Question

A risk averse decision maker with u(x) = vx faces a lottery L that delivers $2500 or $100 with equal (1/2) probabilities. (a) Would

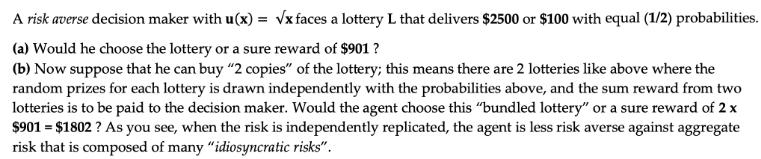

A risk averse decision maker with u(x) = vx faces a lottery L that delivers $2500 or $100 with equal (1/2) probabilities. (a) Would he choose the lottery or a sure reward of $901 ? (b) Now suppose that he can buy "2 copies" of the lottery; this means there are 2 lotteries like above where the random prizes for each lottery is drawn independently with the probabilities above, and the sum reward from two lotteries is to be paid to the decision maker. Would the agent choose this "bundled lottery" or a sure reward of 2 x $901 = $1802 ? As you see, when the risk is independently replicated, the agent is less risk averse against aggregate risk that is composed of many "idiosyncratic risks".

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Guen ux x2 Faces of lottery L delivers 2500 o l00 with equa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics

Authors: Douglas Bernheim, Michael Whinston

2nd edition

73375853, 978-0073375854

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App