Answered step by step

Verified Expert Solution

Question

1 Approved Answer

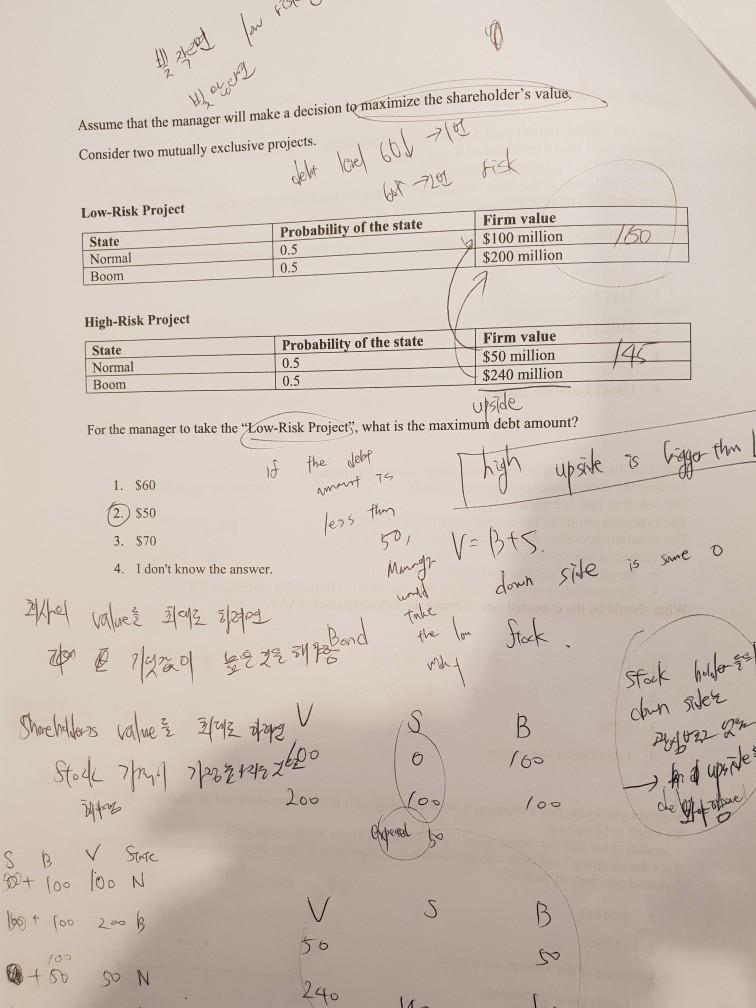

a ry Assume that the manager will make a decision to maximize the shareholder's value Consider two mutually exclusive projects. oleht level 666 661 201

a ry Assume that the manager will make a decision to maximize the shareholder's value Consider two mutually exclusive projects. oleht level 666 661 201 risk Low-Risk Project State Firm value $100 million $200 million Probability of the state 0.5 0.5 160 Normal Boom Stock art 7/222 142 2600 Value zone pagal Share holders value fue otorg High-Risk Project State Probability of the state Firm value Normal 0.5 $50 million Boom 0.5 $240 million upside For the manager to take the "Low-Risk Project", what is the maximum debt amount? if the debe 75 [ high upsik bigger the 1. $60 2.) $50 3. $70 0 amust Ts less than 50 Manage would take 4. I don't know the answer. V=Bts. down site some is the lou Flock Bez sur Bond stock heller i down sites V B 6 200 loo 100 by try che genue exeed to S B v State + 100 100 N 165 + 1oo V S B 70 + 50 SON 240

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started