Question

A small manufacturer is planning to release a new product and purchases a new equipment for $1,920,000, which will be depreciated by the straight-line

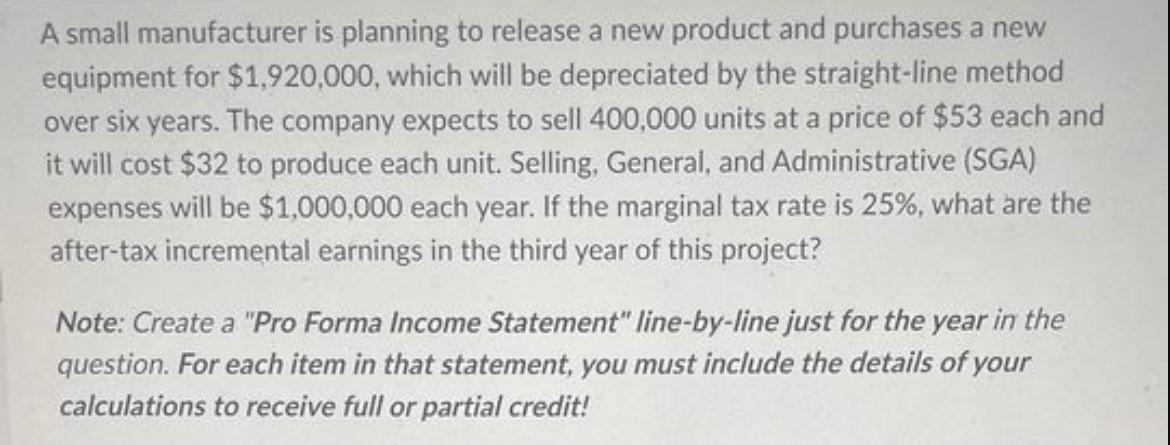

A small manufacturer is planning to release a new product and purchases a new equipment for $1,920,000, which will be depreciated by the straight-line method over six years. The company expects to sell 400,000 units at a price of $53 each and it will cost $32 to produce each unit. Selling, General, and Administrative (SGA) expenses will be $1,000,000 each year. If the marginal tax rate is 25%, what are the after-tax incremental earnings in the third year of this project? Note: Create a "Pro Forma Income Statement" line-by-line just for the year in the question. For each item in that statement, you must include the details of your calculations to receive full or partial credit!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Chemical Engineering Design

Authors: Ray Sinnott, R.K. Sinnott, Sinnott Gavin Towler

6th Edition

0081025998, 9780081025994

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App