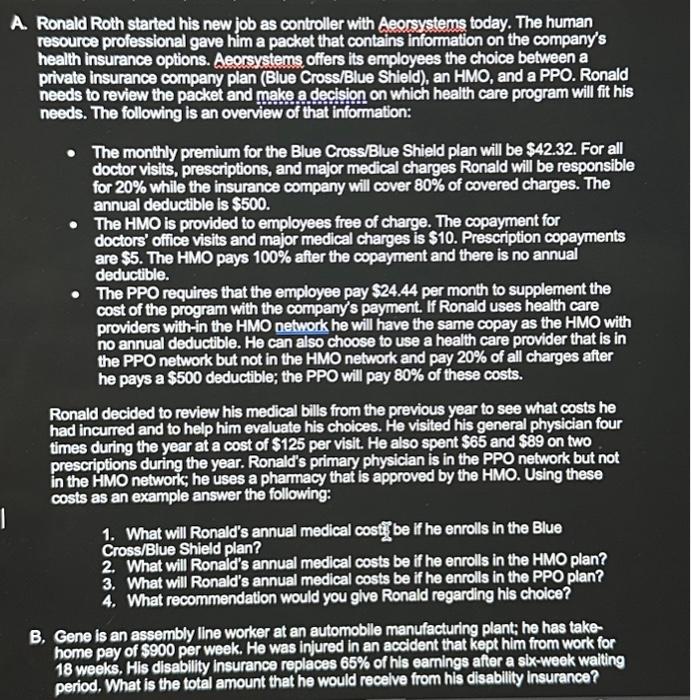

A. Ronald Roth started his new job as controller with Aeorsystems today. The human resource professional gave him a packet that contains information on the company's health insurance options. Aleorsystems offers its employees the choice between a private insurance company plan (Blue Cross/Blue Shield), an HMO, and a PPO. Ronald needs to review the packet and make a decision on which health care program will fit his needs. The following is an overview of that information: - The monthly premium for the Blue Cross/Blue Shield plan will be \$42.32. For all doctor visits, prescriptions, and major medical charges Ronald will be responsible for 20% while the insurance company will cover 80% of covered charges. The annual deductible is $500. - The HMO is provided to employees free of charge. The copayment for doctors' office visits and major medical charges is S10. Prescription copayments are \$5. The HMO pays 100% after the copayment and there is no annual deductible. - The PPO requires that the employee pay $24.44 per month to supplement the cost of the program with the company's payment. If Ronald uses health care providers with-in the HMO network he will have the same copay as the HMO with no annual deductible. He can also choose to use a health care provider that is in the PPO network but not in the HMO network and pay 20% of all charges after he pays a $500 deductible; the PPO will pay 80% of these costs. Ronald decided to review his medical bills from the previous year to see what costs he had incurred and to help him evaluate his choices. He visited his general physician four times during the year at a cost of $125 per visit. He also spent $65 and $89 on two prescriptions during the year. Ronald's primary physiclan is in the PPO network but not in the HMO network, he uses a pharmacy that is approved by the HMO. Using these costs as an example answer the following: 1. What will Ronald's annual medical cosffise if he enrolls in the Blue Cross/Blue Shield plan? 2. What will Ronald's annual medical costs be if he enrolls in the HMO plan? 3. What will Ronald's annual medical costs be if he enrolls in the PPO plan? 4. What recommendation would you glve Ronald regarding his choice? B. Gene is an assembly line worker at an automoblle manufacturing plant; he has takehome pay of 5900 per week. He was injured in an accident that kept him from work for 18 weeks, His disability insurance replaces 65% of his eamings after a slx-week walting period. What is the total amount that he would recelve from his disability insurance