Question

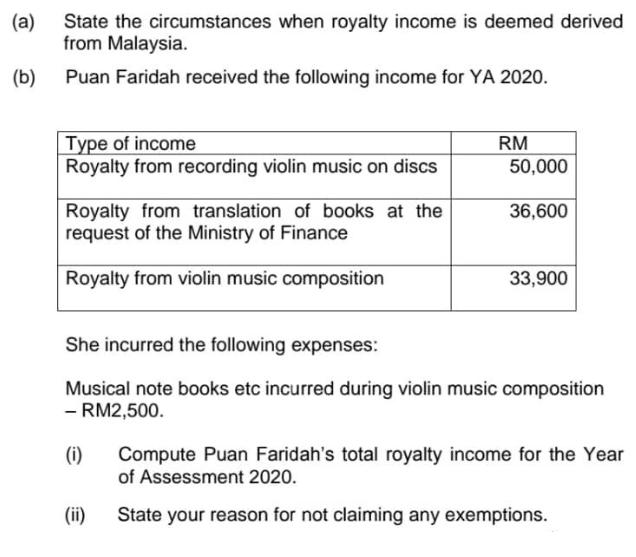

(a) State the circumstances when royalty income is deemed derived from Malaysia. Puan Faridah received the following income for YA 2020. (b) Type of

(a) State the circumstances when royalty income is deemed derived from Malaysia. Puan Faridah received the following income for YA 2020. (b) Type of income Royalty from recording violin music on discs Royalty from translation of books at the request of the Ministry of Finance Royalty from violin music composition RM (ii) 50,000 36,600 33,900 She incurred the following expenses: Musical note books etc incurred during violin music composition - RM2,500. (i) Compute Puan Faridah's total royalty income for the Year of Assessment 2020. State your reason for not claiming any exemptions.

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a The circumstances when royalty income is deemed derived from Malaysia are as f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Financial Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan E. Duchac

12th edition

1305041399, 1285078586, 978-1-133-9524, 9781133952428, 978-1305041394, 9781285078588, 1-133-95241-0, 978-1133952411

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App