Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A sells sports equipment. Both subsidiaries A and B are primarily financed by long-term loans in CU at market interest rates from the parent.

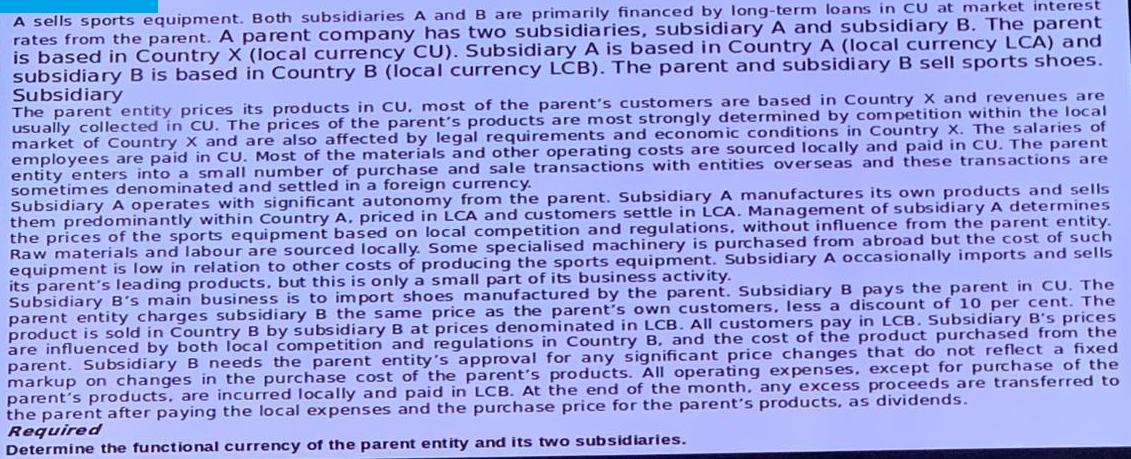

A sells sports equipment. Both subsidiaries A and B are primarily financed by long-term loans in CU at market interest rates from the parent. A parent company has two subsidiaries, subsidiary A and subsidiary B. The parent is based in Country X (local currency CU). Subsidiary A is based in Country A (local currency LCA) and subsidiary B is based in Country B (local currency LCB). The parent and subsidiary B sell sports shoes. Subsidiary The parent entity prices its products in CU, most of the parent's customers are based in Country X and revenues are usually collected in CU. The prices of the parent's products are most strongly determined by competition within the local market of Country X and are also affected by legal requirements and economic conditions in Country X. The salaries of employees are paid in CU. Most of the materials and other operating costs are sourced locally and paid in CU. The parent entity enters into a small number of purchase and sale transactions with entities overseas and these transactions are sometimes denominated and settled in a foreign currency. Subsidiary A operates with significant autonomy from the parent. Subsidiary A manufactures its own products and sells them predominantly within Country A, priced in LCA and customers settle in LCA. Management of subsidiary A determines the prices of the sports equipment based on local competition and regulations, without influence from the parent entity. Raw materials and labour are sourced locally. Some specialised machinery is purchased from abroad but the cost of such equipment is low in relation to other costs of producing the sports equipment. Subsidiary A occasionally imports and sells its parent's leading products, but this is only a small part of its business activity. Subsidiary B's main business is to import shoes manufactured by the parent. Subsidiary B pays the parent in CU. The parent entity charges subsidiary B the same price as the parent's own customers, less a discount of 10 per cent. The product is sold in Country B by subsidiary B at prices denominated in LCB. All customers pay in LCB. Subsidiary B's prices are influenced by both local competition and regulations in Country B, and the cost of the product purchased from the parent. Subsidiary B needs the parent entity's approval for any significant price changes that do not reflect a fixed markup on changes in the purchase cost of the parent's products. All operating expenses, except for purchase of the parent's products, are incurred locally and paid in LCB. At the end of the month, any excess proceeds are transferred to the parent after paying the local expenses and the purchase price for the parent's products, as dividends. Required Determine the functional currency of the parent entity and its two subsidiaries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started