Question

A South African investor has bought 5000 Facebook shares 10 years ago at $25 per share (assuming there are no other investment costs). At

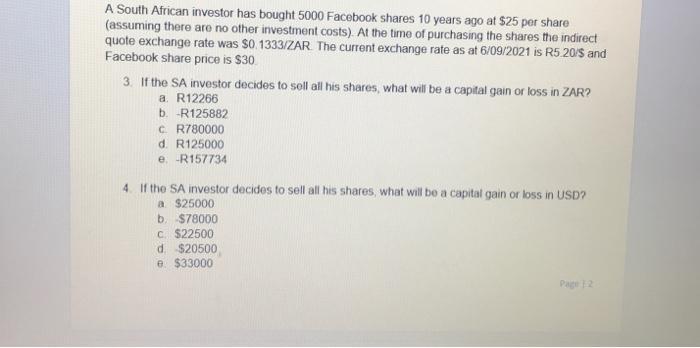

A South African investor has bought 5000 Facebook shares 10 years ago at $25 per share (assuming there are no other investment costs). At the time of purchasing the shares the indirect quote exchange rate was $0.1333/ZAR. The current exchange rate as at 6/09/2021 is R5.20/S and Facebook share price is $30. 3. If the SA investor decides to sell all his shares, what will be a capital gain or loss in ZAR? a. R12266 b. -R125882 CR780000 d. R125000 e. -R157734 4. If the SA investor decides to sell all his shares, what will be a capital gain or loss in USD? a $25000 b. $78000 C. $22500 d. $20500 e $33000 Page 12

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 3 The correct answer is e R157734 Exlpaination Capital Gain in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Financial Management

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen

15th edition

77861612, 1259194078, 978-0077861612, 978-1259194078

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App