Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Solid Ltd is an investment company that trades in shares on the Australian Securities Exchange. Solid Ltd values its equity instruments (shares) at

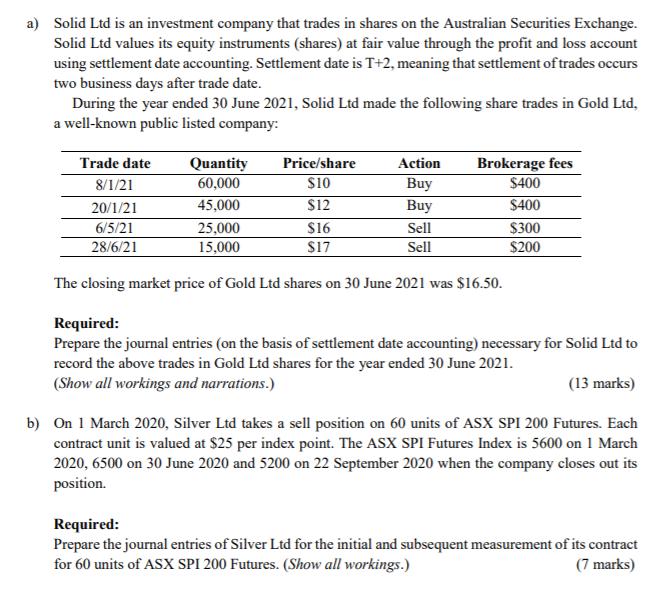

a) Solid Ltd is an investment company that trades in shares on the Australian Securities Exchange. Solid Ltd values its equity instruments (shares) at fair value through the profit and loss account using settlement date accounting. Settlement date is T+2, meaning that settlement of trades occurs two business days after trade date. During the year ended 30 June 2021, Solid Ltd made the following share trades in Gold Ltd, a well-known public listed company: Trade date 8/1/21 20/1/21 6/5/21 28/6/21 Quantity 60,000 45,000 25,000 15,000 The closing market price of Gold Ltd shares on 30 June 2021 was $16.50. Price/share $10 $12 Action Buy Buy Sell Sell $16 $17 Brokerage fees $400 $400 $300 $200 Required: Prepare the journal entries (on the basis of settlement date accounting) necessary for Solid Ltd to record the above trades in Gold Ltd shares for the year ended 30 June 2021. (Show all workings and narrations.) (13 marks) b) On 1 March 2020, Silver Ltd takes a sell position on 60 units of ASX SPI 200 Futures. Each contract unit is valued at $25 per index point. The ASX SPI Futures Index is 5600 on 1 March 2020, 6500 on 30 June 2020 and 5200 on 22 September 2020 when the company closes out its position. Required: Prepare the journal entries of Silver Ltd for the initial and subsequent measurement of its contract for 60 units of ASX SPI 200 Futures. (Show all workings.) (7 marks)

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a 8121 Investment in Gold Ltd shares 60000 shares 10 per share Dr Cash at bank ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started