Question

A small part of the Financial Instruments footnote for PepsiCo is attached. Answer the following questions. 1. We see in reference (f) from the Fair

A small part of the “Financial Instruments” footnote for PepsiCo is attached. Answer the following questions.

1. We see in reference (f) from the Fair Value Measurement that the fair value of interest rate swaps are based on LIBOR forward rates. You will need to look this one up. (4 points)

A. What does LIBOR stand for?

B. What five currencies are included in the LIBOR?

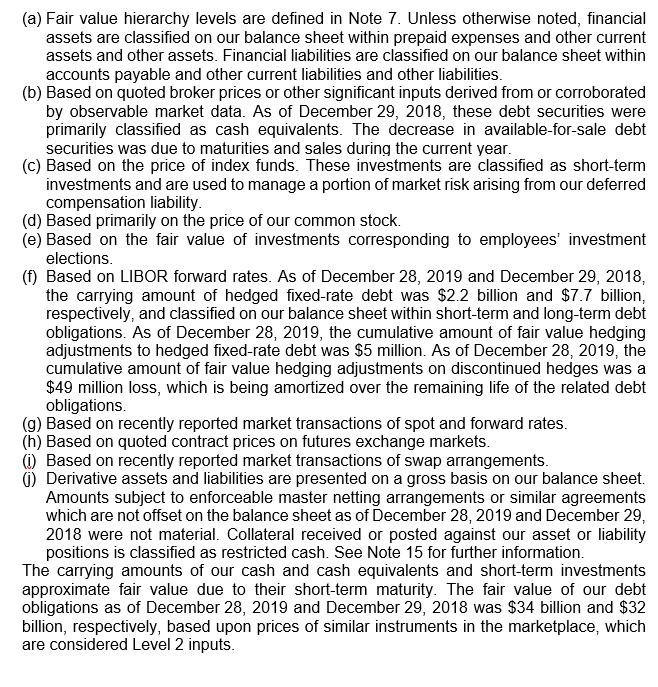

2. see that one item is “the location and net amount of gain or loss reported in earnings.” That sounds funny until we read this footnote. Looking at the Losses and Gains section, where are the following located? (6 points)

Losses/Gains in the income statement:

A. Foreign exchange derivative losses/gains

B. Interest rate derivative losses/gains

C. Commodity derivative losses/gains

Losses/Gains reclassified from the Statement of Comprehensive income to income statement:

D. Foreign exchange derivative losses/gains

E. Interest rate derivative losses/gains

F. Commodity derivative losses/gains

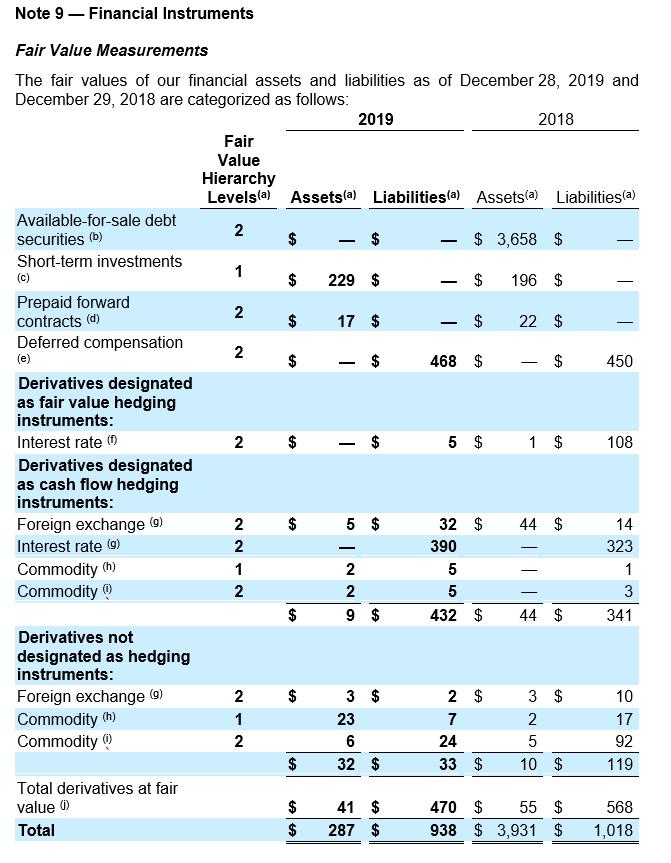

Note 9 - Financial Instruments Fair Value Measurements The fair values of our financial assets and liabilities as of December 28, 2019 and December 29, 2018 are categorized as follows: 2019 2018 Fair Value Hierarchy Levels(a) Assets(a) Liabilities(a) Assets(a) Liabilities(a) Available-for-sale debt 2 securities (b) $ 3,658 $ - Short-term investments 1 (c) 229 $ $ 196 $ Prepaid forward contracts (d) 17 $ $ 22 $ Deferred compensation (e) 2 468 $ 450 - Derivatives designated as fair value hedging instruments: Interest rate (0 2 5 $ 1 $ 108 Derivatives designated as cash flow hedging instruments: Foreign exchange (9) 2 $ 5 $ 32 $ 44 $ 14 Interest rate (9) 2 390 323 Commodity () Commodity 0 1 1 2 5 3 9 $ 432 $ 44 $ 341 Derivatives not designated as hedging instruments: Foreign exchange (9) Commodity (h) Commodity O 3 $ 2 $ 3 $ 10 1 23 7 2 17 2 6 24 5 92 $ 32 $ 33 $ 10 $ 119 Total derivatives at fair value ) $ 41 $ 470 $ 55 $ 568 Total $ 287 $ 938 $ 3,931 $ 1,018 %24 | || %24 %24 %24 %24 %24 %24 %24 %24 %24 %24

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A LIBOR stands for London Interbank Offered Rate B The five currencies included in the LIBOR ar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started