Question

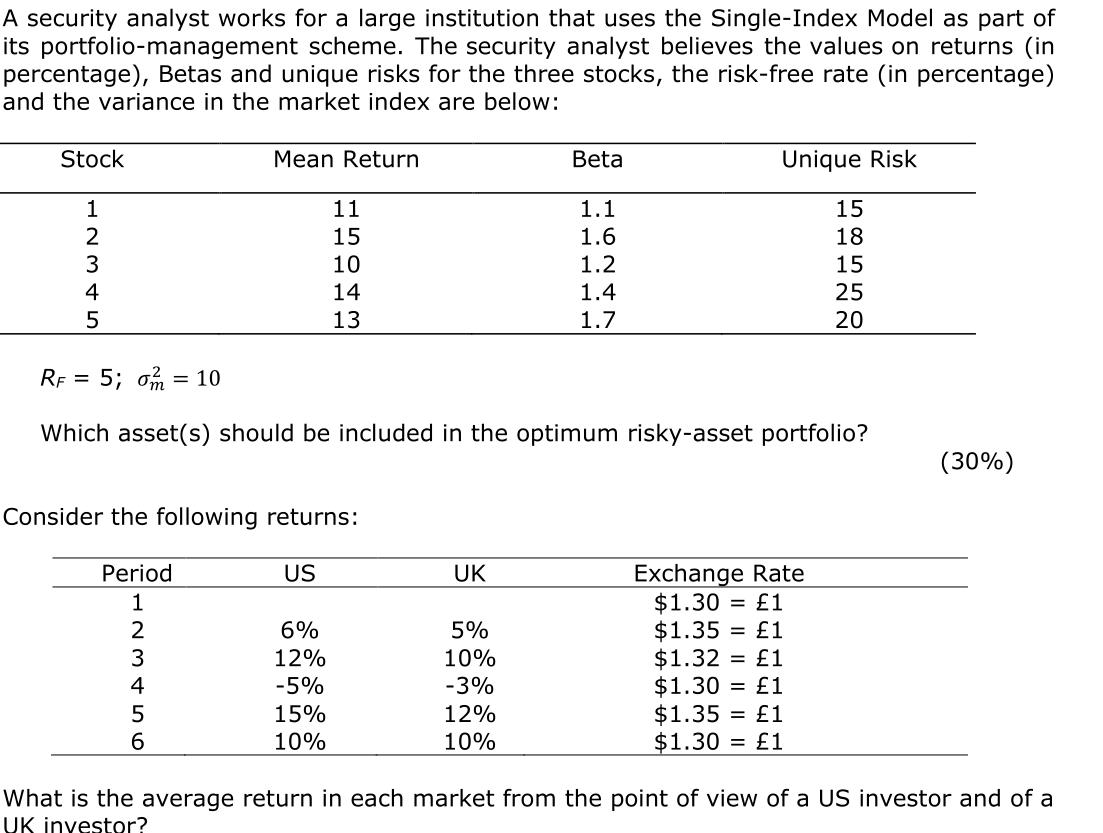

A security analyst works for a large institution that uses the Single-Index Model as part of its portfolio-management scheme. The security analyst believes the

A security analyst works for a large institution that uses the Single-Index Model as part of its portfolio-management scheme. The security analyst believes the values on returns (in percentage), Betas and unique risks for the three stocks, the risk-free rate (in percentage) and the variance in the market index are below: Stock 12345 5 Mean Return RF = Consider the following returns: Period 1 2 3 4 5 6 US 11 15 10 14 13 6% 12% -5% 15% 10% UK 5; = 10 Which asset(s) should be included in the optimum risky-asset portfolio? 5% 10% -3% Beta 12% 10% 1.1 1.6 1.2 1.4 1.7 Unique Risk 15 18 15 8550 Exchange Rate $1.30 = 1 $1.35 = 1 $1.32 = 1 $1.30 = 1 $1.35 = 1 $1.30 = 1 25 20 (30%) What is the average return in each market from the point of view of a US investor and of a UK investor?

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Smith and Roberson Business Law

Authors: Richard A. Mann, Barry S. Roberts

15th Edition

1285141903, 1285141903, 9781285141909, 978-0538473637

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App