Answered step by step

Verified Expert Solution

Question

1 Approved Answer

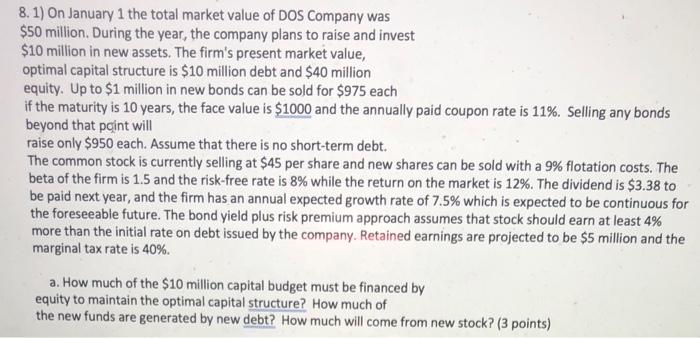

a step-by-step process to the answer on all parts of the question will be greatly appreciated!! 8. 1) On January 1 the total market value

a step-by-step process to the answer on all parts of the question will be greatly appreciated!!

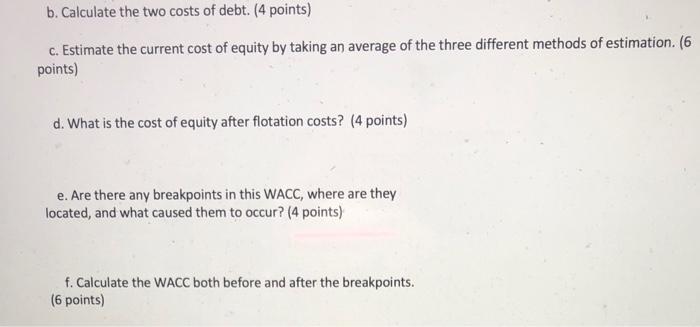

8. 1) On January 1 the total market value of DOS Company was $50 million. During the year, the company plans to raise and invest $10 million in new assets. The firm's present market value, optimal capital structure is $10 million debt and $40 million equity. Up to $1 million in new bonds can be sold for $975 each if the maturity is 10 years, the face value is $1000 and the annually paid coupon rate is 11%. Selling any bonds beyond that point will raise only $950 each. Assume that there is no short-term debt. The common stock is currently selling at $45 per share and new shares can be sold with a 9% flotation costs. The beta of the firm is 1.5 and the risk-free rate is 8% while the return on the market is 12%. The dividend is $3.38 to be paid next year, and the firm has an annual expected growth rate of 7.5% which is expected to be continuous for the foreseeable future. The bond yield plus risk premium approach assumes that stock should earn at least 4% more than the initial rate on debt issued by the company. Retained earnings are projected to be $5 million and the marginal tax rate is 40%. a. How much of the $10 million capital budget must be financed by equity to maintain the optimal capital structure? How much of the new funds are generated by new debt? How much will come from new stock? (3 points) b. Calculate the two costs of debt. (4 points) c. Estimate the current cost of equity by taking an average of the three different methods of estimation. (6 points) d. What is the cost of equity after flotation costs? (4 points) e. Are there any breakpoints in this WACC, where are they located, and what caused them to occur? (4 points) f. Calculate the WACC both before and after the breakpoints. (6 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started