7.1. The instructions direct individuals to select the "total pencentage reducstion" that corresponds to the year before birth. In Mary's case, she selected the total percentage reduction for 19U, the year before her birth, in 1941, If this reduction did not apply. Mary would have earned $55,005 until full retirement age-that is. ($15,000 x 3 years) + (S15,000 A 0.667 year). The amount by which Mary's benefit will be reduced is $12,375 (1.e., $55,005 x 22.5%), yielding an annual benefit of $42.628 (i.e., $55,005 - $12,375). he retrement program contains incentives to encourage individuals to delay their retirement after reaching full retirement age, Specifically, the Social Security Administration increases retirement benefits by a designated percent age for each month worked beyond full retirement until age 70, subject to a maximum per- centage increase. The percentage increase depends upon the year of birth. Why does Social Security pay reduced monthly benefits for those who claim them 7.1 No matter what a person's full retirement age Is, he or she may start recelving benefits as early as age 62: the earliest a person can start recelving Social Security retirement benefits will remain at age 62. all jons Year of Birth Full Retirement Age Total % Reduction 1937 or earlier 65 20.00 1938 65 and 2 months 20.83 cu- nt 1939 65 and 4 months 21.67 1940 65 and 6 months 22.50 1941 65 and 8 months 23.33 1942 65 and 10 months 24.17 1943-1954 66 25.00 1955 66 and 2 months 25.84 1956 66 and 4 months 26.66 1957 66 and 6 months 27.50 1958 66 and 8 months 28.33 66 and 10 months 67 29.17 1959 1960 and later 30.00 *Persons born on January 1 of any year should refer to the previous year. Part Two Retemnt ak Care and L Iner Crepter 7 Cm aded Slal ey Pgren 97 Automatic Cost-of-Living Adjustments The Social Security Administration considers applying automatie cost-of adjustments (COLAs) to annual benefits each December to account for cha in the cost of living based on the Consumer Price Index. Social Security he were not increased in 2016 because on average, the cost of Iving did not incres during the previous year. The Consumer Price Index (CPO is the most.commo used method for tracking changes in the costs of goods and services throur the United States. According to the U.S. Bureau of Labor Statistics (BLS The Consumer Price Indes for Urban Wage Earners and Clerical Workers (Cn is based on the expenditure ef houstholds induded in the C-U definition th also meet two requiremente more than one-hal of the household's income mun e come from clerical or wage oorupations, and at least one of the household'a and 20.6 years respectively The age for collecting hill Social Security retirement benetits is gradually increasing from 65 to 67 over a 22year period ending in 2022. Exhibit 71 shows the changes in full retirement age based on year of hirth and the reduction in benefits received before full retirement age. For example, Mary was borm in 1941, which means she wil be entitled to full Social Security retirement benefits when she turna 65 years and 8 montha (hull retirement age). She has decided to retire at age 62, making her eligible to receive reduced Social Security netirement benetits. Let's asume that her annual Social Security retirement benefit will be $15,000 at full retirement age. At age 62. Mary falls three years and eight months short of full retirement age. Aa a result, her benefits will be reduced by 225 percent until full retirement age. Look caretully at Exhibt 71 The inatructions direct individuals to select the "botal percentage reduction that corresponds to the year before birth. In Mary's case, she selected the total percentage reduction for 1940, the year before her birth, in 1941 If this reduction did not apply, Mary would have carned $55,005 until full setirement age-that ia. (S15.000 x 3 years) + (S15,000 x 0.667 year). The amount by which Mary's benefit will be reduced is $12.375 (e. $55,005 x 225%), yielding an annual benefit of S42.628 (Le, S55,005 - $12.375). The retirement program contains incentives to encourage individuals to delay their retirement ater reaching full retirement age. Specifically. the Social Security Administration increases retirement benefits by a designated percent age for each month worked beyond full retirement until age 70, subject to a maximum per- centage increase. The percentage increase depends upon the year of birth. Why does Social Security pay reduced monthly benefits for those who claim them uldan ejerners must have been employed fer at least 37 weeks during the previous 12 montha. The CPI-W population represents about 32 percent of the total US population. bieant Fold-Age Benefits kyla The Social Security Administration uses several criteria to determine an individu eligibility for retirement benefits and uses formulas to calculate monthly benefit Eligibility Criteria ae go 1The number of credits needed to participate in the old-age program depends on the year of birth. Everyone born in 1929 or later needs 40 credits. Individu born prior to 1929 require fewer credits. Individuals become fully insured foe lie when they have earned the minimum number of credits. EXHIBIT 7.1 Social Security Full Retirement and Reductions by Age No mater whet a person's fu retement age s, he or she may start receving benefts as eany as age 62: the eariest a person can stert receving Social Securty retrement benefts wil remain et ege 62 Credits Needed Year of Birth d t ad fr y 1929 or later 1928 40 39 Year of Birth Full Retirement Age Total % Reduction 38 1937 or ee 65 2000 1927 1930 65 and 2 months 2083 1926 1925 1924 37 36 35 l Se h enant 1939 65 and 4 months 2167 A Ad Jry . www. y 1540 65 and 6 months 2250 941 65 and 8 manths 2333 2417 4 Ver Once an individual has become fully insured, he or she must meet an age crite ide Fjon before receiving retirement benefits. Individuals may begin receiving retire ment benefits as early as age 62 but their benefits will be permanently reduced prior to reaching full rettrement age, Benefits are reduced to account for the longer period over wvhich benefits will be paid. The year of birth determines the full retire- ment age for the purposes of these benefits. Fully insured individuals born prior to 1938 meet the ful retirement age criterion at age 65. Congress increased the fil etirement age for people born in 1938 or later because of higher life expectancles of 65-yearold individuals-for men and women born in 1940, at age 65, life expec xit tancy is expected to be an additional 11.9 and 13.4 years, respectively. For men and se women bom in 2014, at age 63, life expectancy is projected to be an additional 18 1942 65 and 10 morthe 1943-1954 66 25.00 1955 66 ond 2 months 2584 1956 66 and 4 months 26.66 1957 66 and 6 months 2750. 1958 66 end 8 monms 2833 1959 1960 and later 56 end 10 months 67 2917 3000 "Tmee bom Jeary T yr d win the pon

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The full retirement age is 65 years and 8 months Since Ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started