A sole trader requests you to prepare his Trading and Profit & Loss Account for the year ended 31st March, 2013 and Balance Sheet

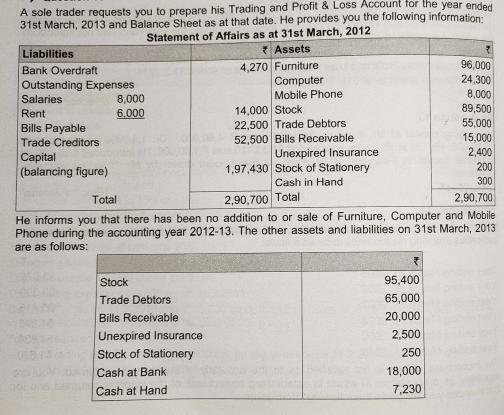

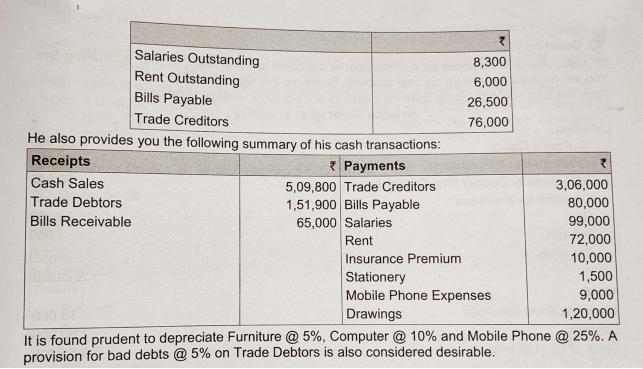

A sole trader requests you to prepare his Trading and Profit & Loss Account for the year ended 31st March, 2013 and Balance Sheet as at that date. He provides you the following information: Statement of Affairs as at 31st March, 2012 Assets Liabilities Bank Overdraft Outstanding Expenses Salaries Rent Bills Payable Trade Creditors Capital (balancing figure) 8,000 6,000 Stock Trade Debtors Bills Receivable 4,270 Furniture. Computer Mobile Phone Unexpired Insurance Stock of Stationery Cash at Bank Cash at Hand 14,000 Stock 22,500 Trade Debtors 52,500 Bills Receivable Unexpired Insurance 1,97,430 Stock of Stationery Cash in Hand 2,90,700 Total Total 2,90,700 He informs you that there has been no addition to or sale of Furniture, Computer and Mobile Phone during the accounting year 2012-13. The other assets and liabilities on 31st March, 2013 are as follows: 95,400 65,000 20,000 2,500 250 96,000 24,300 8,000 89,500 55,000 15,000 2,400 18,000 7,230 200 300 Salaries Outstanding Rent Outstanding Bills Payable Trade Creditors He also provides you the following summary of his cash transactions: Receipts Cash Sales Trade Debtors Bills Receivable *Payments 5,09,800 Trade Creditors 1,51,900 Bills Payable 65,000 Salaries Rent 8,300 6,000 26,500 76,000 Insurance Premium Stationery Mobile Phone Expenses Drawings 3,06,000 80,000 99,000 72,000 10,000 1,500 9,000 1,20,000 It is found prudent to depreciate Furniture @ 5%, Computer @ 10% and Mobile Phone @ 25%. A provision for bad debts @ 5% on Trade Debtors is also considered desirable.

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started