Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) State and explain the three (3) main inter-related financial decisions a company listed on the Ghana stock Exchange has to make with respect to

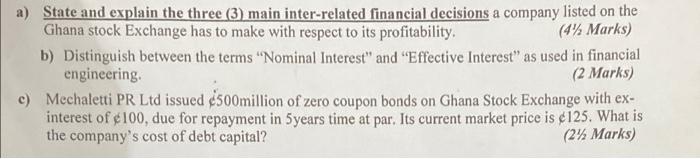

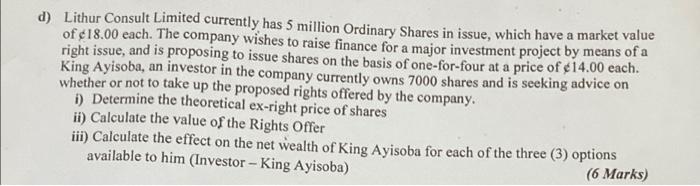

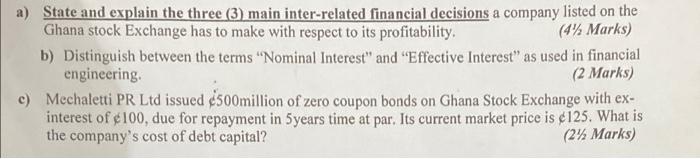

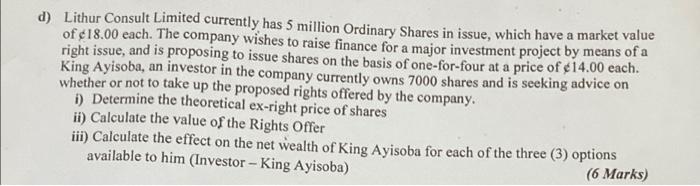

a) State and explain the three (3) main inter-related financial decisions a company listed on the Ghana stock Exchange has to make with respect to its profitability, (4% Marks) b) Distinguish between the terms Nominal Interest" and "Effective Interest" as used in financial engineering (2 Marks) c) Mechaletti PR Ltd issued 2500million of zero coupon bonds on Ghana Stock Exchange with ex- interest of 100, due for repayment in 5years time at par. Its current market price is 125. What is the company's cost of debt capital? (2% Marks) d) Lithur Consult Limited currently has 5 million Ordinary Shares in issue, which have a market value of 18.00 each. The company wishes to raise finance for a major investment project by means of a right issue, and is proposing to issue shares on the basis of one-for-four at a price of 14.00 each. King Ayisoba, an investor in the company currently owns 7000 shares and is seeking advice on whether or not to take up the proposed rights offered by the company. i) Determine the theoretical ex-right price of shares ii) Calculate the value of the Rights Offer iii) Calculate the effect on the net wealth of King Ayisoba for each of the three (3) options available to him (Investor - King Ayisoba) (6 Marks)

a) State and explain the three (3) main inter-related financial decisions a company listed on the Ghana stock Exchange has to make with respect to its profitability, (4% Marks) b) Distinguish between the terms Nominal Interest" and "Effective Interest" as used in financial engineering (2 Marks) c) Mechaletti PR Ltd issued 2500million of zero coupon bonds on Ghana Stock Exchange with ex- interest of 100, due for repayment in 5years time at par. Its current market price is 125. What is the company's cost of debt capital? (2% Marks) d) Lithur Consult Limited currently has 5 million Ordinary Shares in issue, which have a market value of 18.00 each. The company wishes to raise finance for a major investment project by means of a right issue, and is proposing to issue shares on the basis of one-for-four at a price of 14.00 each. King Ayisoba, an investor in the company currently owns 7000 shares and is seeking advice on whether or not to take up the proposed rights offered by the company. i) Determine the theoretical ex-right price of shares ii) Calculate the value of the Rights Offer iii) Calculate the effect on the net wealth of King Ayisoba for each of the three (3) options available to him (Investor - King Ayisoba) (6 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started