Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a specific state is not necessary for solving. 5. (25 points) Cleveland Manufacturing wants to invest $220,000 on a new machine to replace an old

a specific state is not necessary for solving.

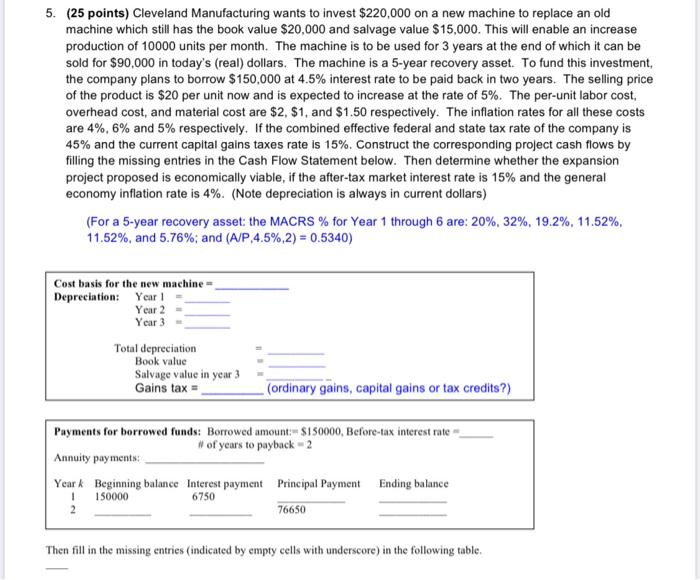

5. (25 points) Cleveland Manufacturing wants to invest $220,000 on a new machine to replace an old machine which still has the book value $20,000 and salvage value $15,000. This will enable an increase production of 10000 units per month. The machine is to be used for 3 years at the end of which it can be sold for $90,000 in today's (real) dollars. The machine is a 5-year recovery asset. To fund this investment, the company plans to borrow $ 150,000 at 4.5% interest rate to be paid back in two years. The selling price ct is $20 per unit now and is expected to increase at the rate of 5%. The per-unit labor cost, overhead cost, and material cost are $2, $1, and $1.50 respectively. The inflation rates for all these costs are 4%, 6% and 5% respectively. If the combined effective federal and state tax rate of the company is 45% and the current capital gains taxes rate is 15%. Construct the corresponding project cash flows by filling the missing entries in the Cash Flow Statement below. Then determine whether the expansion project proposed is economically viable, if the after-tax market interest rate is 15% and the general economy inflation rate is 4%. (Note depreciation is always in current dollars) (For a 5-year recovery asset: the MACRS % for Year 1 through 6 are: 20%, 32%, 19.2%, 11.52%, 11.52%, and 5.76%; and (A/P 4.5%, 2) = 0.5340) Cost basis for the new machine Depreciation: Year! Year 2- Year 3 - Total depreciation Book value Salvage value in year 3 Gains tax = (ordinary gains, capital gains or tax credits?) Payments for borrowed funds: Borrowed amount: $150000, Before-tax interest rate # of years to payback 2 Annuity payments: Principal Payment Ending balance Yeark Beginning balance Interest payment 1 150000 6750 76650 Then fill in the missing entries indicated by empty cells with underscore) in the following table. 5. (25 points) Cleveland Manufacturing wants to invest $220,000 on a new machine to replace an old machine which still has the book value $20,000 and salvage value $15,000. This will enable an increase production of 10000 units per month. The machine is to be used for 3 years at the end of which it can be sold for $90,000 in today's (real) dollars. The machine is a 5-year recovery asset. To fund this investment, the company plans to borrow $ 150,000 at 4.5% interest rate to be paid back in two years. The selling price ct is $20 per unit now and is expected to increase at the rate of 5%. The per-unit labor cost, overhead cost, and material cost are $2, $1, and $1.50 respectively. The inflation rates for all these costs are 4%, 6% and 5% respectively. If the combined effective federal and state tax rate of the company is 45% and the current capital gains taxes rate is 15%. Construct the corresponding project cash flows by filling the missing entries in the Cash Flow Statement below. Then determine whether the expansion project proposed is economically viable, if the after-tax market interest rate is 15% and the general economy inflation rate is 4%. (Note depreciation is always in current dollars) (For a 5-year recovery asset: the MACRS % for Year 1 through 6 are: 20%, 32%, 19.2%, 11.52%, 11.52%, and 5.76%; and (A/P 4.5%, 2) = 0.5340) Cost basis for the new machine Depreciation: Year! Year 2- Year 3 - Total depreciation Book value Salvage value in year 3 Gains tax = (ordinary gains, capital gains or tax credits?) Payments for borrowed funds: Borrowed amount: $150000, Before-tax interest rate # of years to payback 2 Annuity payments: Principal Payment Ending balance Yeark Beginning balance Interest payment 1 150000 6750 76650 Then fill in the missing entries indicated by empty cells with underscore) in the following tableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started