A stock has an expected return of 20% with a standard deviation of 0.15. Assume you can borrow and lend risk-free at 5%. Assume

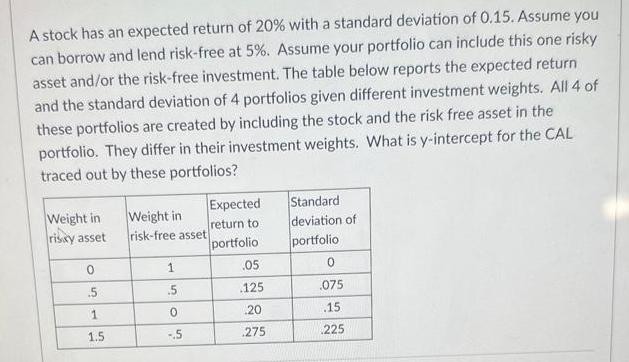

A stock has an expected return of 20% with a standard deviation of 0.15. Assume you can borrow and lend risk-free at 5%. Assume your portfolio can include this one risky asset and/or the risk-free investment. The table below reports the expected return and the standard deviation of 4 portfolios given different investment weights. All 4 of these portfolios are created by including the stock and the risk free asset in the portfolio. They differ in their investment weights. What is y-intercept for the CAL traced out by these portfolios? Weight in Weight in risky asset 0 .5 1 1.5 risk-free asset 1 .5 0 -.5 Expected return to portfolio .05 125 20 275 Standard deviation of portfolio 0 075 15. 225

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 Step 1 Y intercept of CAL The Y intercept of Capita...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started