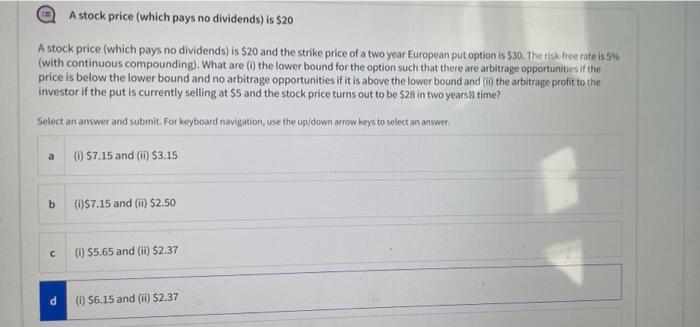

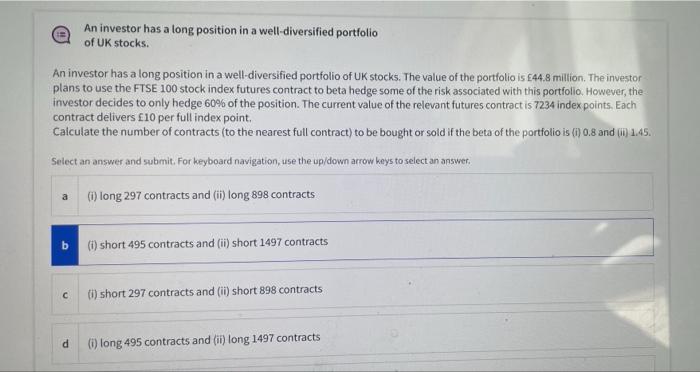

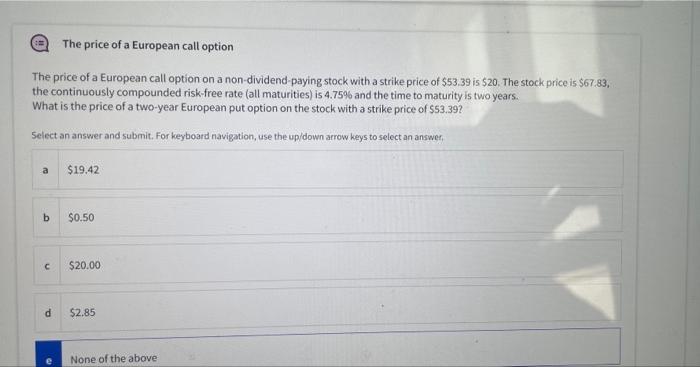

A stock price (which pays no dividends) is $20 A stock price (which pays no dividends) is $20 and the strike price of a two year European put option is $30. The risk-free rate is 5% (with continuous compounding). What are (i) the lower bound for the option such that there are arbitrage opportunities if the price is below the lower bound and no arbitrage opportunities if it is above the lower bound and (ii) the arbitrage profit to the investor if the put is currently selling at $5 and the stock price turns out to be $28 in two years time? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a (1) $7.15 and (ii) $3.15 b (i)$7.15 and (ii) $2.50 (i) $5.65 and (ii) $2.37 d (i) $6.15 and (ii) $2.37 An investor has a long position in a well-diversified portfolio of UK stocks. An investor has a long position in a well-diversified portfolio of UK stocks. The value of the portfolio is 44.8 million. The investor plans to use the FTSE 100 stock index futures contract to beta hedge some of the risk associated with this portfolio. However, the investor decides to only hedge 60% of the position. The current value of the relevant futures contract is 7234 index points. Each contract delivers 10 per full index point. Calculate the number of contracts (to the nearest full contract) to be bought or sold if the beta of the portfolio is (i) 0.8 and (ii) 1.45. Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a (i) long 297 contracts and (ii) long 898 contracts b (i) short 495 contracts and (ii) short 1497 contracts C (i) short 297 contracts and (ii) short 898 contracts d (i) long 495 contracts and (ii) long 1497 contracts The price of a European call option The price of a European call option on a non-dividend-paying stock with a strike price of $53.39 is $20. The stock price is $67.83, the continuously compounded risk-free rate (all maturities) is 4.75% and the time to maturity is two years. What is the price of a two-year European put option on the stock with a strike price of $53.39? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer, a $19.42 b $0.50 $20.00 d $2.85 None of the above A stock price (which pays no dividends) is $20 A stock price (which pays no dividends) is $20 and the strike price of a two year European put option is $30. The risk-free rate is 5% (with continuous compounding). What are (i) the lower bound for the option such that there are arbitrage opportunities if the price is below the lower bound and no arbitrage opportunities if it is above the lower bound and (ii) the arbitrage profit to the investor if the put is currently selling at $5 and the stock price turns out to be $28 in two years time? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a (1) $7.15 and (ii) $3.15 b (i)$7.15 and (ii) $2.50 (i) $5.65 and (ii) $2.37 d (i) $6.15 and (ii) $2.37 An investor has a long position in a well-diversified portfolio of UK stocks. An investor has a long position in a well-diversified portfolio of UK stocks. The value of the portfolio is 44.8 million. The investor plans to use the FTSE 100 stock index futures contract to beta hedge some of the risk associated with this portfolio. However, the investor decides to only hedge 60% of the position. The current value of the relevant futures contract is 7234 index points. Each contract delivers 10 per full index point. Calculate the number of contracts (to the nearest full contract) to be bought or sold if the beta of the portfolio is (i) 0.8 and (ii) 1.45. Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a (i) long 297 contracts and (ii) long 898 contracts b (i) short 495 contracts and (ii) short 1497 contracts C (i) short 297 contracts and (ii) short 898 contracts d (i) long 495 contracts and (ii) long 1497 contracts The price of a European call option The price of a European call option on a non-dividend-paying stock with a strike price of $53.39 is $20. The stock price is $67.83, the continuously compounded risk-free rate (all maturities) is 4.75% and the time to maturity is two years. What is the price of a two-year European put option on the stock with a strike price of $53.39? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer, a $19.42 b $0.50 $20.00 d $2.85 None of the above