Question

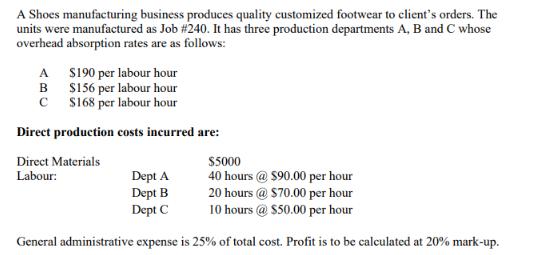

A Shoes manufacturing business produces quality customized footwear to client's orders. The units were manufactured as Job #240. It has three production departments A,

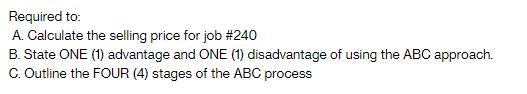

A Shoes manufacturing business produces quality customized footwear to client's orders. The units were manufactured as Job #240. It has three production departments A, B and C whose overhead absorption rates are as follows: A B $190 per labour hour $156 per labour hour $168 per labour hour C Direct production costs incurred are: Direct Materials Labour: $5000 Dept A Dept B 40 hours @ $90.00 per hour 20 hours @ $70.00 per hour 10 hours @ $50.00 per hour Dept C General administrative expense is 25% of total cost. Profit is to be calculated at 20% mark-up.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate the selling price for job 240 we need to determine the total cost of the job and then apply the desired profit margin Calculate the ove...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management and Cost Accounting

Authors: Colin Drury

10th edition

1473748873, 9781473748910 , 1473748917, 978-1473748873

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App