Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Scranton Industrial Manufacturing company purchased three (3) flexible manufacturing cells at a price of $400,000 each, all to be delivered with one shipment.

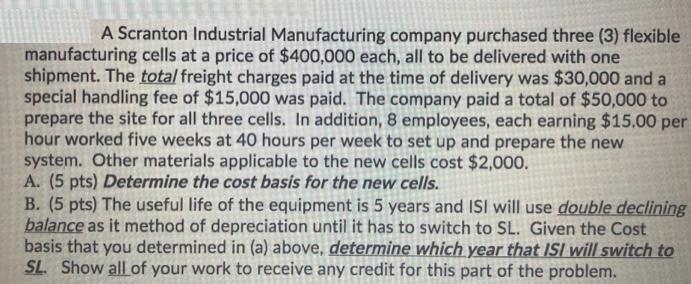

A Scranton Industrial Manufacturing company purchased three (3) flexible manufacturing cells at a price of $400,000 each, all to be delivered with one shipment. The total freight charges paid at the time of delivery was $30,000 and a special handling fee of $15,000 was paid. The company paid a total of $50,000 to prepare the site for all three cells. In addition, 8 employees, each earning $15.00 per hour worked five weeks at 40 hours per week to set up and prepare the new system. Other materials applicable to the new cells cost $2,000. A. (5 pts) Determine the cost basis for the new cells. B. (5 pts) The useful life of the equipment is 5 years and ISI will use double declining balance as it method of depreciation until it has to switch to SL. Given the Cost basis that you determined in (a) above, determine which year that ISI will switch to SL Show all of your work to receive any credit for this part of the problem.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution a Computation of Cost basis of new Cells Particulars Description Amount Cost of 3 Cells 3X4...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started