Answered step by step

Verified Expert Solution

Question

1 Approved Answer

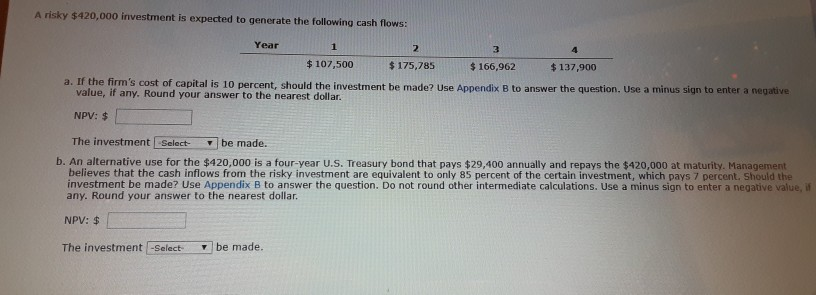

A risky $420,000 investment is expected to generate the following cash flows: Year $ 107,500 $175,785 $ 166,962 $137,900 a. If the firm's cost of

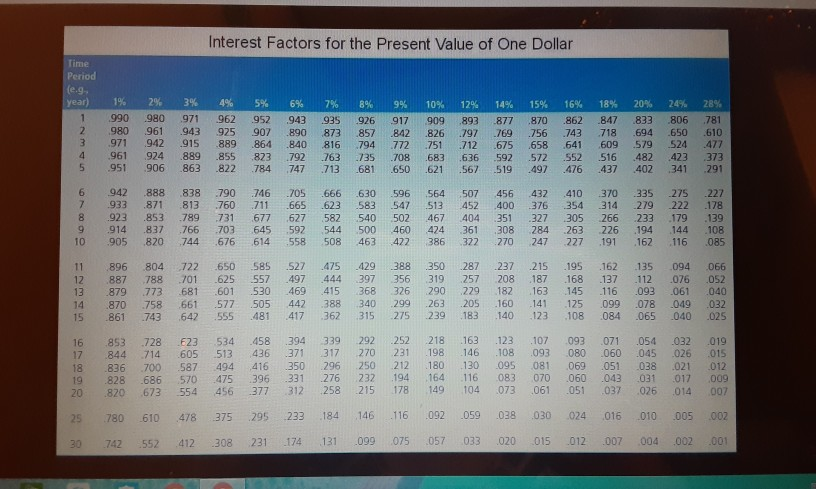

A risky $420,000 investment is expected to generate the following cash flows: Year $ 107,500 $175,785 $ 166,962 $137,900 a. If the firm's cost of capital is 10 percent, should the investment be made? Use Appendix B to answer the question. Use a minussion to enter a negative value, if any. Round your answer to the nearest dollar. NPV: $ The investment Select be made. b. An alternative use for the $420,000 is a four-year U.S. Treasury bond that pays $29,400 annually and repays the $420,000 at maturity Management believes that the cash inflows from the risky investment are equivalent to only 85 percent of the certain investment, which pays 7 percent, Should the investment be made? Use Appendix B to answer the question. Do not round other intermediate calculations. Use a minus sign to enter a negatve value, any. Round your answer to the nearest dollar. NPV: $ The investment -Select be made. Interest Factors for the Present Value of One Dollar Time Period E.94 year 1982 - % 5% 6% 7% B . 102 4 % 5% 6% 18% ; 990 990 971962 952 949 5926 91790993 87.80 62 847833 806781 9 961943950/| 81 8 PM2g2 07564371864 650 BC 7942915986440 816 477517127565854160959524423 | 961924 88985 823 92 63 | 35 TDB | 583636 592 572552 516 482 423 373 951906 863.82278474773 | 681 650 21 56 519 19776 437 402 341791 1.227 | 178 942 8888 790 6 5 666 60 596564 507 456 432 410 30 335 25 933 81 83 760 III 666 523 583 4 5 452 400 36 354 34 29 222 1923 1853 789 31 57 527 540 502467 404 351 327 305 266 233 179 914 8377663 645 597 544 500 460 | 308 284 253 225 194 905870 744576614558 1508 | 463422 386 322 270 147 17 191 162 116 582 139 12345 678gm "UBBB Eng98 8 %w www 085 896804722650 56 52 | 887788 01 625 89 773 681601 530 469 1870 758 66 577505 442 1861 43 54295 483417 5 .429 388 350 287 237 25 195 162 135094066 | 397 56 39 257 208 187 168 137 .112 052 415 26 290 9 182 | 145 116 092 061 046 388 340 29 263 205 160 141 125 099 078 49032 362315 25 29 183 140 23 108 084 065 040 025 139 93 78 F23534 458 39 844 14 65 53436 373 1826 TCO 587494 416 350 1.228686 570 475 30531 0820673 54 46 377312 92 1252 218 IE3 123 107093071 054 32 09 270 231 198 146.108 093 080 D60 045 026 015 | 22 180 130 095 081069 051038 021 LD12 232 194 164 116 083 070 060 43 03/ 01] 25 17 140 104 073 06105 37 026 01400 Da 25 0 780 42 610 478 552 412 375 232 108 231 174 258 184 131 146 116 092 059 28 1030 09 05 057 033 020 015 024 016 010 005 CD2 012 007 004 0020 A risky $420,000 investment is expected to generate the following cash flows: Year $ 107,500 $175,785 $ 166,962 $137,900 a. If the firm's cost of capital is 10 percent, should the investment be made? Use Appendix B to answer the question. Use a minussion to enter a negative value, if any. Round your answer to the nearest dollar. NPV: $ The investment Select be made. b. An alternative use for the $420,000 is a four-year U.S. Treasury bond that pays $29,400 annually and repays the $420,000 at maturity Management believes that the cash inflows from the risky investment are equivalent to only 85 percent of the certain investment, which pays 7 percent, Should the investment be made? Use Appendix B to answer the question. Do not round other intermediate calculations. Use a minus sign to enter a negatve value, any. Round your answer to the nearest dollar. NPV: $ The investment -Select be made. Interest Factors for the Present Value of One Dollar Time Period E.94 year 1982 - % 5% 6% 7% B . 102 4 % 5% 6% 18% ; 990 990 971962 952 949 5926 91790993 87.80 62 847833 806781 9 961943950/| 81 8 PM2g2 07564371864 650 BC 7942915986440 816 477517127565854160959524423 | 961924 88985 823 92 63 | 35 TDB | 583636 592 572552 516 482 423 373 951906 863.82278474773 | 681 650 21 56 519 19776 437 402 341791 1.227 | 178 942 8888 790 6 5 666 60 596564 507 456 432 410 30 335 25 933 81 83 760 III 666 523 583 4 5 452 400 36 354 34 29 222 1923 1853 789 31 57 527 540 502467 404 351 327 305 266 233 179 914 8377663 645 597 544 500 460 | 308 284 253 225 194 905870 744576614558 1508 | 463422 386 322 270 147 17 191 162 116 582 139 12345 678gm "UBBB Eng98 8 %w www 085 896804722650 56 52 | 887788 01 625 89 773 681601 530 469 1870 758 66 577505 442 1861 43 54295 483417 5 .429 388 350 287 237 25 195 162 135094066 | 397 56 39 257 208 187 168 137 .112 052 415 26 290 9 182 | 145 116 092 061 046 388 340 29 263 205 160 141 125 099 078 49032 362315 25 29 183 140 23 108 084 065 040 025 139 93 78 F23534 458 39 844 14 65 53436 373 1826 TCO 587494 416 350 1.228686 570 475 30531 0820673 54 46 377312 92 1252 218 IE3 123 107093071 054 32 09 270 231 198 146.108 093 080 D60 045 026 015 | 22 180 130 095 081069 051038 021 LD12 232 194 164 116 083 070 060 43 03/ 01] 25 17 140 104 073 06105 37 026 01400 Da 25 0 780 42 610 478 552 412 375 232 108 231 174 258 184 131 146 116 092 059 28 1030 09 05 057 033 020 015 024 016 010 005 CD2 012 007 004 0020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started