Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A speculator forms a strong opinion that the FKLI futures is about to enter a downtrend. 3rd March A speculator shorts 5 contracts March

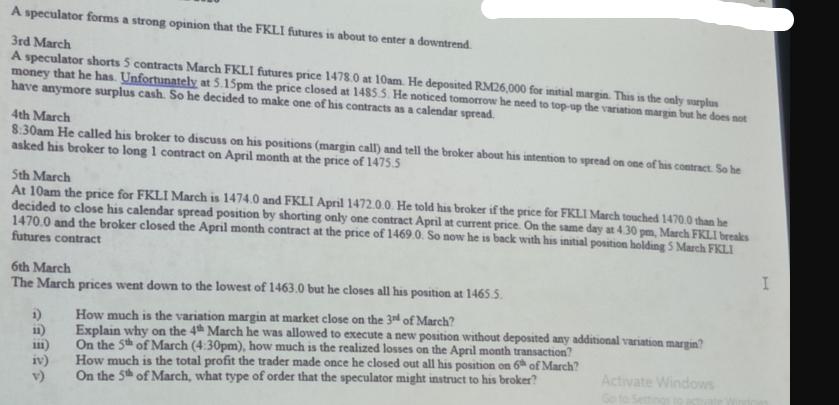

A speculator forms a strong opinion that the FKLI futures is about to enter a downtrend. 3rd March A speculator shorts 5 contracts March FKLI futures price 1478.0 at 10am. He deposited RM26,000 for initial margin. This is the only surplus money that he has. Unfortunately at 5.15pm the price closed at 1485.5. He noticed tomorrow he need to top-up the variation margin but he does not have anymore surplus cash. So he decided to make one of his contracts as a calendar spread. 4th March 8:30am He called his broker to discuss on his positions (margin call) and tell the broker about his intention to spread on one of his contract. So he asked his broker to long 1 contract on April month at the price of 1475.5 5th March At 10am the price for FKLI March is 1474.0 and FKLI April 1472.0.0. He told his broker if the price for FKLI March touched 1470.0 than he decided to close his calendar spread position by shorting only one contract April at current price. On the same day at 4.30 pm, March FKLI breaks 1470.0 and the broker closed the April month contract at the price of 1469.0. So now he is back with his initial position holding 5 March FKLI futures contract 6th March The March prices went down to the lowest of 1463.0 but he closes all his position at 1465.5 1) How much is the variation margin at market close on the 3rd of March? 11) 111) iv) v) Explain why on the 4th March he was allowed to execute a new position without deposited any additional variation margin? On the 5th of March (4:30pm), how much is the realized losses on the April month transaction? How much is the total profit the trader made once he closed out all his position on 6th of March? On the 5th of March, what type of order that the speculator might instruct to his broker? Activate Windows I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started