Answered step by step

Verified Expert Solution

Question

1 Approved Answer

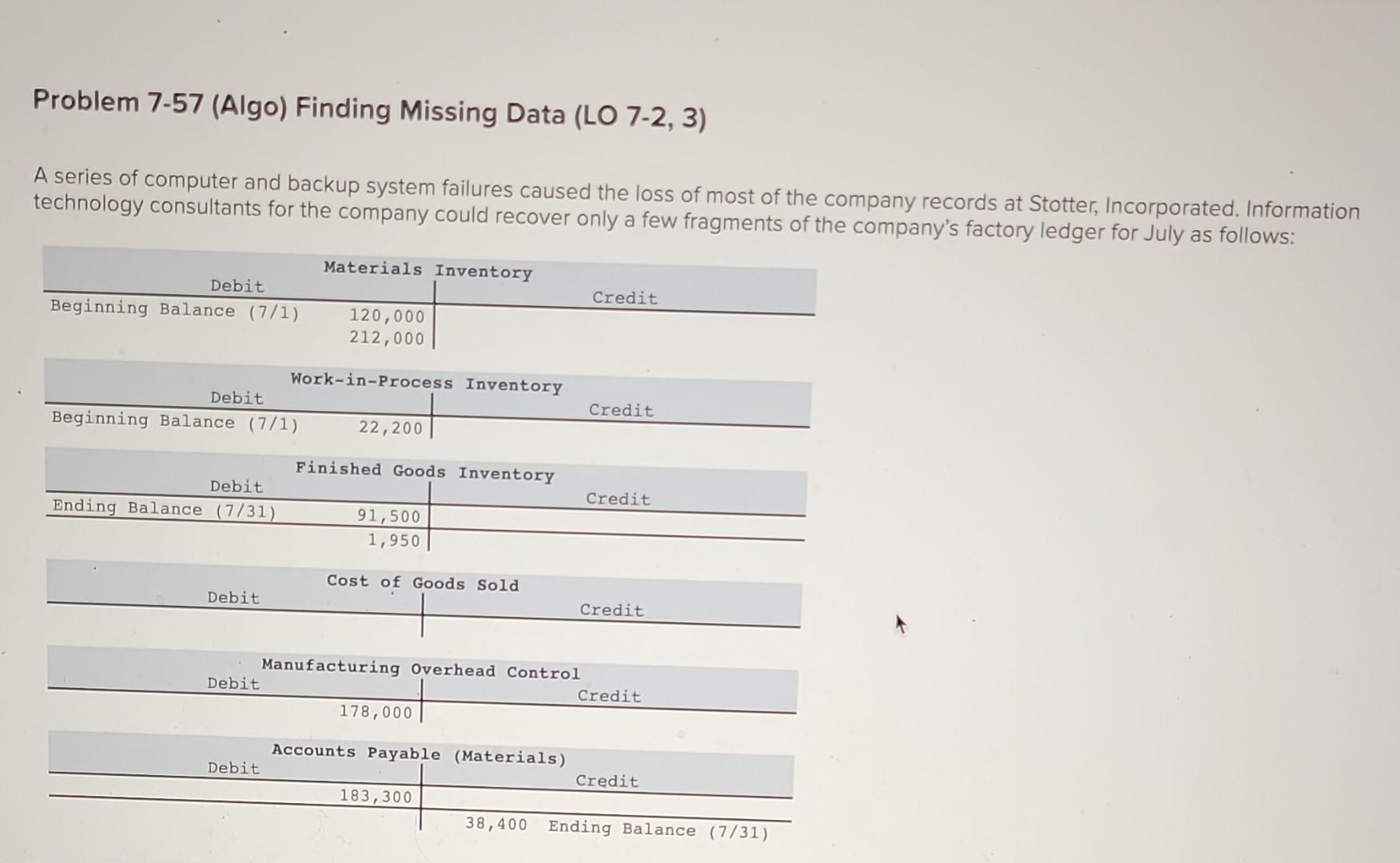

A series of computer and backup system failures caused the loss of most of the company records at Stotter, Incorporated. Information technology consultants for the

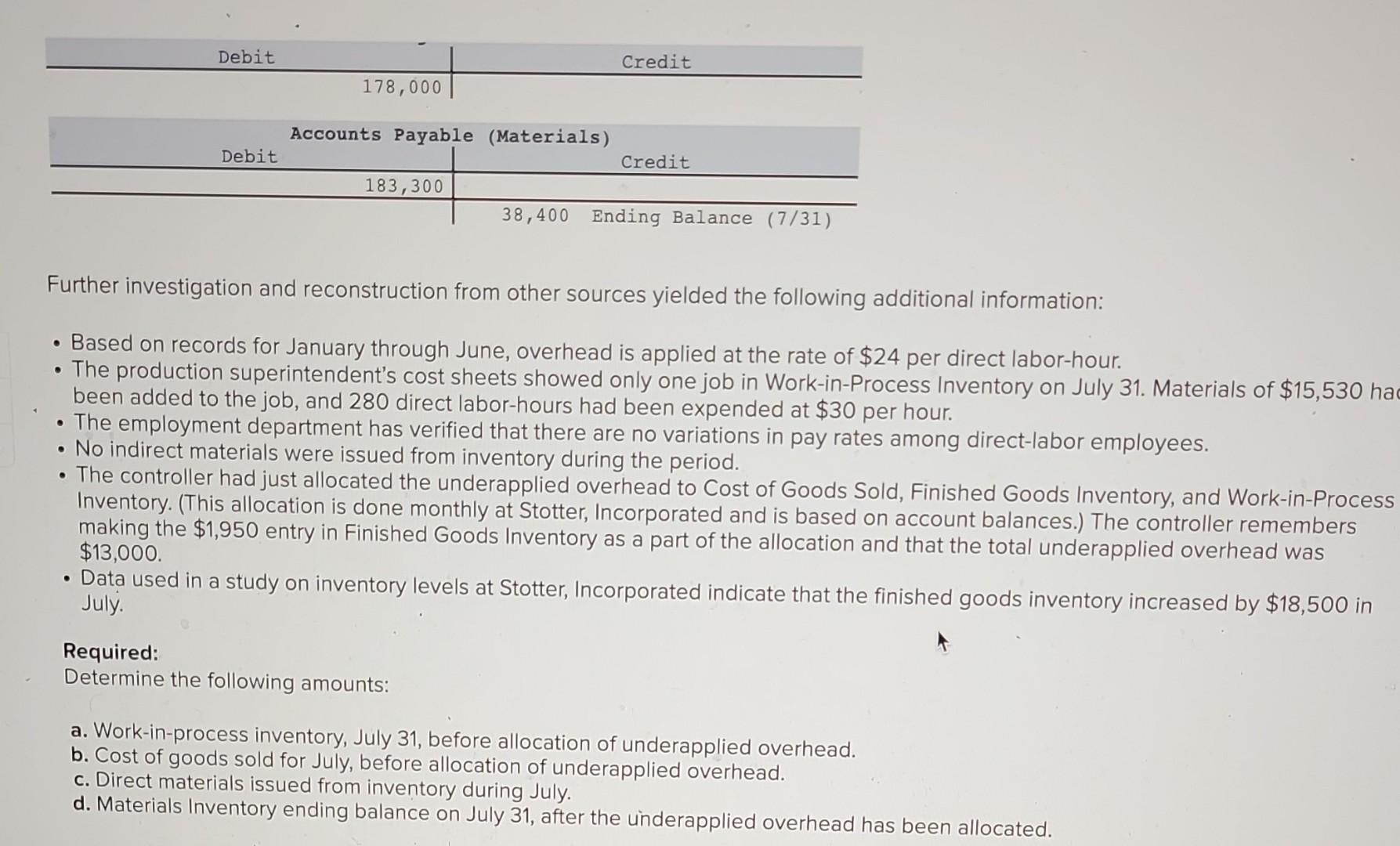

A series of computer and backup system failures caused the loss of most of the company records at Stotter, Incorporated. Information technology consultants for the company could recover only a few fragments of the company's factory ledger for July as follows: Further investigation and reconstruction from other sources yielded the following additional information: - Based on records for January through June, overhead is applied at the rate of $24 per direct labor-hour. - The production superintendent's cost sheets showed only one job in Work-in-Process Inventory on July 31 . Materials of $15,530 ha been added to the job, and 280 direct labor-hours had been expended at $30 per hour. - The employment department has verified that there are no variations in pay rates among direct-labor employees. - No indirect materials were issued from inventory during the period. - The controller had just allocated the underapplied overhead to Cost of Goods Sold, Finished Goods Inventory, and Work-in-Process Inventory. (This allocation is done monthly at Stotter, Incorporated and is based on account balances.) The controller remembers making the $1,950 entry in Finished Goods Inventory as a part of the allocation and that the total underapplied overhead was $13,000. - Data used in a study on inventory levels at Stotter, Incorporated indicate that the finished goods inventory increased by $18,500 in July. Required: Determine the following amounts: a. Work-in-process inventory, July 31 , before allocation of underapplied overhead. b. Cost of goods sold for July, before allocation of underapplied overhead. - Based on records tor January through June, overhead is applied at the rate of $24 per direct labor-hour. - The production superintendent's cost sheets showed only one job in Work-in-Process Inventory on July 31. Materials of \$15,530 had been added to the job, and 280 direct labor-hours had been expended at $30 per hour. - The employment department has verified that there are no variations in pay rates among direct-labor employees. - No indirect materials were issued from inventory during the period. - The controller had just allocated the underapplied overhead to Cost of Goods Sold, Finished Goods Inventory, and Work-in-Process Inventory. (This allocation is done monthly at Stotter, Incorporated and is based on account balances.) The controller remembers making the $1,950 entry in Finished Goods Inventory as a part of the allocation and that the total underapplied overhead was $13,000 - Data used in a study on inventory levels at Stotter, Incorporated indicate that the finished goods inventory increased by $18,500 in July. Required: Determine the following amounts: a. Work-in-process inventory, July 31 , before allocation of underapplied overhead. b. Cost of goods sold for July, before allocation of underapplied overhead. c. Direct materials issued from inventory during July. d. Materials Inventory ending balance on July 31 , after the underapplied overhead has been allocated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started