Question

A small, private company is contemplating an initial public offering (IPO) in which they will sell 40,000 shares of stock. The price of the stock

A small, private company is contemplating an initial public offering (IPO) in which they will sell 40,000 shares of stock.

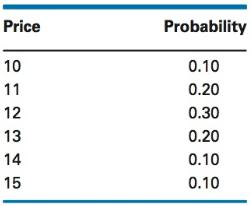

The price of the stock at the IPO is uncertain, with the following distribution

In each of the next five years, there is a 30 percent chance the company will fail.

If it does not fail, its stock value will increase by an amount given by a lognormal distribution with a mean of 1.5 percent and a standard deviation of 0.5 percent.

a. What is the mean value of the stock at the end of five years, assuming the company does not fail in the interim?

b. What is the probability the company will still be in existence after 5 years?

Price Probability 10 0.10 11 0.20 12 0.30 13 0.20 14 0.10 15 0.10

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solution Given that Small company is contemplating an nitial public of...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management For Decision Makers

Authors: Peter Atrill, Paul Hurley

2nd Canadian Edition

138011605, 978-0138011604

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App