Answered step by step

Verified Expert Solution

Question

1 Approved Answer

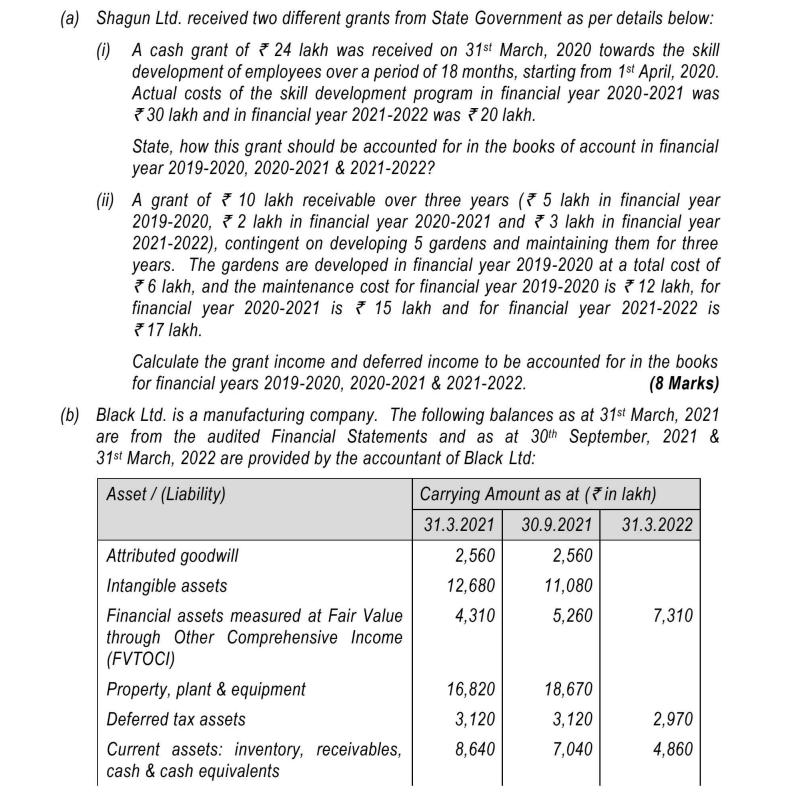

(a) Shagun Ltd. received two different grants from State Government as per details below: (i) A cash grant of 24 lakh was received on

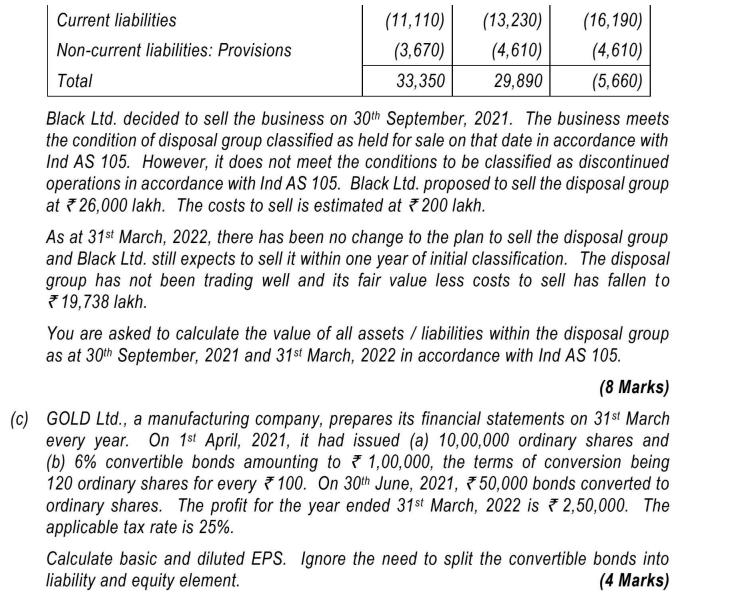

(a) Shagun Ltd. received two different grants from State Government as per details below: (i) A cash grant of 24 lakh was received on 31st March, 2020 towards the skill development of employees over a period of 18 months, starting from 1st April, 2020. Actual costs of the skill development program in financial year 2020-2021 was * 30 lakh and in financial year 2021-2022 was 20 lakh. State, how this grant should be accounted for in the books of account in financial year 2019-2020, 2020-2021 & 2021-2022? (ii) A grant of 10 lakh receivable over three years ( 5 lakh in financial year 2019-2020,2 lakh in financial year 2020-2021 and 3 lakh in financial year 2021-2022), contingent on developing 5 gardens and maintaining them for three years. The gardens are developed in financial year 2019-2020 at a total cost of 6 lakh, and the maintenance cost for financial year 2019-2020 is 12 lakh, for financial year 2020-2021 is 15 lakh and for financial year 2021-2022 is 17 lakh. Calculate the grant income and deferred income to be accounted for in the books for financial years 2019-2020, 2020-2021 & 2021-2022. (8 Marks) (b) Black Ltd. is a manufacturing company. The following balances as at 31st March, 2021 are from the audited Financial Statements and as at 30th September, 2021 & 31st March, 2022 are provided by the accountant of Black Ltd: Asset / (Liability) Attributed goodwill Intangible assets Financial assets measured at Fair Value through Other Comprehensive Income (FVTOCI) Property, plant & equipment Deferred tax assets Current assets: inventory, receivables, cash & cash equivalents Carrying Amount as at (in lakh) 31.3.2021 30.9.2021 2,560 12,680 4,310 16,820 3,120 8,640 2,560 11,080 5,260 18,670 3,120 7,040 31.3.2022 7,310 2,970 4,860 Current liabilities Non-current liabilities: Provisions Total Black Ltd. decided to sell the business on 30th September, 2021. The business meets the condition of disposal group classified as held for sale on that date in accordance with Ind AS 105. However, it does not meet the conditions to be classified as discontinued operations in accordance with Ind AS 105. Black Ltd. proposed to sell the disposal group at 26,000 lakh. The costs to sell is estimated at 200 lakh. (11,110) (13,230) (3,670) (4,610) 33,350 29,890 (16,190) (4,610) (5,660) As at 31st March, 2022, there has been no change to the plan to sell the disposal group and Black Ltd. still expects to sell it within one year of initial classification. The disposal group has not been trading well and its fair value less costs to sell has fallen to 19,738 lakh. You are asked to calculate the value of all assets / liabilities within the disposal group as at 30th September, 2021 and 31st March, 2022 in accordance with Ind AS 105. (8 Marks) (c) GOLD Ltd., a manufacturing company, prepares its financial statements on 31st March every year. On 1st April, 2021, it had issued (a) 10,00,000 ordinary shares and (b) 6% convertible bonds amounting to 1,00,000, the terms of conversion being 120 ordinary shares for every 100. On 30th June, 2021, 50,000 bonds converted to ordinary shares. The profit for the year ended 31st March, 2022 is 2,50,000. The applicable tax rate is 25%. Calculate basic and diluted EPS. Ignore the need to split the convertible bonds into liability and equity element. (4 Marks)

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started