Answered step by step

Verified Expert Solution

Question

1 Approved Answer

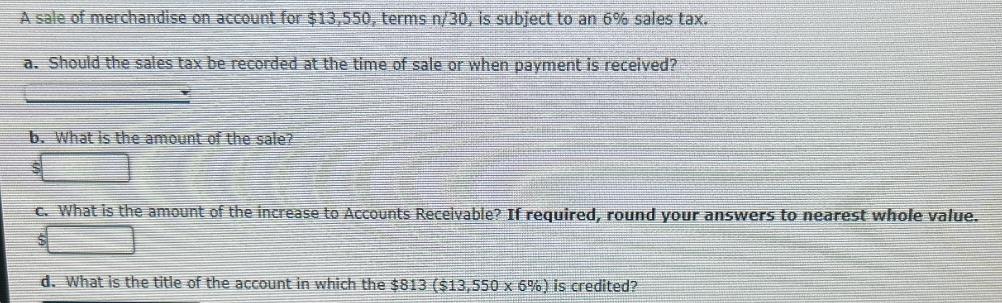

A sale of merchandise on account for $13,550, terms n/30, is subject to an 6% sales tax. a. Should the sales tax be recorded

A sale of merchandise on account for $13,550, terms n/30, is subject to an 6% sales tax. a. Should the sales tax be recorded at the time of sale or when payment is received? b. What is the amount of the sale? c. What is the amount of the increase to Accounts Receivable? If required, round your answers to nearest whole value. d. What is the title of the account in which the $813 ($13,550 x 6%) is credited?

Step by Step Solution

★★★★★

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

answer aThe sales tax should be recorded at the time of s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663da195a7f76_964236.pdf

180 KBs PDF File

663da195a7f76_964236.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started