Question

A statement of profit or loss and a statement of financial position for Monicas Pies are presented below: Statement of profit or loss for the

A statement of profit or loss and a statement of financial position for Monicas Pies are presented below:

| Statement of profit or loss for the year ending 30 June 2017 |

| ||||||

|

| |||||||

|

| 2017 | 2016 |

| ||||

| Sales | $760,000 | 700,000 |

| ||||

| less cost of sales | 420,000 | 400,000 |

| ||||

| Gross profit | 340,000 | 300,000 |

| ||||

| less expenses |

| ||||||

| Depreciation expense | $50,000 | 60,000 |

| ||||

| Interest expense | 44,000 | 70,000 |

| ||||

| Other expenses | 100,000 | 95,000 |

| ||||

| Profit before tax | 146,000 | 75,000 |

| ||||

| Income tax expense | 26,000 | 20,000 |

| ||||

| Net profit after tax | 120,000 | 55,000 |

| ||||

|

|

|

|

| ||||

| Statement of financial position | |||||||

| as at 30 June 2017 | |||||||

|

| 2017 | 2016 | 2015 | ||||

| Cash | $40,000 | $24,000 | $20,000 | ||||

| Accounts receivable | 120,000 | 45,000 | 48,000 | ||||

| Inventory | 80,000 | 75,000 | 62,000 | ||||

| Equipment (net) | 90,000 | 70,000 | 50,000 | ||||

| Motor vehicles (net) | 603,000 | 400,000 | 360,000 | ||||

| Total assets | 933,000 | 614,000 | 540,000 | ||||

| Accounts payable | 98,000 | 75,000 | 70,000 | ||||

| Long term loan | 250,000 | 75,000 | 65,000 | ||||

| Total liabilities | 348,000 | 150,000 | 135,000 | ||||

| Ordinary shares ($1 each) | 400,000 | 400,000 | 400,000 | ||||

| Retained earnings | 185,000 | 64,000 | 5,000 | ||||

| Total equity | 585,000 | 464,000 | 405,000 | ||||

| Total liabilities and equity | 933,000 | 614,000 | 540,000 | ||||

|

| |||||||

The share price at the end of 2017 and 2016 was $1.33 and $2.80 respectively.

The ordinary shares were issued at $1 each.

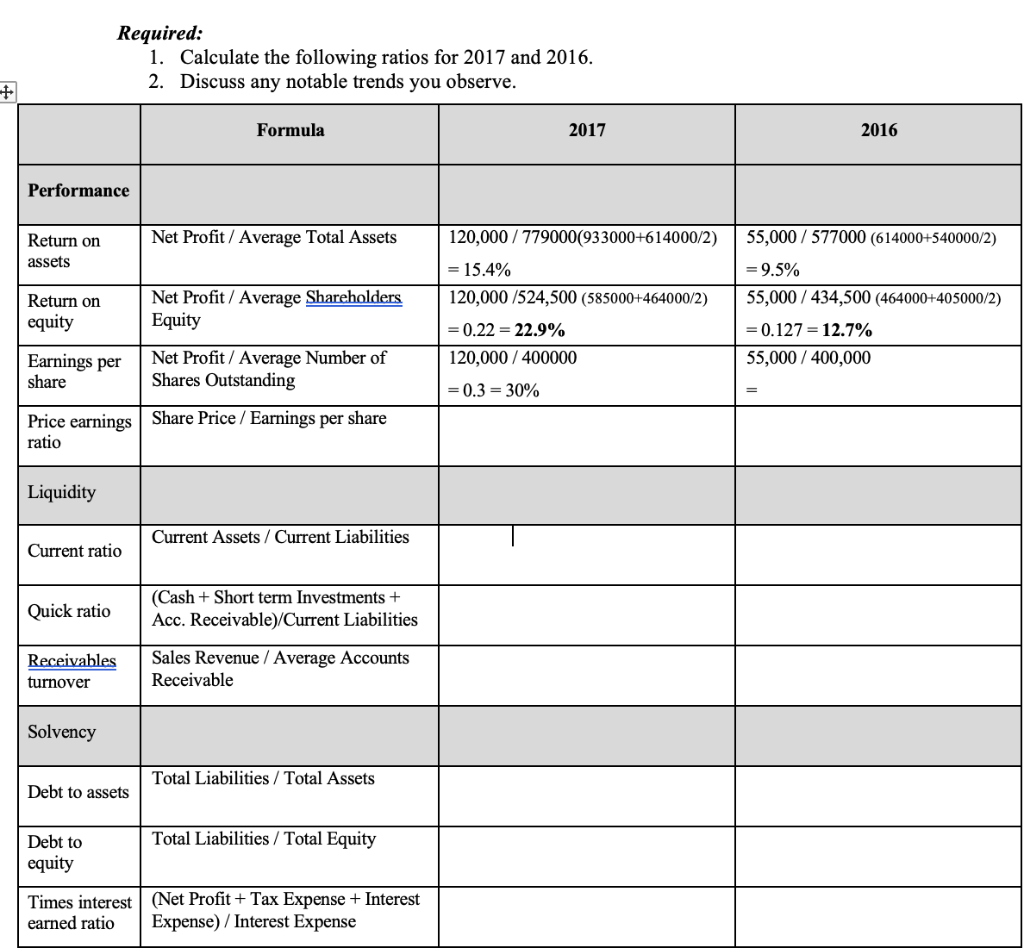

Required: 1. Calculate the following ratios for 2017 and 2016. 2. Discuss any notable trends you observe. Formula 2017 2016 Performance Net Profit/ Average Total Assets 55,000 / 577000 (614000+540000/2) Return on assets Return on equity Net Profit/ Average Shareholders Equity 120,000 / 779000(933000+614000/2) = 15.4% 120,000/524,500 (585000+464000/2) = 0.22 = 22.9% 120,000 / 400000 = 9.5% 55,000/434,500 (464000+405000/2) = 0.127 = 12.7% 55,000 / 400,000 Earnings per share Net Profit/ Average Number of Shares Outstanding = 0.3 = 30% Price earnings Share Price / Earnings per share ratio Liquidity Current Assets / Current Liabilities Current ratio Quick ratio (Cash + Short term Investments + Acc. Receivable)/Current Liabilities Receivables turnover Sales Revenue / Average Accounts Receivable Solvency Total Liabilities/Total Assets Debt to assets Total Liabilities / Total Equity Debt to equity Times interest (Net Profit + Tax Expense + Interest earned ratio Expense) / Interest Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started