Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Solve the program for the 1-, 5-, 10-, 15-, 20-, 25-, and 30-year investment horizons; then copy the weights into the results table. (Note

a. Solve the program for the 1-, 5-, 10-, 15-, 20-, 25-, and 30-year investment horizons; then copy the weights into the results table. (Note that the long-only constraint is imposed on the 5 assets.)

a. Solve the program for the 1-, 5-, 10-, 15-, 20-, 25-, and 30-year investment horizons; then copy the weights into the results table. (Note that the long-only constraint is imposed on the 5 assets.)

b. How do the weights on stocks in this example compare with earlier examples?

c. Explain why they may be different. What is the definition of return in this example?

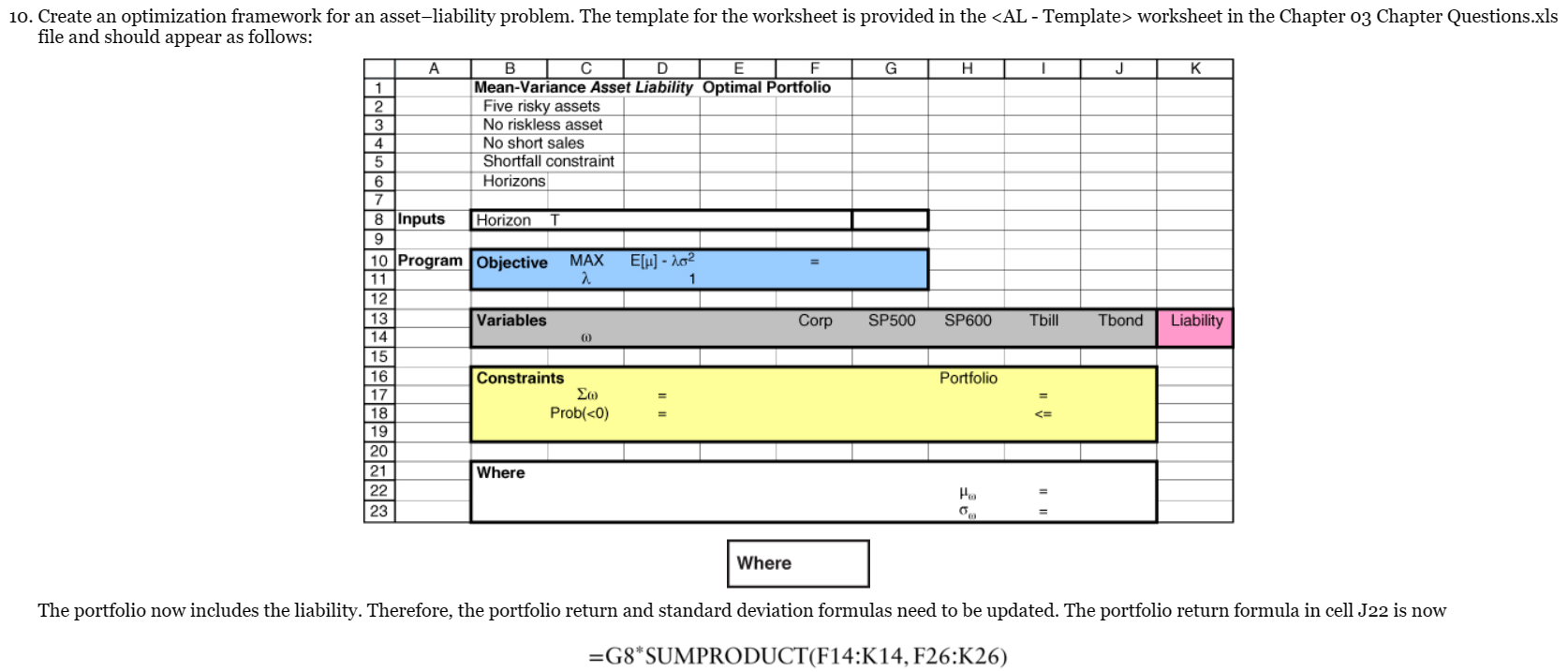

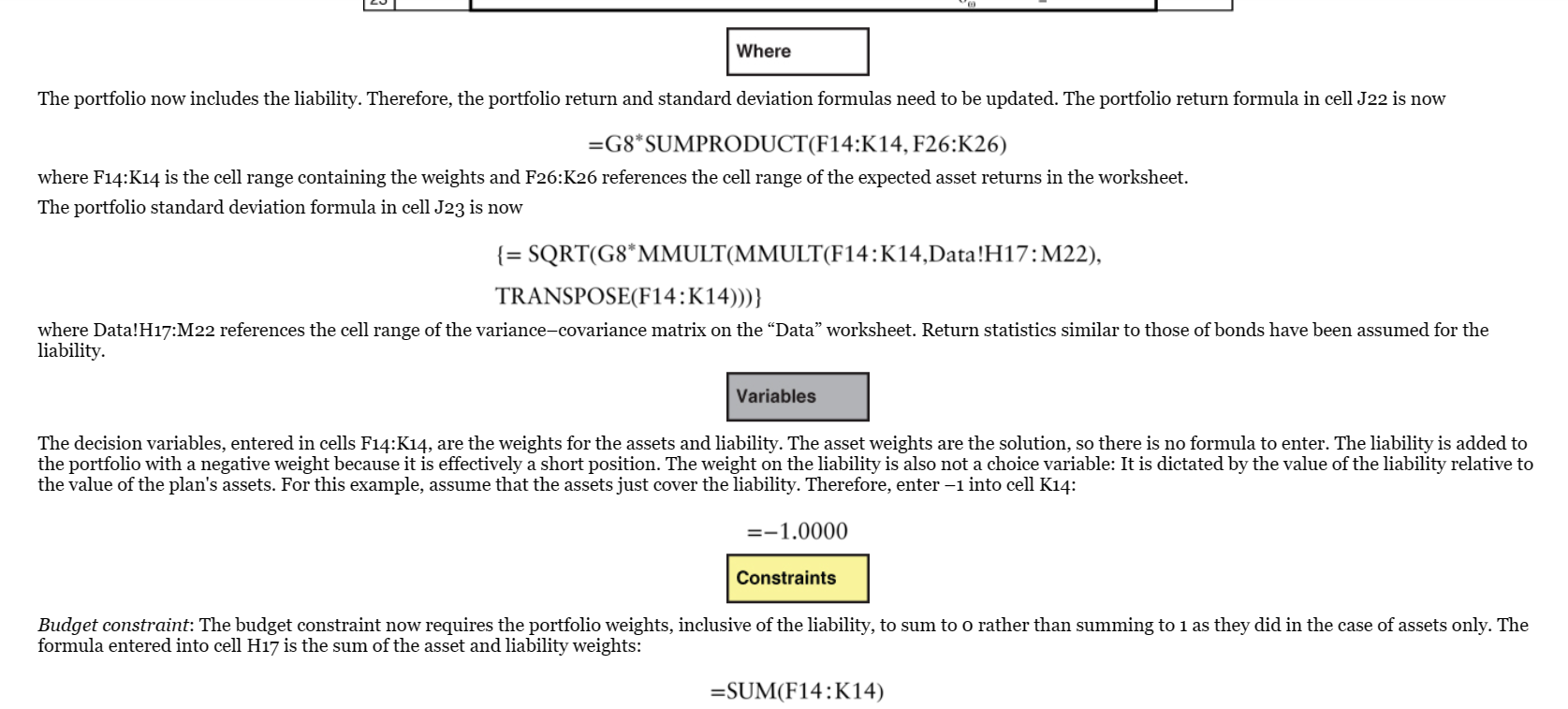

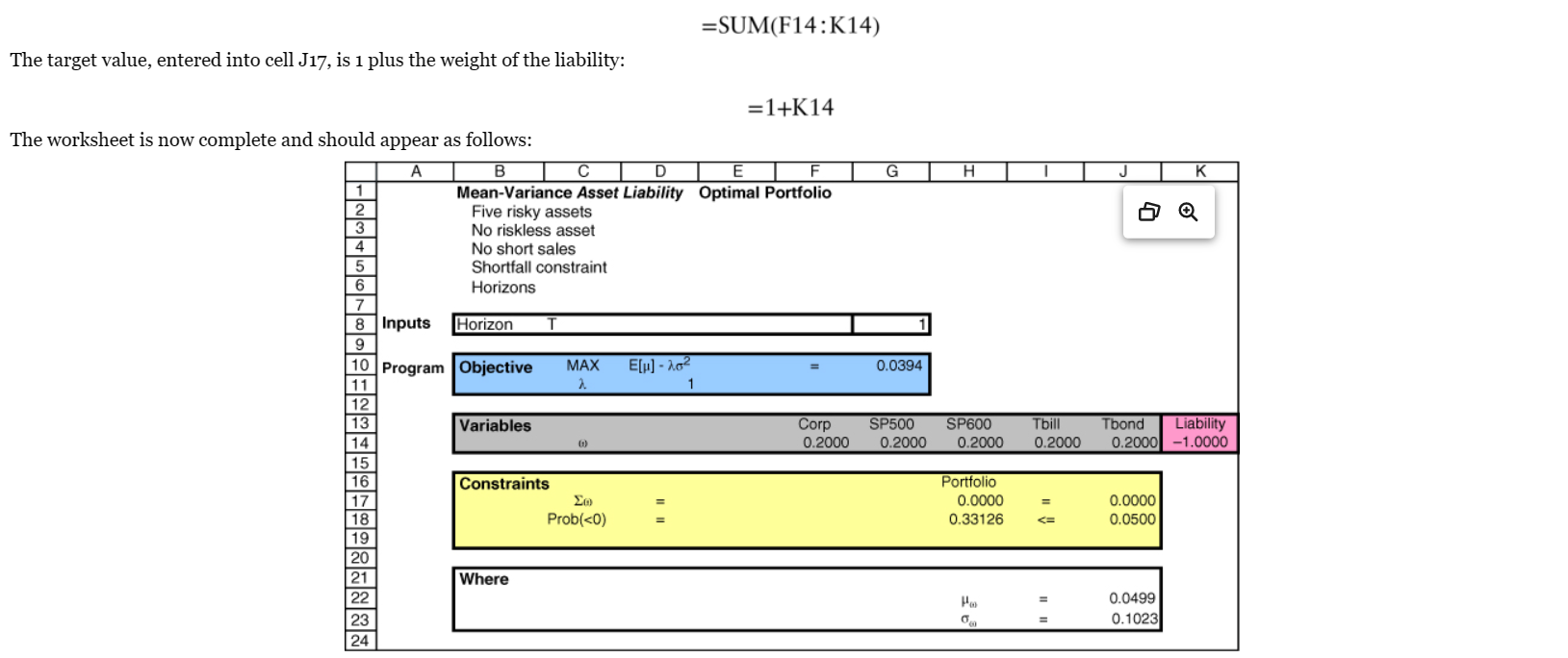

The portfolio now includes the liability. Therefore, the portfolio return and standard deviation formulas need to be updated. The portfolio return formula in cell J22 is now =G8SUMPRODUCT(F14:K14,F26:K26) The portfolio now includes the liability. Therefore, the portfolio return and standard deviation formulas need to be updated. The portfolio return formula in cell J22 is now =G8SUMPRODUCT(F14:K14,F26:K26) where F14:K14 is the cell range containing the weights and F26:K26 references the cell range of the expected asset returns in the worksheet. The portfolio standard deviation formula in cell J23 is now {=SQRT(G8*MMULT(MMULT(F14:K14,Data!H17:M22),TRANSPOSE(F14:K14))) where Data!H17:M22 references the cell range of the variance-covariance matrix on the "Data" worksheet. Return statistics similar to those of bonds have been assumed for the liability. The decision variables, entered in cells F14:K14, are the weights for the assets and liability. The asset weights are the solution, so there is no formula to enter. The liability is added to the portfolio with a negative weight because it is effectively a short position. The weight on the liability is also not a choice variable: It is dictated by the value of the liability relative to the value of the plan's assets. For this example, assume that the assets just cover the liability. Therefore, enter 1 into cell K14: =1.0000 Budget constraint: The budget constraint now requires the portfolio weights, inclusive of the liability, to sum to o rather than summing to 1 as they did in the case of assets only. The formula entered into cell H17 is the sum of the asset and liability weights: =SUM(F14:K14) =SUM(F14:K14) The target value, entered into cell J17, is 1 plus the weight of the liability: =1+K14 The worksheet is now complete and should appear as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started