Question

A significant strategic shareholding in Malaysia Airlines (MAS) had become available in the market. The flag carrier of Malaysia with a fleet of 85 aircraft

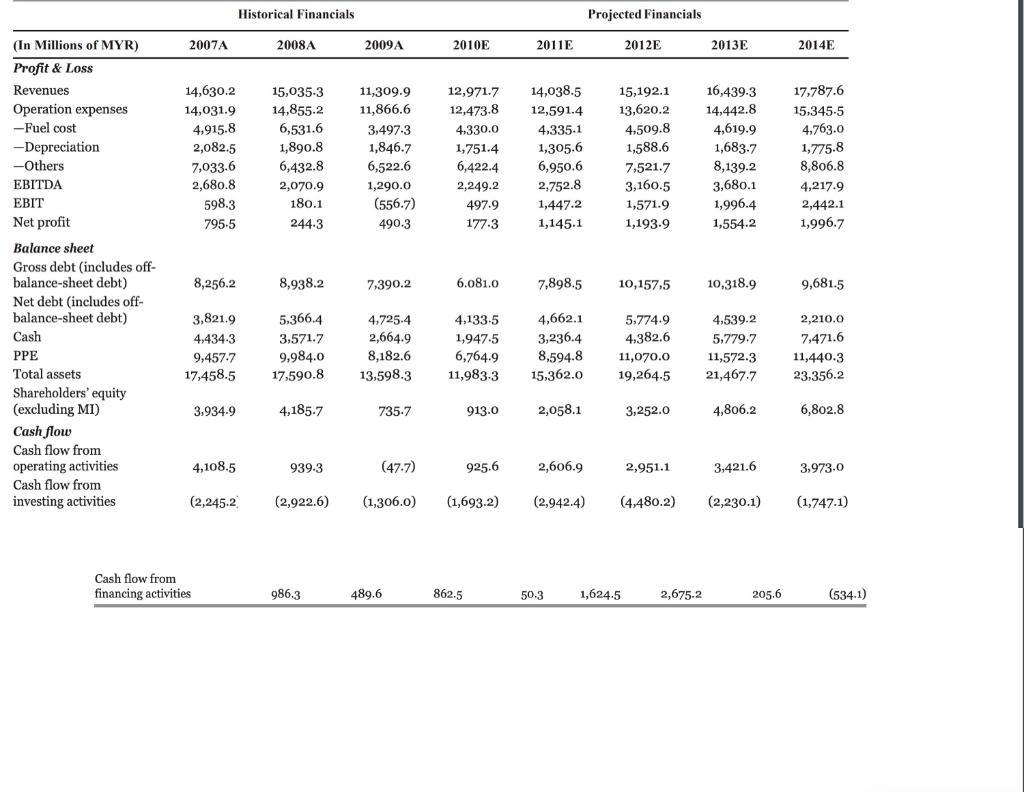

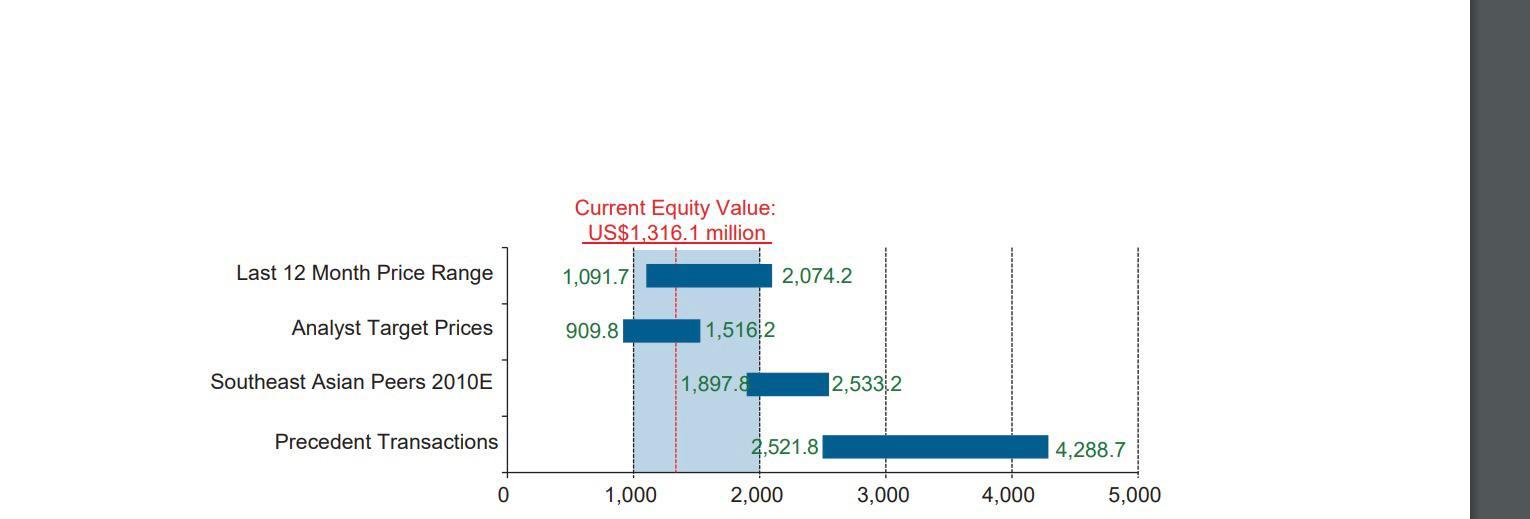

A significant strategic shareholding in Malaysia Airlines (MAS) had become available in the market. The flag carrier of Malaysia with a fleet of 85 aircraft traveling to 103 destinations worldwide, the airline was trading at an equity value of US$1,316 million as of March 30, 2010. MAS was led by a strong management team with a proven track record. Over the past few years, the management had undertaken a strategic business transformation resulting in a significant positive turnaround of performance, including Malaysian ringgit (MYR) 2.3 billion in cost savings from 2006 to 2008 and steady revenue growth from MYR 9 billion in 2006 to MYR 15 billion in 2008. Etihad Airlines was a Middle Eastern carrier looking to extend its route network beyond its hub in Dubai, and it hoped to gain access to lucrative routes to Singapore, Hong Kong, and Australia. Etihad’s bankers at Standard Chartered advised them to consider a 20 to 25 percent investment stake in MAS, hand in glove with an operating alliance. Etihad Airways was established as the flag carrier of the United Arab Emirates in July 2003 by royal decree with an initial paid-up capital of United Arab Emirates dirham (AED) 500 million provided by the Abu Dhabi Investment Authority. As of January 2010, the airline operated passenger and cargo services to 85 destinations around the world from its home base in Abu Dhabi. Malaysia Airlines is partially privatized with Khazana Nasional, the Malaysian sovereign wealth fund, holding a residual equity stake in the airline. Malaysia Airlines operates flights in Southeast Asia, East Asia, South Asia, Middle East, and on the Kangaroo Route between Europe and Australasia. It operates transpacific flights from Kuala Lumpur to Los Angeles via Tokyo. It flies to 87 destinations in over six continents. Malaysia Airlines has existing code share agreements with American Airlines, Cathay Pacific, and Japan Airlines, among others. As an international airline, Malaysia Airlines was exposed to the effects of foreign exchange rate fluctuations because of its foreign currency–denominated operating revenues and expenses. Its largest exposures were to the U.S. dollar, followed by the euro, British pound, Japanese yen, and Australian dollar. Approximately 58 per- cent of the airline’s sales and almost 65 percent of the airline’s costs are denominated in foreign currencies. The airline’s trade receivables and trade payables balances had similar exposures. The airline was also exposed to fuel price volatility, partially mitigated by entering into jet fuel hedges. The bankers articulated several strategic benefits arising from the potential acquisition. The transaction would ensure major presences in two of the highestgrowing air traffic regions in the world (Asia and the Middle East) and allow Etihad to lever- age consistently growing tourism and trade between Asia and the Middle East. The acquisition would grant Etihad access to a complementary route network—30 out of 56 unique MAS destinations in Asia did not overlap with Etihad’s routes. Importantly, it would give Etihad an opportunity to significantly strengthen its competitive position on the important Kangaroo Route (London/Dubai to Sydney via Kuala Lumpur/Singapore). Last, it would create a politically appealing alliance between two Islamic nations’ flag carriers. Etihad’s management asked its bankers to value the target based on trading and transaction comparables. Based on a current share price of US$0.64, MAS was trading at an equity value of US$1,316 million, which was at the lower end of its 12-month trading range between US$1,092 million and US$2,074 million—an attractive entry price. On the other hand, research analysts were suggesting that prices could fall further, reducing equity value to as low as US$910 million, which made the current price less attractive than it seemed initially. However, based on comparable trading multiples, the airline was undervalued relative to its Southeast Asian peers, which were trading on higher multiples based on their enterprise value/EBITDA ratios in 2010 and 2011. Market indicators, though, often do not serve as the best indicators for successful bid prices, as airline mergers and acquisitions (M&A) transactions in Asia cleared the market at significant premiums to traded value— reflecting high investor interest in the market, acquisition synergies, and control premiums. Thus, if precedent transactions were an indicator, the target could be valued at over twice its current market value. (See Case Exhibit 1.) Etihad’s management now wanted to embark on a more detailed due diligence of the airline, culminating in a discounted cash-flow valuation of the airline based on the projected financials shown in Case Exhibit 21.2. Malaysia Airlines was trading at a levered beta of 1.06, with a market risk premium of 9.38 percent above a risk-free rate of 3.68 percent. Its cost of debt based on outstanding bonds, loans, and leases was 3.09 percent. Etihad on the other hand was trading at a cost of equity of 10.5 percent and a cost of debt of 2.4 percent. Based on these assumptions and the cash-flow projections provided in Case Exhibit 2, the deal team proceeded to value the acquisition.

Do you trust this cash-flow projections? Give reasons and suggestions.

Do you trust this cash-flow projections? Give reasons and suggestions.

Historical Financials Projected Financials (In Millions of MYR) 2007A 2008A 2009A 2010E 2011E 2012E 2013E 2014E Profit & Loss Revenues 14,630.2 14,038.5 16,439.3 17,787.6 12,971.7 12,473.8 15,035-3 11,309.9 15,192.1 Operation expenses 14,031.9 14,855.2 11,866.6 12,591.4 13,620.2 14,442.8 15,345-5 -Fuel cost 4,915.8 6,531.6 3,497.3 4,330.0 4,335.1 4,509.8 4,619.9 4,763.0 -Depreciation -Others 1,890.8 6,432.8 1,305.6 6,950.6 2,752.8 1,588.6 1,775.8 8,806.8 2,082.5 1,846.7 1,751.4 1,683.7 7,033.6 2,680.8 8,139.2 3,680.1 1,996.4 6,522.6 6,422.4 7,521.7 EBITDA 2,070.9 1,290.0 2,249.2 3,160.5 4,217.9 EBIT (556.7) 2,442.1 1,996.7 598.3 180.1 497.9 1,447.2 1,571.9 Net profit 795-5 244.3 490.3 177.3 1,145.1 1,193.9 1,554.2 Balance sheet Gross debt (includes off- balance-sheet debt) 8,256.2 8,938.2 7,390.2 6.081.0 7,898.5 10,157,5 10,318.9 9,681.5 Net debt (includes off- balance-sheet debt) 3,821.9 5,366.4 4,725.4 2,664.9 8,182.6 4,662.1 5.774.9 4,382.6 4,133-5 4,539.2 2,210.0 Cash 1,947-5 6,764.9 11,983.3 3,236.4 8,594.8 15,362.0 4,434-3 3,571.7 5,779.7 7,471.6 PPE 9,457.7 9,984.0 11,070.0 11,572.3 11,440.3 Total assets 17,458.5 17,590.8 13,598.3 19,264.5 21,467.7 23,356.2 Shareholders' equity (excluding MI) 3,934.9 4,185.7 735-7 913.0 2,058.1 3,252.0 4,806.2 6,802.8 Cash flow Cash flow from operating activities 4,108.5 939-3 (47.7) 925.6 2,606.9 2,951.1 3,421.6 3,973.0 Cash flow from investing activities (2,245.2 (2,922.6) (1,306.0) (1,693.2) (2,942.4) (4,480.2) (2,230.1) (1,747.1) Cash flow from financing activities 986.3 489.6 862.5 50.3 1,624.5 2,675-2 205.6 (534.1)

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Do you trust this cash flow projections Give reasons and suggestions ANS WER There are a few potenti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started