Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. standard deviation= SQRT(4%^2*1.25^2+0.02^2) = 5.39% Reward to variability = (r-rf)/standard deviation =(15%-5%)/5.39% =1.8553 b. Volatility ratio = (r-rf)/Beta =(15%-5%)/1.25 =8 c. Jensen's alpha =

a. standard deviation= SQRT(4%^2*1.25^2+0.02^2) = 5.39%

Reward to variability = (r-rf)/standard deviation

=(15%-5%)/5.39%

=1.8553

b. Volatility ratio = (r-rf)/Beta

=(15%-5%)/1.25

=8

c.

Jensen's alpha = 15%-(5%+1.25*(12%-5%)) = 1.25%

d.

M2 = Sharpe ratio*Standard Deviation of Bench mark+rf

=1.8553*4%+5%

=12.42%

Please continue on questions e, f, g

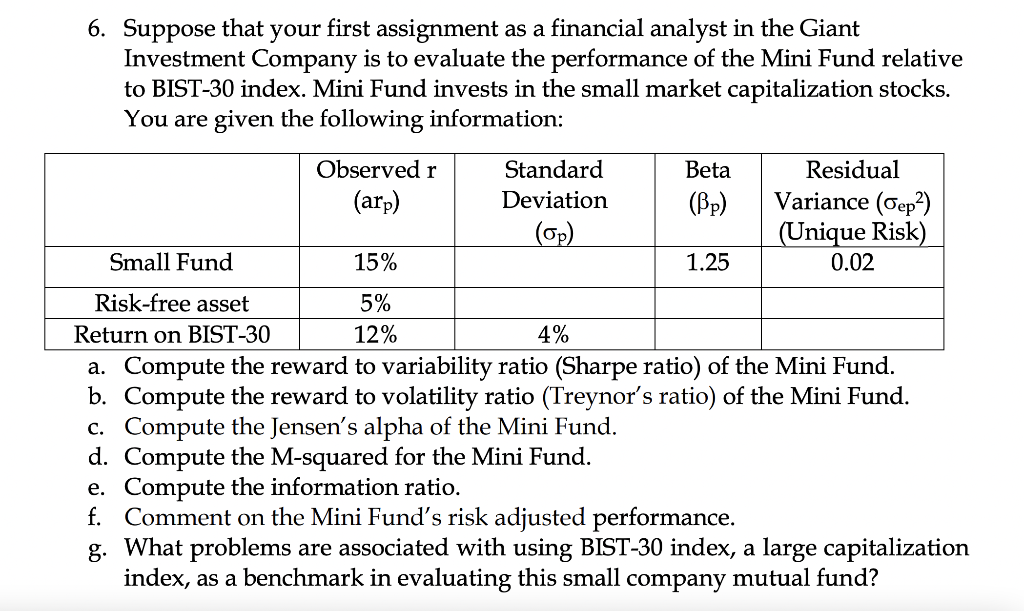

6. Suppose that your first assignment as a financial analyst in the Giant Investment Company is to evaluate the performance of the Mini Fund relative to BIST-30 index. Mini Fund invests in the small market capitalization stocks. You are given the following information: Observed r Standard Beta Residual (arp) Deviation (Bp) Variance (Cep) (op) (Unique Risk) Small Fund 15% 1.25 0.02 Risk-free asset 5% Return on BIST-30 12% 4% a. Compute the reward to variability ratio (Sharpe ratio) of the Mini Fund. b. Compute the reward to volatility ratio (Treynor's ratio) of the Mini Fund. c. Compute the Jensen's alpha of the Mini Fund. d. Compute the M-squared for the Mini Fund. e. Compute the information ratio. f. Comment on the Mini Fund's risk adjusted performance. g. What problems are associated with using BIST-30 index, a large capitalization index, as a benchmark in evaluating this small company mutual fundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started