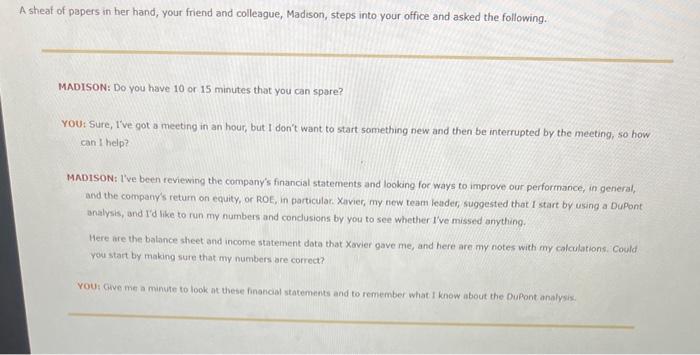

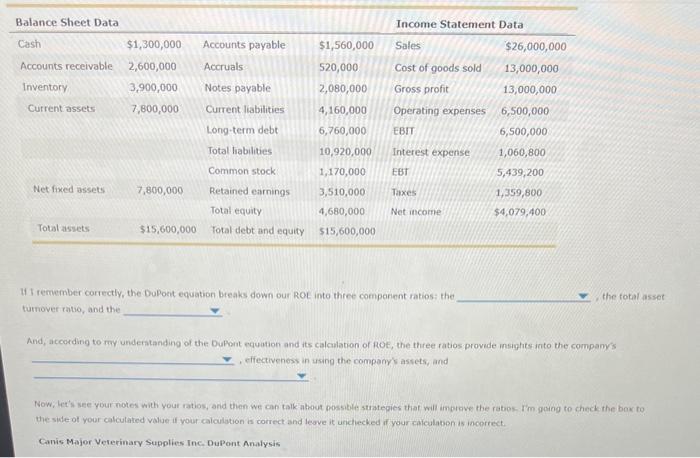

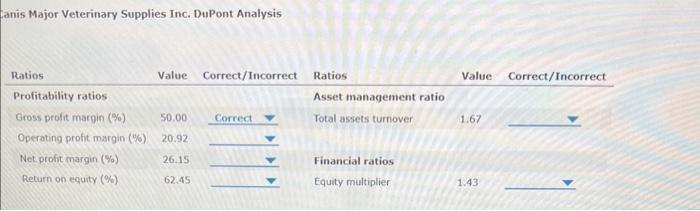

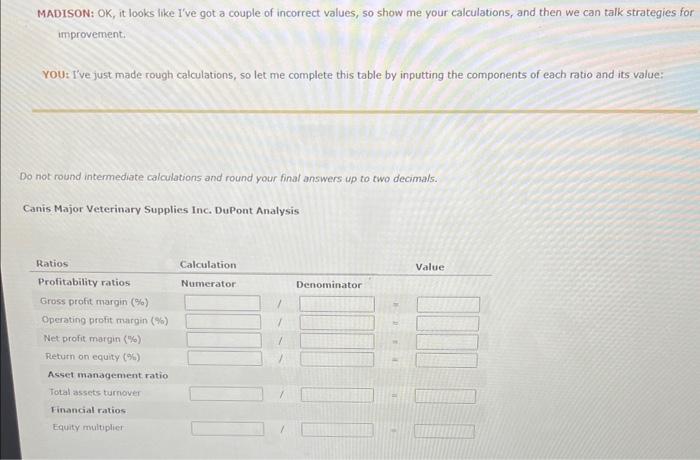

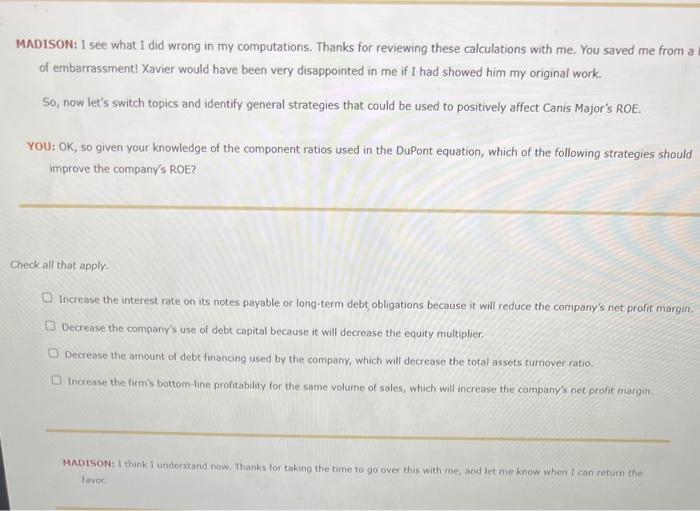

A sheat of papers in her hand, your friend and colleague, Madison, steps into your office and asked the following. MADISON: Do you have 10 or 15 minutes that you can spare? You: Sure, 1've got a meeting in an hour, but I don't want to start samething new and then be interrupted by the meeting, so how can 1 help? MADISON: l've been reviewing the company's financial statements and looking for ways to improve our performance, in general, and the company's return on equity, or ROE, in particular. Xavier, my new team leaden, suggested that I start by using a DuPont analysis, and Id like to run my numbers and condusions by you to see whether I've missed anything. Here are the balance sheet and income statement dota that Xavier gave me, and here are my notes with my calculations. Could you start by making sure that my numbers are correct? You: Give me a minute to look at these financal statements and to remember what 1 know about the Dufont analysix. If 1 remember correctly, the Dupoet equation bueaks down our ROt into three comporent ratios: the turnover ratso, and the And, according to my underatandina of the Duhant equation and its calculation of Rot, the three ratios provede insights into the compamy's E.ffinctivenese in using the company's astets, and Now, Let's see your notes with your ratios, and then we can talk athout possible stratepies that will imprave the ratoos. Fim goung to check the bos to the side of your calcutated value if your calculation is correct and leove it unchecked if your calculaben is incorrect. Cans Major Veterinary Supplies Inc- DuPont Analysis Aanis Major Veterinary Supplies Inc. DuPont Analysis MADISON: OK, it looks like I've got a couple of incorrect values, so show me your calculations, and then we can talk strategies for improvement. You: I've just made rough calculations, so let me complete this table by inputting the components of each ratio and its value: Do not round intermediate calculations and round your final answers up to two decimals. Canis Major Veterinary Supplies Inc. DuPont Analysis MADISON: 1 see what I did wrong in my computations. Thanks for reviewing these calculations with me. You saved me from a of embarrassment! Xavier would have been very disappointed in me if I had showed him my original work. So, now let's switch topics and identify general strategies that could be used to positively affect Canis Major's ROE. YOU: OK, so given your knowledge of the component ratios used in the DuPont equation, which of the following strategies should improve the company's ROE? Check all that apply. Increase the interest rate on its notes payable or long-term debt obligations because it will reduce the company's net profit margin. Decrease the company's use of debt capital because it will decrease the equity multiplier. Decrease the amount of debt financing used by the company, which will decrease the total assets tumover ratio. Inciease the firm's bottom-line profitability for the same volume of soles, which will increase the company's net profit margin. MADISON: 1 think 1 understand now. Thanks for taking the time to go over this with me, and let me know when l can retum the tavor