Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A sports team has asked a city to build a new stadium. Future revenues and costs for the expected stadium life of 10 years

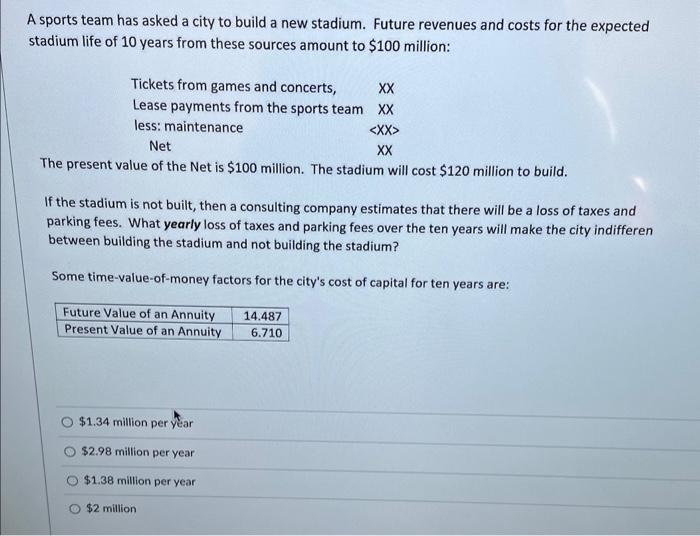

A sports team has asked a city to build a new stadium. Future revenues and costs for the expected stadium life of 10 years from these sources amount to $100 million: Tickets from games and concerts, XX Lease payments from the sports team XX less: maintenance XX Net The present value of the Net is $100 million. The stadium will cost $120 million to build. If the stadium is not built, then a consulting company estimates that there will be a loss of taxes and parking fees. What yearly loss of taxes and parking fees over the ten years will make the city indifferen between building the stadium and not building the stadium? Some time-value-of-money factors for the city's cost of capital for ten years are: Future Value of an Annuity Present Value of an Annuity $1.34 million per year $2.98 million per year $1.38 million per year $2 million 14.487 6.710

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To determine the yearly loss of taxes a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started