Question

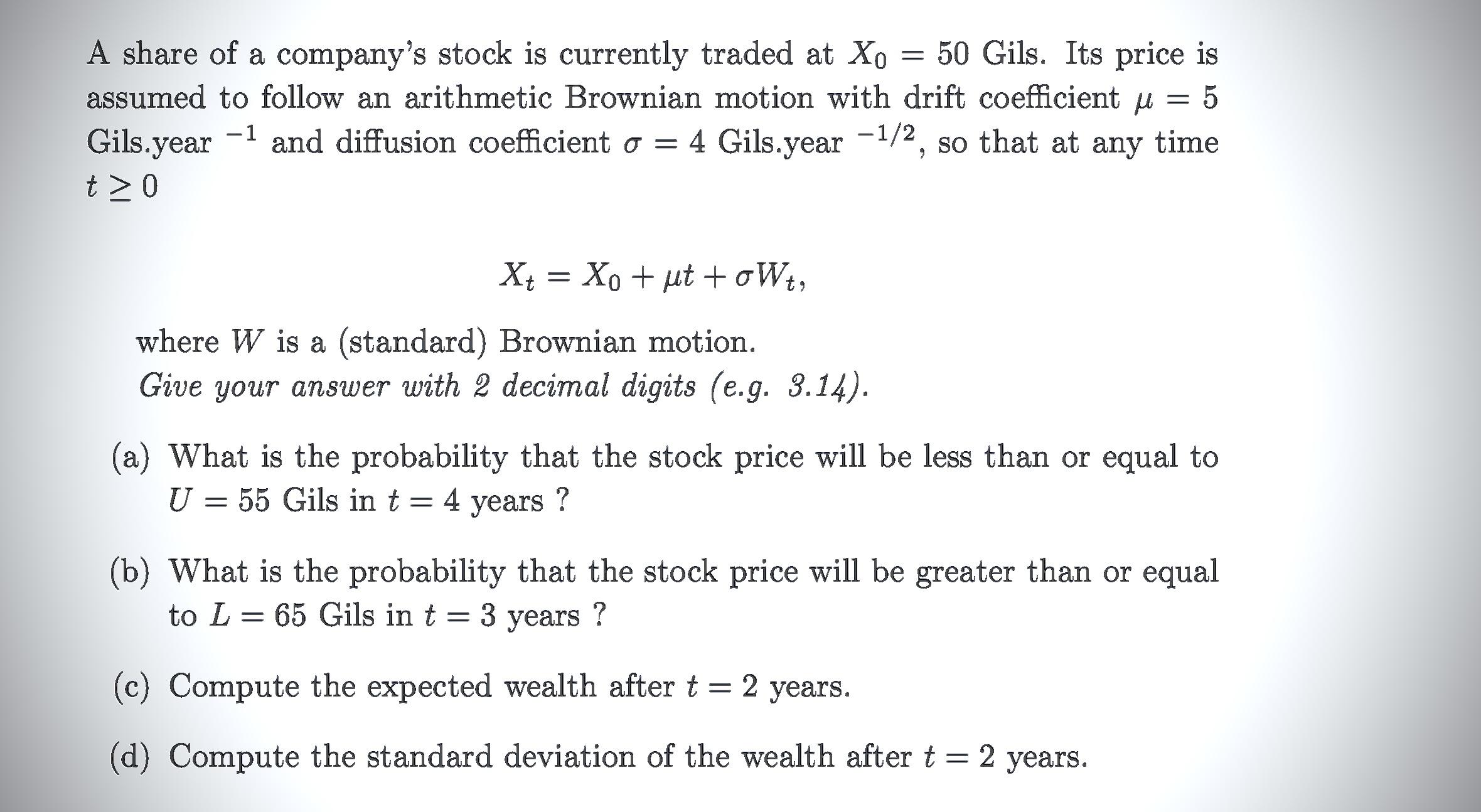

A share of a company's stock is currently traded at Xo = 50 Gils. Its price is assumed to follow an arithmetic Brownian motion

A share of a company's stock is currently traded at Xo = 50 Gils. Its price is assumed to follow an arithmetic Brownian motion with drift coefficient = 5 Gils.year and diffusion coefficient = 4 Gils.year 1/2, so that at any time t> 0 -1 o Xt = Xo+pt+oWt, where W is a (standard) Brownian motion. Give your answer with 2 decimal digits (e.g. 3.14). (a) What is the probability that the stock price will be less than or equal to U = 55 Gils in t = 4 years ? (b) What is the probability that the stock price will be greater than or equal to L 65 Gils in t = 3 3 years ? (c) Compute the expected wealth after t = 2 (d) Compute the standard deviation of the wealth after t = 2 years. years.

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To solve the given problem we will use the formulas and properties of arithmetic Brownian motion a T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Classical Physics Optics Fluids Plasmas Elasticity Relativity And Statistical Physics

Authors: Kip S. Thorne, Roger D. Blandford

1st Edition

0691159025, 978-0691159027

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App