Question

a) Stenson, Inc., imposes a payback cutoff of three years for its international investment projects. If the company has the following two projects available, should

a)

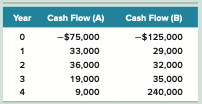

Stenson, Inc., imposes a payback cutoff of three years for its international investment projects. If the company has the following two projects available, should it accept either of them?

b)

Youre trying to determine whether or not to expand your business by building a new manufacturing plant. The plant has an installation cost of $10.8 million, which will be depreciated straight-line to zero over its four-year life. If the plant has projected net income of $1,293,000, $1,725,000, $1,548,000, and $1,310,000 over these four years, what is the projects average accounting return (AAR)?

\begin{tabular}{crr|} \hline Year & Cash Flow (A) & Cash Flow (B) \\ \hline 0 & $75,000 & $125,000 \\ 1 & 33,000 & 29,000 \\ 2 & 36,000 & 32,000 \\ 3 & 19,000 & 35,000 \\ 4 & 9,000 & 240,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started