Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A stock has a current price of 80 and pays dividends continuously at a rate of 3% per year. The continuously compounded risk-free interest

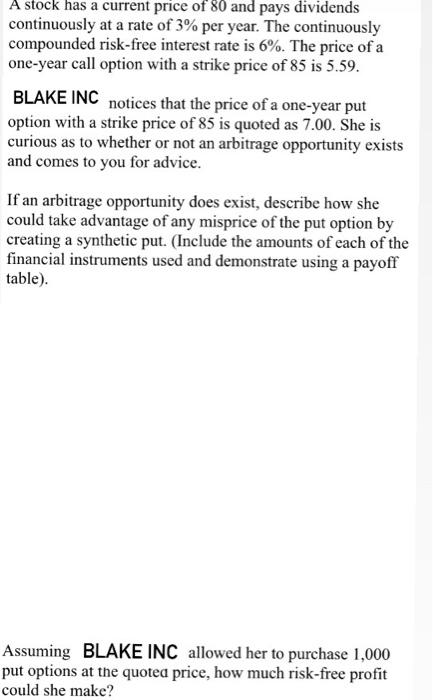

A stock has a current price of 80 and pays dividends continuously at a rate of 3% per year. The continuously compounded risk-free interest rate is 6%. The price of a one-year call option with a strike price of 85 is 5.59. BLAKE INC notices that the price of a one-year put option with a strike price of 85 is quoted as 7.00. She is curious as to whether or not an arbitrage opportunity exists and comes to you for advice. If an arbitrage opportunity does exist, describe how she could take advantage of any misprice of the put option by creating a synthetic put. (Include the amounts of each of the financial instruments used and demonstrate using a payoff table). Assuming BLAKE INC allowed her to purchase 1,000 put options at the quoted price, how much risk-free profit could she make?

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether an arbitrage opportunity exists we can compare the cost of buying the put option to the cost of creating a synthetic put option A ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started