Answered step by step

Verified Expert Solution

Question

1 Approved Answer

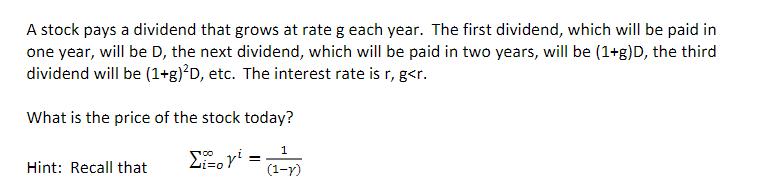

A stock pays a dividend that grows at rate g each year. The first dividend, which will be paid in one year, will be

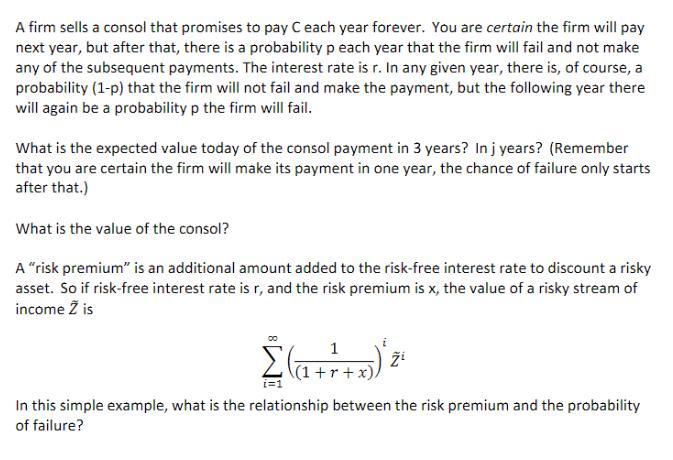

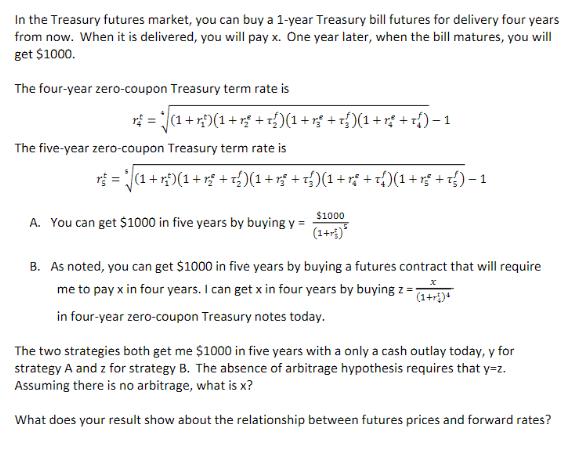

A stock pays a dividend that grows at rate g each year. The first dividend, which will be paid in one year, will be D, the next dividend, which will be paid in two years, will be (1+g)D, the third dividend will be (1+g)2D, etc. The interest rate is r, g A firm sells a consol that promises to pay C each year forever. You are certain the firm will pay next year, but after that, there is a probability p each year that the firm will fail and not make any of the subsequent payments. The interest rate is r. In any given year, there is, of course, a probability (1-p) that the firm will not fail and make the payment, but the following year there will again be a probability p the firm will fail. What is the expected value today of the consol payment in 3 years? In j years? (Remember that you are certain the firm will make its payment in one year, the chance of failure only starts after that.) What is the value of the consol? A "risk premium" is an additional amount added to the risk-free interest rate to discount a risky asset. So if risk-free interest rate is r, and the risk premium is x, the value of a risky stream of income is ( +7 + x)) i i=1 In this simple example, what is the relationship between the risk premium and the probability of failure? In the Treasury futures market, you can buy a 1-year Treasury bill futures for delivery four years from now. When it is delivered, you will pay x. One year later, when the bill matures, you will get $1000. The four-year zero-coupon Treasury term rate is r = *(1 + r) (1 + r + ) (1 + r + t )(1 + r + r) -1 The five-year zero-coupon Treasury term rate is r = (1 + r)(1 + r + 1 )(1 + rf + t)(1 + r + {)(1 + rf + ) - 1 A. You can get $1000 in five years by buying y = $1000 B. As noted, you can get $1000 in five years by buying a futures contract that will require me to pay x in four years. I can get x in four years by buying z = (1+r)* in four-year zero-coupon Treasury notes today. The two strategies both get me $1000 in five years with a only a cash outlay today, y for strategy A and z for strategy B. The absence of arbitrage hypothesis requires that y=z. Assuming there is no arbitrage, what is x? What does your result show about the relationship between futures prices and forward rates?

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Stock Price with Growing Dividends The formula for the price P of a stock that pays a constant dividend D that grows at a rate g each year with an interest rate r and g r is P D r g This formula uses ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started